Last Update 27 Nov 25

Fair value Increased 15%The Narrative Shift Has Arrived. And It Arrived With Vengeance

In July, I wrote that Google was the "cheapest AI play in the market," trading at 18x earnings because Wall Street was obsessed with two phantom risks: the "death of Search" via ChatGPT and a DOJ breakup.

Fast forward 20 weeks. The stock has gone parabolic, ripping from $177 to over $320. The narrative didn't just shift; it completely inverted. Google isn't being priced as a "dying incumbent" anymore, it’s now being priced as the inevitable AI infrastructure king.

Here is why the thesis played out faster than expected, and what we do now.

1. Search Revenue: What Disruption?

The "Search is Dead" bears have gone into hibernation. Search revenue didn't shrink; it accelerated. It turns out that integrating Gemini into Search (AI Overviews) didn't kill the ad model, it increased engagement. The transition was smooth, and Google proved it can monetize AI answers just as effectively as blue links.

2. Execution Alpha: Gemini 3 Ended the Debate

Back in July, the consensus was that OpenAI was "miles ahead." That gap has not only closed; it has reversed.

- Gemini 3 dropped this month and is sweeping the benchmarks. It is currently beating GPT-5.1 on reasoning and coding tasks.

- Adoption: We are seeing this show up in the numbers. 650M Monthly Active Users (MAUs) for Gemini is a staggering acceleration.

- The "Vibe Shift": Salesforce CEO Marc Benioff recently tweeted he’s "not going back" to ChatGPT after using Gemini 3. That is the kind of enterprise validation you can't buy.

- Advantage Realized: As predicted, Google’s distribution (Android + Workspace) + Clean Data = Winning Product. The "laggard" label is officially retired.

3. The Regulatory "Nothingburger"

The DOJ antitrust case, the single biggest overhang on the stock, effectively dissolved with the changing political winds. With the new administration signalling a lighter touch on tech M&A and breakups, the "Existential Breakup Risk" (divesting Chrome/Android) has gone from a 30% probability to near zero. The market hates uncertainty; removing that tail risk instantly repriced the multiple.

4. Cloud & Infrastructure: The New Crown Jewel

While everyone was watching Search ads, Google Cloud became a monster.

- Growth: Revenue accelerated to 34% YoY ($15.2B in Q3). This is no longer a distant third; it is the growth engine.

- Strategic Wins: Securing the NATO sovereign cloud contract is a massive signal of trust. If NATO trusts Google with its secrets, enterprises will trust them with their data.

- The TPU Coup: This is the most bullish "fresh" rumour in the market: Meta is reportedly in talks to buy/lease Google TPUs instead of relying solely on Nvidia GPUs. If true, this transforms Google from just a "chip user" to a "chip supplier" for the rest of Big Tech. That is a multi-billion dollar revenue stream that wasn't in anyone's model in July.

5. The Ultimate Validation: The Buffett Stamp

The biggest signal wasn't a product launch; it was a SEC filing. Berkshire Hathaway disclosed a $5B stake in Alphabet in Q3. Warren Buffett doesn't buy "speculative tech." He buys wide moats, cash flow, and rational valuation. His entry effectively killed the bear case. It told the market: “The moat is intact, and the price is wrong.” When the Oracle of Omaha validates your value thesis, the floor on the stock price rises overnight.

6. Waymo: The Quiet Expansion

Tesla still owns the "vision-only" narrative, but Waymo owns the roads. They are now live in 5+ major cities (Miami, Austin, etc.). While I still believe Tesla wins the global scale game eventually, Waymo has proven it is a real, revenue-generating business today, not a science project.

The New Setup: Why I am Cautious Short-Term

The fundamentals are flawless. However, as an investor, I must respect price action and psychology.

When I wrote the original thesis, everyone hated the stock. Now, Jim Cramer just told his followers to "Buy" Google. This is never a good thing... When the last bear capitulates and the mainstream media starts chasing a stock after an 80% run, the easy money has been made.

