Last Update 04 Dec 25

Fair value Decreased 0.19%TAP: Future Returns Will Depend On Consumer Strength And Category Trend Stabilization

Analysts have modestly lowered their price target on Molson Coors Beverage to approximately $51 per share from roughly $51 previously, citing a weak Q3 print, tempered FY25 guidance, ongoing category softness and share losses, and a lack of near term catalysts despite stable margins and only slight adjustments to growth and valuation assumptions.

Analyst Commentary

Recent Street research reflects a mixed but generally cautious stance on Molson Coors, with modest price target cuts clustered in the high $40s to low $50s and a tilt toward Neutral or Hold ratings. While execution has been relatively stable, the risk reward profile is viewed as balanced amid softer category trends and limited near term growth catalysts.

Bullish Takeaways

- Bullish analysts highlight stable margins and disciplined cost control as key supports for valuation, helping to limit downside despite weaker top line trends.

- Some see upside optionality from strategic partnerships, such as enterprise level marketing collaborations, which could enhance brand reach and support revenue growth over time.

- Valuation is viewed by some as undemanding after the recent pullback, with shares now pricing in a cautious outlook and potentially offering room for multiple expansion if execution improves.

Bearish Takeaways

- Bearish analysts emphasize that category weakness and share losses are likely to persist near term, constraining revenue growth and limiting visibility into a sustained recovery.

- Lowered FY25 guidance, while largely expected, reinforces concerns that earnings growth will be subdued, keeping pressure on both earnings multiples and sentiment.

- The absence of clear near term catalysts beyond a broadly stronger U.S. consumer makes it difficult to justify multiple expansion, especially against a backdrop of softer demand.

- With several firms trimming price targets toward the high $40s, the Street sees a more range bound trading setup, with limited scope for outsized upside absent a positive inflection in category trends.

What's in the News

- Recorded significant non cash goodwill and intangible asset impairment charges in Q3 2025, including a $3.65 billion goodwill write down and $273.9 million in intangible asset impairments (Key Developments).

- Lowered full year 2025 guidance, now expecting net sales to decline 3% to 4% on a constant currency basis and indicating results are likely to come in at the low end of that range (Key Developments).

- Continued returning capital to shareholders, repurchasing 502,212 shares for $25 million in Q3 2025 and completing 9.26% of shares outstanding for a total of about $1.12 billion under the current buyback program (Key Developments).

- Announced leadership transition, with Chief Strategy Officer Rahul Goyal set to succeed Gavin Hattersley as CEO on October 1, 2025, while Hattersley remains in an advisory role through year end (Key Developments).

- Dropped from the FTSE All World Index, removing Molson Coors Beverage (NYSE:TAP) from that global benchmark (Key Developments).

Valuation Changes

- Fair Value: edged down slightly to approximately $50.81 from about $50.90 per share, reflecting only a minor reduction in the intrinsic value estimate.

- Discount Rate: remained effectively unchanged at roughly 6.96%, indicating no material shift in perceived risk or required return.

- Revenue Growth: lowered modestly to about 28.1% from 29.3% over the forecast horizon, signaling a slightly more conservative top line outlook.

- Net Profit Margin: increased marginally to roughly 9.33% from 9.33%, implying a very small improvement in expected profitability.

- Future P/E: ticked down slightly to about 10.78x from 10.80x, suggesting a marginally more cautious view on valuation multiples.

Key Takeaways

- Diversification into premium, non-beer, and international segments supports higher margins, global growth, and resilience to shifting consumer preferences.

- Supply chain enhancements and strong cash flow enable cost mitigation, share buybacks, and investments in innovation, setting the stage for improved profitability and valuation.

- Persistent weakness in core markets, high input cost volatility, and lagging innovation in growth segments threaten Molson Coors' revenue, margin stability, and long-term growth potential.

Catalysts

About Molson Coors Beverage- Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- Molson Coors' expansion into above-premium and non-beer beverage categories (e.g., Fever-Tree mixers, seltzers, flavored malt beverages) positions it to capitalize on shifting consumer preferences for higher-quality, better-for-you, and non-alcoholic options, which should drive higher-margin revenue growth in future periods.

