Last Update 29 Oct 24

Fair value Decreased 8.17%Good Coffee Is Instant, Preparation Takes Time: Starbucks’ New CEO Is Just Getting Started

- The suspension of earnings guidance and low performance indicates that SBUX will need more time to recover.

- I missed the forecasts for the company and am downgrading my revenue estimates from 7.5% to 5% p.a. for the next 5-years.

- Despite low performance, I am maintaining my 5-year profit margin expectation at 13%.

- The new CEO has already started laying the groundwork for optimizing operations from within, which is the right approach in my view.

No Indication For Short-Term Improvement

In Q3 2024 Starbucks reported (1, 2) a drop in revenues of 3% to $9.1B and a global sales decline by 7%. This was driven by a 10% decrease in U.S. transactions volume, leading to a 6% lower U.S. revenue.

On a full-year basis sales declined 2%, but net revenues increased 1% to $36.2B. This is 8% short of my 2024 projection for $39.4B, and increases the top-line growth SBUX needs to achieve to reach my 2028 target from 7.5% to 9.8%. I believe this is an unreasonable growth estimate for a company positioned within a saturated market, which is also experiencing significant headwinds.

EPS dropped 25% to $0.80 per share, v.s. an expected $1.05. For the full fiscal year, EPS was down by 8% to $3.31, which resulted in a net income of around $3.8B. Note that the full-year results aren’t audited yet, so the bottom line may shift. This is a deterioration of profits, which underperforms my $4.7B expected profit for 2024.

The company is suspending guidance for 2025, allegedly due to the change in management. However, Starbucks has a relatively stable business model, and could have easily opted to update guidance throughout the coming quarters. This leads me to believe that they did not want to share estimates about underwhelming growth which the company is likely forecasting for 2025.

Wiping The Slate Clean

- Mr. Niccol, Starbucks’ new CEO is also embarking on a “cleaning house” campaign where he lists some of the failures of Starbucks, while appointing people from his circle of trust to key positions in the company. This is good for investors as it will fast-track the ability of new management to enact changes, and is done in a time where change is demanded from investors, giving its new management a budget to err on the side of overcorrection.

- Management mentions that increasing the range of products and more in-app promotional campaigns failed to improve customer behavior. This admission is a rare type of PR that occasionally happens in a management change scenario, and in this case, it seems that the new CEO wants a clean slate upon which he will build his own record.

- It seems that in the near future, the company will be focusing on an internal reorganization instead of relying on capex investments to drive growth. This will ensure stable dividend returns for investors despite lower profitability. Once SBUX settles into a more efficient business approach, management will have to re-employ capital in order to drive growth, but before that, it can take some time to drive the one-time efficiency boost that is expected from the new CEO.

- Management will likely simplify the menu and pricing structure for the business, as it has been an approach that worked for Niccol in the past. The company will also focus on the U.S. region as its key growth and profit driver.

- Conversely, Starbucks China store sales declined 14%, and is further being pressured by increased competition, and a weaker consumer.

What’s In A Cup: Analyzing Starbucks As A Brand

In order to understand the future of Starbucks, I’m going to recap what I think are the characteristics and benefits that made Starbucks an alluring product.

While Starbucks may seem to be unreasonably priced when seen from a non-customer POV, there are some compelling reasons why the product is sticky:

- Breakfast disguised as coffee - many of SBUX’s products fulfill people's caloric and sugar needs. Especially for people who want to present themselves as eating less.

- Anti-constipation: for some reason, pumpkin-spice latte is magic.

- Status signaling: the large, branded cups are a visible testament showing that people can afford to treat themselves. Conspicuous consumption also manifests itself as a social penalty if a person downgrades i.e. once you start showing up at work with a Starbucks coffee you can’t downgrade without the office gossiping about how “you must have fallen on hard times”. However, one of the few ways to avoid this is if everyone downgrades - which may be happening at the moment.

Additionally, a non cynical view is that SBUX does serve great coffee, is a nice and clean place to relax or be productive in. The pricing structure also selects a smaller portion of people, which de-clutters the seating areas. Unless the hiring manager is working in a labor-constrained environment, they tend to hire young, attractive, and energetic baristas - one of the oldest tricks in the industry.

In summary, Starbucks has a more sticky product offering than it might seem at first glance. However, it does appear that the ever-increasing pricing and weak consumer environment are turning a few defectors into a culture shift, where people are looking to find an alternative way to signal for status. If not managed properly, this can turn into an extended lose/lose scenario, where the brand isn’t as strong, further decreasing the value of the expensive drink.

