Narratives are currently in beta

- Sustained innovation and new product introductions in key segments are driving future revenue share growth and technology inflection momentum for Lam Research.

- Increased R&D spending aimed at semiconductor device inflections and next-generation technologies is expected to foster long-term revenue growth and market expansion.

- Normalized equipment lead times, NAND spending trends, and geopolitical shifts could impact Lam Research's revenue growth and market responsiveness.

What are the underlying business or industry changes driving this perspective?

- Lam Research has improved market positioning in foundry, logic, and specialty technology segments through sustained investment in innovation and new products, influencing future revenue share growth and technology inflection momentum.

- Significant growth in customer support business group (CSBG) with a substantially larger installed base, impacting revenue growth from services.

- Enhanced cost management and operational efficiency improvements contributing to higher operating margins.

- Anticipation of modest recovery in memory spending, especially in high-bandwidth memory and NAND technology upgrades, which could positively impact revenue growth and market share.

- Commitment to R&D spending increases for product differentiation in semiconductor device inflections, targeting next-generation 3D architectures and advanced packaging, likely influencing long-term revenue growth and expansion in served markets.

How have these above catalysts been quantified?

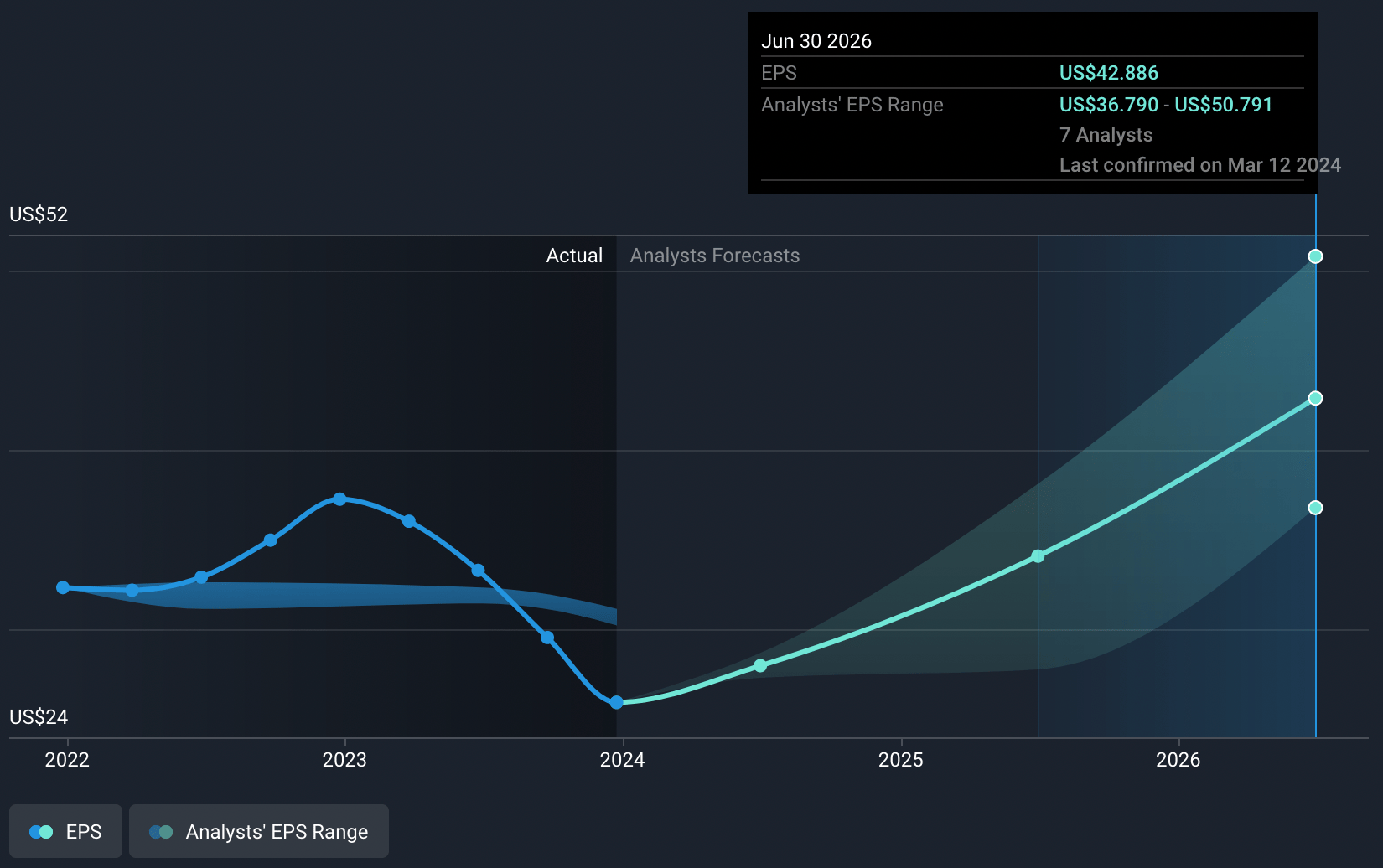

- Analysts are assuming Lam Research's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.2% today to 26.9% in 3 years time.

- Analysts expect earnings to reach $5.7 billion (and earnings per share of $46.1) by about March 2027, up from $3.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2027 earnings, down from 35.1x today.

- To value all of this in today’s dollars, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

What could happen that would invalidate this narrative?

- Lead times for Lam's equipment return to a more normalized level, implying the potential risk of not being the bottleneck in planning new fabs could affect overall market responsiveness and revenue recognition.

- NAND spending increases are largely expected to come from technology upgrades in the near term rather than new capacity additions, which could limit Lam's revenue growth potential if new capacity demand unexpectedly surges.

- The installed base of Lam equipment necessitates technology upgrades for older equipment to operate at the latest technology nodes, potentially delaying revenue from new equipment sales if customers opt for upgrades over new purchases.

- The China market, representing a significant portion of Lam's revenue, is expected to remain stable; however, shifts in regional spending patterns or geopolitical tensions could unpredictably impact revenue distribution and growth prospects.

- Lam's focus on R&D investments to drive long-term growth, particularly in new technology areas like advanced packaging and dry EUV patterning, poses execution risk. The successful development and market acceptance of these technologies are critical for revenue and earnings growth, but any delays or setbacks could impact financial performance.

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $912.75 for Lam Research based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $21.2 billion, earnings will come to $5.7 billion, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $925.68, the analyst's price target of $912.75 is 1.4% lower. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 31 Analysts

AI-Driven Advances Will Shape Future NAND And Semiconductor Technologies

Key Takeaways Lam Research's lead in critical NAND processes and new material use will drive significant growth opportunities and improved margins. AI-driven demands in advanced packaging and logic nodes position Lam to capture high market share, enhancing revenue and earnings.

View narrativeUS$92.82

FV

20.3% undervalued intrinsic discount11.94%

Revenue growth p.a.

3users have liked this narrative

0users have commented on this narrative

46users have followed this narrative

1 day ago author updated this narrative