Key Takeaways

- Accelerated share repurchases and premium brand growth are supporting higher margins, enhanced EPS, and ongoing share price strength.

- Strategic non-alcoholic innovations and portfolio streamlining are driving cost savings, operational agility, and expanding reach to health-conscious and emerging market consumers.

- Reliance on shrinking U.S. markets, rising input costs, and slow adaptation to premium trends threaten Molson Coors' long-term relevance, margins, and growth potential.

Catalysts

About Molson Coors Beverage- Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- While analyst consensus sees substantial EPS upside from share repurchases, the pace and scale of Molson Coors' buybacks are far exceeding expectations, with 55% of the $2 billion authorization completed in less than two years; this aggressive repurchasing could lead to outsized EPS growth and provide a persistent support for the share price going forward.

- Analysts broadly agree that premiumization in EMEA and APAC, led by Madri and Peroni, will boost revenue and margins, but they may be underestimating the long-term runway, given that Madri has already become a top-four beer in the UK and continues to show strong growth and geographic expansion potential, suggesting far greater high-margin revenue gains than currently modeled.

- Molson Coors' rapid integration and scale-up of premium non-alc and functional beverage brands like Fever-Tree, which is already delivering higher net sales per hectoliter than any product except spirits, positions the company to capture surging demand among health-conscious consumers, potentially unlocking an entire new profit engine with structurally higher margins and broader consumer appeal than legacy beer.

- With the simplification of its brand and production footprint (via exiting low-margin contract brewing and closing inefficient breweries), Molson Coors can realize intensified cost savings and operational agility, allowing for increased investment in innovation and core brands-this could yield a step change in both net margin and long-term earnings power.

- Demographic shifts in emerging markets are significantly expanding the pool of legal drinking age consumers, and Molson Coors' active geographic and product innovation strategy-evidenced by successful launches in Central/Eastern Europe and APAC-sets the stage for sustained volume expansion and top-line acceleration well beyond developed market forecasts.

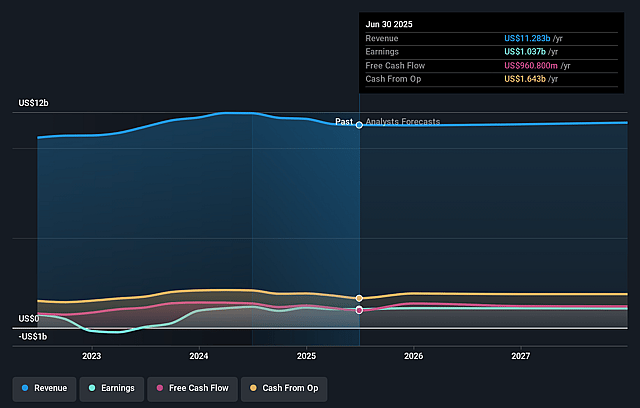

Molson Coors Beverage Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Molson Coors Beverage compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Molson Coors Beverage's revenue will grow by 1.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.2% today to 10.1% in 3 years time.

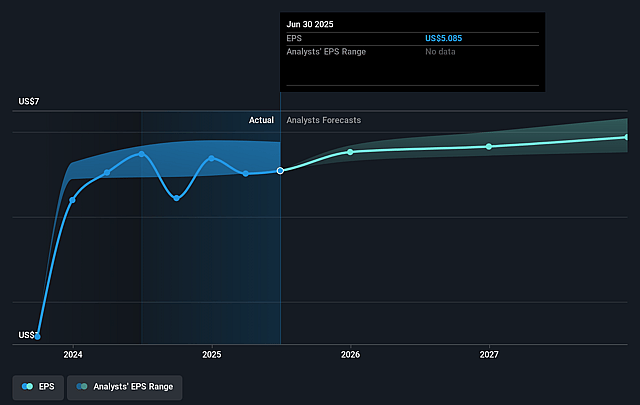

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $6.5) by about September 2028, up from $1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Beverage industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 4.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Molson Coors Beverage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in overall U.S. beer industry volume, with management now expecting industry declines of 4 to 6 percent for the second half of the year and a revised company outlook for net sales revenue to shrink 3 to 4 percent, signal ongoing secular declines in alcohol consumption that may continue eroding Molson Coors' revenue base long term.

- Significant cost pressure and margin squeezes from sharp increases and ongoing volatility in aluminum input costs, especially the Midwest Premium cost, which saw a 180 percent spike since January, demonstrate the company's vulnerability to commodity price swings that are difficult to hedge, putting sustained downward pressure on net margins and earnings.

- Molson Coors continues to underperform in the faster-growing above-premium and non-alcoholic beverage segments within the U.S., risking long-term relevance as secular trends shift consumers away from legacy brands and mass-market offerings, threatening to depress both future revenue growth and pricing power.

- The company's overreliance on North American markets, particularly the U.S., exposes it to the risk of stagnant regional demand, ongoing volume deleverage, and magnified impacts from economic downturns or regulatory changes, leading to greater volatility in revenues and profitability.

- Heightened competitive intensity, especially from craft, flavored, and specialty beverages, along with more aggressive pricing and promotional activity in international markets like the U.K., may force Molson Coors to increase spending and accept lower pricing, putting further strain on net margins and diminishing long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Molson Coors Beverage is $68.47, which represents two standard deviations above the consensus price target of $54.43. This valuation is based on what can be assumed as the expectations of Molson Coors Beverage's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $72.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.7 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $49.45, the bullish analyst price target of $68.47 is 27.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.