- Valuation: We are no longer at 18x earnings. We are trading close to my fair value estimates.

- Technical: An 80% move in 5 months is a "parabolic" advance. Stocks rarely sustain this angle of attack without a cool-off or some sort of consolidation.

Conclusion: Hold the Compounder (...And Trim the Euphoria?)

I believe Alphabet has been correctly repriced. The "Value Gap" I identified in July is closed.

- Short Term: I expect consolidation. The stock needs to digest these gains, likely chopping sideways in the $280–$330 range. Short term traders will take profits and I wouldn't be surprised to see a pullback if the broader "AI Bubble" sentiment wavers.

- Long Term: My thesis is unchanged. Google owns the full stack, from the chips (TPUs) to the model (Gemini) to the distribution (Android, Chrome, apps, search, etc..).

I am holding my core position, but not adding here. If you followed me into this investment in July, congrats, you are sitting on substantial gains.

Summary

- Google trades at ~18× forward earnings; the cheapest among the Magnificent 7

- Market is too focused on AI threats to Search and antitrust noise

- Meanwhile, Google is executing across AI, Cloud, and YouTube

- Key AI differentiator: unmatched distribution across 3B+ users via Search, Gmail, YouTube, Android, Chrome, and Cloud

- Quietly building a world-class AI infrastructure behind the scenes; including proprietary TPUs and a vertically integrated stack

- YouTube generated $8.93B in Q1 ad revenue (up 10% YoY); subscriptions hit 270M

- Google Cloud revenue up 28% YoY to $12.3B; now profitable

- Optionality from long-term bets like Waymo, DeepMind, and Verily

- Risk/reward is compelling; a strong candidate to beat the market long term

Overview

Despite being part of the "Magnificent Seven," Google’s stock lags due to perceived risks around disruption of its Search business from AI competitors and mounting antitrust concerns. But under the hood, Google has quietly built one of the most compelling setups in tech: with deep AI leadership, multiple high-growth businesses, and optionality from long-term moonshots like Waymo. It just needs one narrative shift for the market to reprice it dramatically.

Growth Catalysts

1. AI Leadership Across Products

Google has been positioning itself as an AI-first company for years. Those early bets are now turning into real products and adoption:

- Search is being upgraded with the Search Generative Experience (SGE), integrating AI into the core experience

- Gemini, Google’s flagship LLM, is now embedded across Gmail, Docs, Android, Chrome, and more

- YouTube is deploying AI tools for creators, auto-dubbing, and personalised recommendations

- Gemini already has over 1 billion users through product integrations

But Google’s biggest AI edge isn’t just the models: it’s the distribution moat. With over 3 billion active users across Search, Gmail, YouTube, Chrome, and Android, no other AI player can ship innovations at that kind of global scale. That alone makes Google’s AI rollout far more valuable than many standalone players.

Behind the scenes, Google has also built one of the most advanced private AI stacks in the world. It uses its own Tensor Processing Units (TPUs) instead of relying solely on Nvidia GPUs. These custom chips are optimised for training and serving AI models at scale. Combined with its data centres, frameworks like JAX and TensorFlow, and cloud software like Vertex AI, Google controls the full vertical; from silicon to product.

That infrastructure is now becoming a profit centre as well, via Google Cloud.

2. Google Cloud Momentum

Google Cloud has become a true growth engine:

- $12.3B in Q1 2025 revenue, up 28% YoY, now operating profitably

- Serves over 90% of billion-dollar AI startups, acting as the infrastructure behind the AI boom

- Differentiated by AI-focused hardware (TPUs), software (Vertex AI), and native Gemini integration

As enterprises and startups adopt AI across workflows, Google Cloud is emerging as one of the top three global platforms and the one most tightly integrated with state-of-the-art AI tools.

This cloud growth also diversifies Alphabet’s revenue away from advertising and further deepens its flywheel effect: the more AI adoption happens in the world, the more Google benefits, both directly and indirectly.