- Growth and premiumization in international segments-especially ongoing success of Madri and Peroni in EMEA/APAC and distribution runway for Banquet in the US-indicate strong potential for margin expansion and top-line growth as global urbanization and rising disposable incomes support higher long-term beverage consumption.

- Share retention gains, particularly in core brands like Coors Light, Miller Lite, and Banquet, plus expanded retail shelf space, set a foundation for stronger future sales as consumer sentiment rebounds and on-premise occasions continue to normalize post-pandemic.

- Investments in supply chain efficiency, productivity improvements, and cost optimization are expected to offset recent headwinds (e.g., aluminum costs, volume deleverage), positioning Molson Coors for EBITDA and net margin improvement as input costs normalize and contract brewing headwinds fade.

- Aggressive share repurchases and prudent capital investments, enabled by strong free cash flow, offer EPS growth and balance sheet flexibility to fund innovation and selective M&A-potentially leading to improved valuation multiples as secular demand and portfolio diversification trends play out.

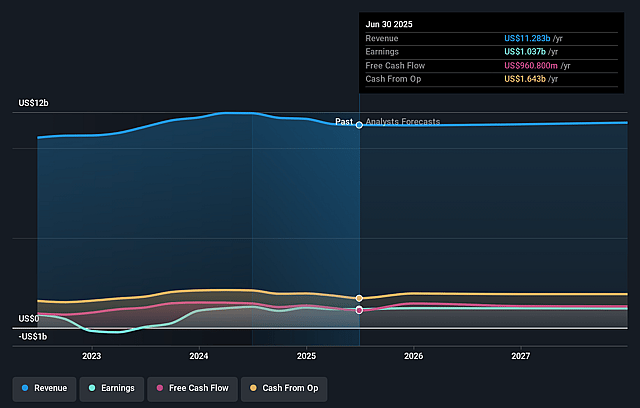

Molson Coors Beverage Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Molson Coors Beverage's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 9.3% in 3 years time.

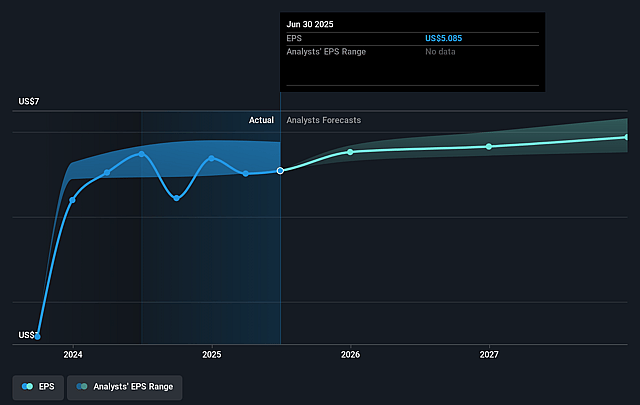

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $5.95) by about September 2028, up from $1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Beverage industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 4.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Molson Coors Beverage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained declines in U.S. beer industry volume-guidance reflects a continued 4–6% drop in the second half of 2025, with management acknowledging there are no signs yet of a turnaround in consumer confidence or consumption patterns. This persistent weakness directly pressures core revenues and creates ongoing operating deleverage.

- The company faces high input cost volatility, especially from unpredictable Midwest Premium aluminum pricing, which remains difficult and expensive to hedge and has spiked over 180% since January; this creates a major headwind for gross margins and threatens overall earnings predictability.

- Growing market exposure and reliance on mature U.S. and Canadian markets, with only incremental revenue contribution from international regions (EMEA and APAC), limits growth opportunities and magnifies risk from demographic shifts and declining beer consumption in developed markets, constraining long-term top-line growth.

- Despite premiumization efforts and innovation in non-alcoholic and above-premium segments, Molson Coors continues to under-index relative to peers in high-growth product categories (e.g., hard seltzers, RTDs, non-beer alternatives); lagging performance in these segments may stifle mix improvement necessary for margin resilience.

- Intensifying competitive and promotional pressure in core markets, ongoing pack and channel shifting, and potential regulatory/taxation actions add further risk to net sales, market share, and profitability, as evidenced by the company's need to reverse incentive compensation and reduce earnings expectations for 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.429 for Molson Coors Beverage based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $72.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.5 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $49.45, the analyst price target of $54.43 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Molson Coors Beverage?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.