The good thing is that the situation can be rectified, and simplifying the business may be a good way to go about it. There is however the question of short-term vs long-term, and I think that the CEO will be faced with taking multiple hits on the P/L in order to fortify the brand, an approach that in my opinion is already approved by the original founder and key shareholders, and a move that investors will ultimately appreciate down the line.

Valuation Implications

For the reasons outlined above, I am changing my 5-year revenue CAGR from 7.5% to 5%, and expect revenues to be around $46.6B in 2029. I expect that a 5% growth rate may feel somewhat bullish at this point in time, but I still see the company being able to drive growth, and the rate is only slightly higher than the expected nominal growth of the economy which is around 4.2% today.

I also remain fairly optimistic in the long-term and maintain my profit margin estimates at 13%, despite the current environment.

This results in my updated net income estimate of $6.1B for 2029, resulting in a $133B forward value for SBUX. Discounted back to today at a 7.6% rate, I get a $93B present value or $86 per share.

Key Takeaways

- Store growth plans to increase by 74% internationally, but only 12% in the US.

- Coffee demand is expected to be a tailwind for revenues longer term, growing at a stable 4.2%.

- Unionization and new competition risks can be offset with store and product offering growth.

- International stores aren’t as lucrative as U.S. stores, so ROI will likely decrease

- Competition from alternative caffeine sources pose a risk to its revenue growth prospects

Catalysts

Starbucks’s Revenue Growth Dynamics Are Solid

Starbucks has announced a long-term growth strategy called "Triple Shot Reinvention with Two Pumps" to elevate the brand, strengthen digital capabilities, and increase global presence. The company will reformat stores, deliver product innovation, increase digital capabilities, and keep expanding globally with a 56K store target by 2030.

Stores And Expansion Plans

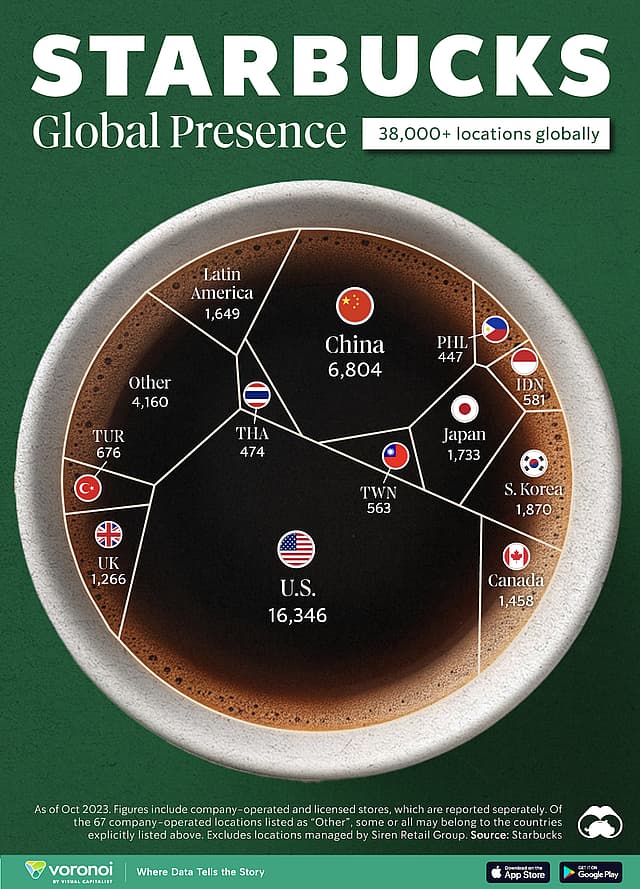

The 17,931 US store count is slated to grow around 4% with an aspiration to reach 20,000 over the long term, while the global target is 56K stores. This means that the long-term expected store mix for Starbucks is 36%/64% US to global stores. The company opened 549 net new stores in Q1 '24, ending the period with 38,587 stores: 51% of which are company-operated and 49% licensed.

Visual Capitalist: Top Starbucks Stores By Country

US Stores Make 4x More Than International Stores

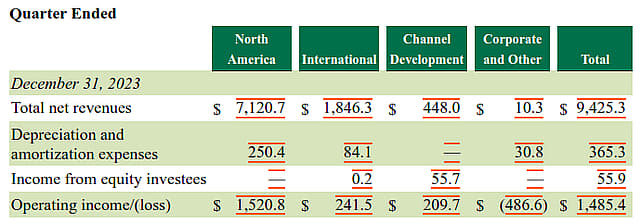

In Q1 '24 Starbucks made $7.120B in revenue (75.5%) from its 17,931 US stores, and $1.846B in revenue (19.6%) from its 20,656 international stores – 6,975 (33%) of which are in China.