3. YouTube’s Strength

YouTube continues to grow as one of the most dominant platforms in global media:

- $9.7B in ad revenue in Q1 2025, up 21% YoY

- YouTube Shorts generates 70B+ daily views, driving new monetisation formats

- 100M+ paid subscribers to YouTube Premium and Music

It’s now effectively a hybrid of TikTok, Netflix, and Spotify, but powered by Google’s unmatched ad infrastructure and recommendation engine. AI also enhances everything from auto-captioning to personalised content feeds, strengthening engagement and monetisation over time.

4. “Other Bets” Optionality

Alphabet’s long-term innovation engine continues to operate quietly but with massive upside:

- Waymo provided over 4 million fully driverless rides in 2024 across Phoenix, SF, LA, and soon Tokyo and Austin

- Operates a fleet of 700+ autonomous EVs and is considered the category leader

- Estimated private valuation of $45B, yet still a rounding error in Alphabet’s market cap

Other long-term bets include Verily (healthcare), Wing (drone delivery), and DeepMind, whose AI breakthroughs increasingly feed back into Google’s core products.

Alphabet is essentially running a VC fund with a free call option on several disruptive future technologies, but with a far more disciplined cost structure and real internal leverage.

Risks

1. Search Disruption

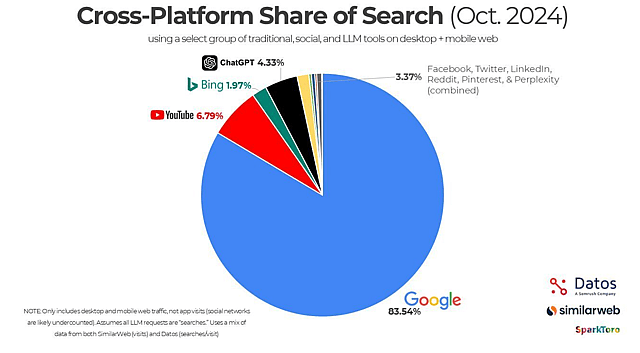

Google still derives over 70% of its revenue from Search advertising, making it highly exposed to any structural changes in how people access information online. That model worked well when competition was limited to Microsoft. But today, a wave of AI-native challengers: OpenAI (ChatGPT), Perplexity, Anthropic, xAI, Deepseek and others are reimagining search from first principles. Many of these platforms offer ad-free, conversational experiences that bypass Google entirely, with different monetisation models.

Google’s rollout of the Search Generative Experience (SGE) and Gemini integration are strong defensive plays, and the company still controls critical internet gateways — Android, Chrome, Google.com. But the predictability of Search revenue is no longer a given. User habits are shifting, particularly among younger demographics, and some early signs suggest ChatGPT is becoming a default destination for certain types of queries.

While Google is well-positioned to pivot long term through Cloud, YouTube, and new AI-native products, its biggest cash cow is under pressure in the short to medium term. If user journeys begin to shift meaningfully away from traditional Search, monetisation could follow, potentially weighing on margins. This doesn’t break the thesis, but it’s a risk investors need to watch closely.

2. Regulatory Overhang

Alphabet remains under scrutiny from both the US DOJ and the European Commission. Forced breakups or unbundling of services are possible, which may introduce friction or complexity across its product suite.

3. Execution Risk

Google has grown into a tech giant, and with that came layers of bureaucracy and internal drift. Incidents like the “Black Nazis” AI image fiasco and the fading “Don’t Be Evil” ethos highlighted a culture slipping into ideological posturing over product innovation.

But there are now clear signs of a course correction. Leadership is refocusing on speed and execution. Sergey Brin is back, hands-on with AI. Recent employee exits, the rapid progress of Gemini, Cloud profitability, and new focus on hardware all point to a company finding its competitive edge again.