10Q: Starbucks’ Revenue Breakdown By Geography

Breaking down these values on a per store average and on an annualized basis, we get a $1.6M average per US store, $357K per international store, and a global average of $944K. This indicates that US-based stores, where the market is close to saturation, are making some 4.4x more than international stores.

This being the case, I expect that as international expansion continues, we’ll start seeing returns on invested capital trend downwards in the name of store growth. Then, over time, they’ll attempt to improve the profitability of these international stores.

Investments in Tech, New Products and Store Formats To Offset Margin headwinds

Starbucks is making investments in different areas to improve store margins and offset headwinds.

With regard to product development, it will increase its food offering, and offer all-day breakfast and snacks. Opening new specialized pick-up, and drive-thru stores, also represent an opportunity for sales growth as management has noticed a market need to deliver the product closer to clients with a lower delay.

As for technological capabilities, it will be experimenting with Amazon’s contactless payment processing platform One, as well as their “Just walk out” technology. These can help increase efficiency by simplifying the checkout process, and reduce the current costs related with the more manual checkout process.

These seem to have been helping. In Q1’24 operating margins increased to 15.7% from 14.4% YoY. The company cites operational efficiencies and sales leverage as the primary drivers. So while international stores might have lower revenue figures as mentioned above, if they can have better margins that’ll offset some of the lower sales.

However, its margins are being offset from partner (employee) wages and benefits, and higher general and administrative expenses. This means that should partner wages keep increasing, profitability is going to be under pressure.

Ideally, the company finds a way to increase wages while driving efficiency in stores, resulting in a net uptick in margins. The company’s investment into specialized pick-up and drive-through stores could allow them to maintain similar sales figures per store but with lower overheads. Unfortunately, management has been reluctant to issue specific guidance on margins, which is fair enough, but I believe the investments mentioned above should be enough to offset the headwinds they’re facing.

Market Demand And Supply Are Stable With A Positive Outlook

Another way to gauge Starbucks’ growth potential is analyzing market trends.

On the supply side, prices are stabilizing as output increases.

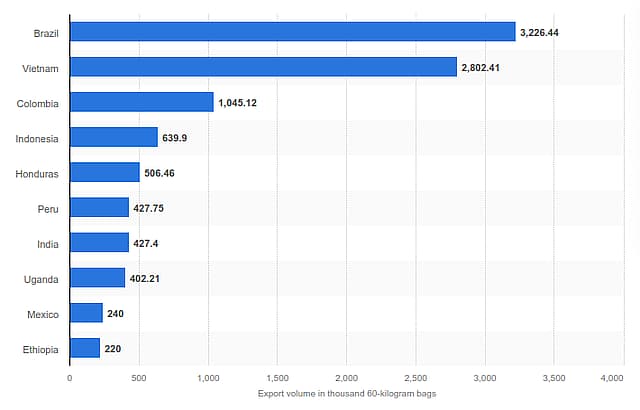

A headwind impacting coffee prices is the 150% rise in freight costs as shipping containers move around Africa to avoid the Red Sea route, as they are threatened by Houthi attacks. This is also causing supply-chain delays of up to three weeks from major producers from Vietnam and Indonesia.

Despite freight adjustments, supply remains strong and the ICO projects that 2023-2024 global coffee production would increase 5.8% YoY to 178 million bags with an estimated 1 million bags of surplus (0.56%).

Trading Economics: Historical Coffee Price Chart

Long-term prices are normalizing after peak 2022 levels, but may remain elevated compared to 2019 as inflation remains priced-in. This is already reflected in end-product prices which consumers have absorbed.

Brazil remains the largest producer and exporter of coffee with 3.2 million bags exported in 2022, followed by Vietnam with 2.8 million bags.

Needless to say, with supply conditions somewhat normalizing, and costs able to be passed on to consumers, the supply challenges faced over the last few years aren’t expected to persist, which helps the likes of Starbucks.

Demand: Stable Industry Growth Continues

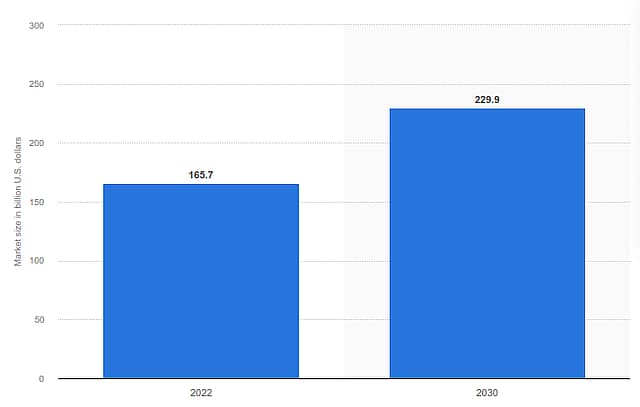

Consumers love their cup of coffee, and more are getting on board. The global coffee market made about $138B in 2023, and is expected to grow at a CAGR of 6.4% between 2024 and 2032, reaching a value of $237B.

According to the NCA 63% of Americans drink coffee, with cold-brew experiencing a surge in popularity by 45% since January 2023, and 400% since 2016. This trend is something Starbucks is benefiting from as people associate cold brew with the Starbucks brand.

Coffee shops are also a good indicator for expansion potential, and estimates indicate that the spend in coffee shops will increase 39% by 2030, from $166B to $230B. This results in a 4.2% yearly growth for coffee shop revenues, which is a natural industry tailwind for Starbucks.

Unionization Pressure May Not Pose A Huge Threat

The company is currently in the midst of a call for unionization and personnel reform.

This has attracted the attention of an investor group that has nominated three names for seats on the board of directors with the hopes of improving labor conditions for Starbucks employees. In the meantime, Starbucks has diluted the board's power by increasing the directors’ seats from 8 to 11, possibly as a precaution to effects from outside influence.

It is unclear how shareholders will benefit from the company swinging in either direction, however, the turbulence itself poses a risk to the stock. Investors have thus far reacted negatively to activism news, which indicates that they may not want to partake in the shake-up.

Looking at the company structure, it is expected that Starbucks has a relatively younger workforce that increases the employee turnover rate, this may make it harder to make a consolidated unionization attempt. So for now, I’m not expecting a huge impact on margins from this catalyst.

Assumptions

Revenue to grow from new stores, products and price increases

- As the company is expected to reach 20K US stores, and 36K international stores by 2030, assuming comparative revenue levels per store, I estimate that the company makes sales of $32B from US stores and $13B from international stores – summing up to a total of $45B by 2029 from store sales alone.

- The company will also drive growth from product expansion with food, as well as efficiency from technological improvements such as better SG&A management tools and the Starbucks app. I estimate that the combined drivers will grow revenue by 7.5% per year, where 4.2% stems from new stores, 2% from product line expansion and 1.3% from price increases and implementing efficiencies.

- By adding on these factors, I expect Starbucks to make around $52B revenues in 2029.

Profits Margins To Maintain Historical Average

- I am assuming a stable profit margin of 13% close to historical averages. While I believe that Starbucks will straighten partner wages and benefits, I assume that productivity gains and food offerings will drive up net profitability. The 13% profit margin results in $6.7B in 2029 earnings.

Earnings Multiple To Reduce As Growth Slows:

- I assume that as Starbucks builds new stores and saturates its market capacity, the PE ratio will converge to 22x reflecting the future growth limitation.

Buybacks To Continue Reducing Share Count

- I expect buybacks to continue in the future as workforce issues get settled. This will leave around $4B for buybacks per year. The company has 1.13B in outstanding shares, and I expect that to drop by 1% p.a. as a consequence of reinstated share repurchases to 1.07 billion shares.

Risks

- The company may experience a weaker consumer preference for premium coffee, as a possible stagnation in wages decreases discretionary spend.

- A higher portion of people may continue working from home - diminishing Starbucks’ store edge and forcing it to compete for deliveries with cheaper coffee providers.

- Customers may find alternative trends appealing and a substitute for status and caffeine. This may further limit the Starbucks market share. Things like Coffee subscription services, Canned and bottled coffee from the supermarket, Coffee infused with vitamins and minerals, Alternative coffee and affordability all pose risks to Starbucks expansion.

- Expanding into emerging markets will involve taking on categorical risk, which is difficult to quantify in a valuation. I expect returns on capital and profitability to diminish in these regions, but they may diminish even more than I already expect if the store rollout hits any hurdles, or if market penetration is harder in different cultures.

- The restaurant industry hasn’t had a new and exciting brand pop up recently. While this doesn’t mean that one is just around the corner, in a competitive market like hospitality, there is a possibility that a new brand that emerges and entices younger generations, thus harming Starbucks's brand and sales. Alternatively, the “new and exciting” competitor doesn’t necessarily need to be a coffee shop, it may appear as an alternative status symbol or a caffeine substitute. An example of this can be seen in the high-growth energy drinks company Celsius Holdings (CELH), which signals status by staying away from sweeteners and artificial colors in their brand, and substitutes coffee with a selection of energy drinks. Starbucks may counter this by coming up with their own store brand energy drinks, and leverage its large network of 38K stores to protect its market leadership position.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:SBUX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.