4. Waymo Doesn’t Play Out

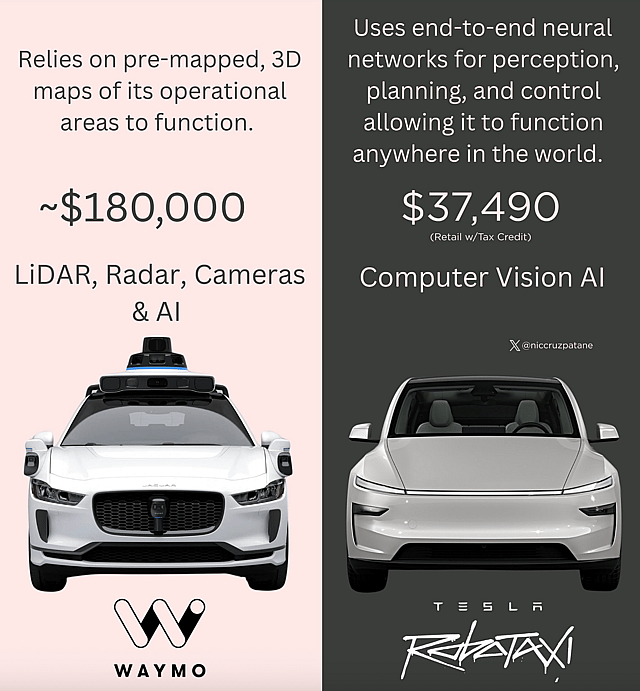

Waymo is often seen as a hidden gem within Alphabet’s portfolio, a potential moonshot with massive upside if robotaxis scale. But that outcome is far from guaranteed. While Waymo is ahead in driverless deployment, I believe Tesla may be better positioned to dominate this market over time.

Tesla’s approach is based on AI and cameras, rather than relying on expensive lidar, radar arrays, and pre-mapped geofenced zones. A Waymo robotaxi currently requires the purchase of a premium Jaguar or similar vehicle, followed by the installation of costly hardware, making it roughly 5× more expensive to deploy than a Tesla robotaxi.

Tesla’s vertically integrated strategy, software-centric stack, and scale advantages could eventually undercut Waymo’s economics and reach. If that happens, Waymo may never reach meaningful commercial scale, removing a major source of optionality from the Alphabet investment case.

I expand on this thesis further in my Tesla narrative.

Valuation

Google trades at around 18× forward earnings, making it the cheapest among the Magnificent 7 despite strong fundamentals, massive user reach, and growing momentum across AI and Cloud.

My investment thesis assumes Google’s core Search business won’t be rapidly disrupted by LLM-based competitors like ChatGPT or Perplexity; at least not to the extent the market fears. Alphabet’s ecosystem offers multiple defensive moats: Search, YouTube, Chrome, Android, and Gemini-powered experiences. This distribution advantage and product velocity should allow it to evolve while maintaining leadership.

Based on that, I assume 9% annual revenue growth over the next five years, margin expansion to 35%, a future PE of 23×, and an 8% discount rate. This implies a fair value of $256 per share. With the stock trading at $177, that suggests the company being valued 33% below my fair value at the time of writing, giving some room for price appreciation and a potential annual return of roughly 10-13% per year (excluding dividends).

Importantly, if just one of Alphabet’s long-term bets (such as Waymo, Verily, or DeepMind) scales commercially, it could help offset potential Search headwinds and even lift long-term growth beyond these base assumptions.

The risk/reward profile remains compelling, underpinned by:

- Strong and growing free cash flow

- A net cash balance sheet

- Exposure to secular trends in AI, cloud, and digital media

- Optionality from long-term moonshots

That said, investors should monitor three key areas: Search revenue and market share, regulatory and antitrust developments, and traction across long-term bets. These factors will ultimately decide whether Alphabet stays a slow compounder or delivers unexpected upside.

Positioning is key. Personally, I don’t view Google as a top three holding in my portfolio, as I’m targeting higher upside opportunities elsewhere and I’m comfortable taking on more risk. That said, it remains a rock-solid, long-term compounder; the kind of stock that can quietly beat the market over time.

Have other thoughts on Alphabet?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:GOOG.. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.