Key Takeaways

- TSMC is the current leader in chip manufacturing, boasting the most advanced technology and a strong customer base

- High-Performance Compute (HPC), AI, and EVs will drive growth, while the smartphone market slowly becomes saturated

- Their specialization strategy optimizes chips for specific use cases, allowing them to maintain their edge

- Peers are catching up, and a capital intensive industry will lower the bottom-line for investors

- TSMC has a high intrinsic value, but their exposure to China expands the risk to reward range

Catalysts

TSMC Will Remain Market Leader

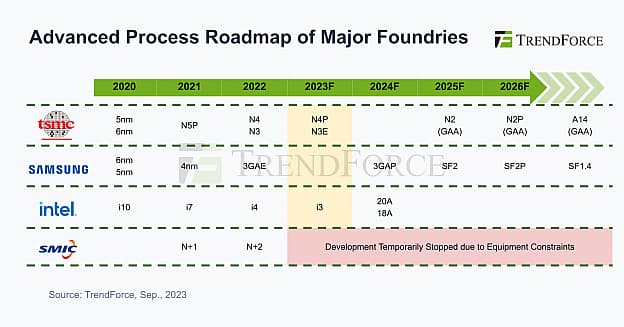

Key semiconductor competitors differ in their innovation and business approach. Roughly speaking, the quality of a semiconductor tends to be judged by its size, the smaller it is, the more transistors you can fit on a chip. Thus, we tend to consider larger semiconductors as older and used for general purposes, while semiconductors smaller than 5 nm are used for higher performing computations (such as AI) and are in higher demand.

The bleeding edge of the technology is in the range of 3 nm (mostly produced by TSMC) and 1.8 nm which are in development by TSMC, Intel, Samsung, etc.

Trendforce: Intense Competition in Advancing Processes at the 2 nm by Samsung, Intel, and TSMC

TSMC: Currently, TSMC has the largest market share and makes chips in the most advanced fabrication technology (5 nm and 3 nm). Their customer base includes Apple, Nvidia, and AMD. This gives them economies of scale and valuable insights into diverse chip needs.

Intel: Despite past stumbles, Intel cannot be counted out. They aim to reclaim the fabrication market (1, 2) with their upcoming 20A (2 nm) chip, and offer a neutral partnership platform for chip designers. Intel's 20A process will introduce two major innovations, RibbonFET Gate-All-Around (GAAFET) design and Backside Power Delivery Network (BSPDN), which are expected to improve performance and efficiency — this has also been acknowledged by TSMC’s leadership. However, Intel’s shift towards a foundry services is in the early stages and faces challenges in attracting new customers.

Samsung has invested heavily in their own fabrication technology, including GAAFET, which could offer performance advantages in the future. Additionally, their vertical integration, encompassing both chip design and fabrication, allows for faster innovation cycles. However, their current 5 nm and 3 nm processes lag slightly behind TSMC's in terms of yield and performance, and their foundry business primarily serves their internal needs.

While TSMC faces plenty of competition, its existing lead is hard to reduce and its speed of innovation is compounded by this lead it has on others. As long as this continues, I expect TSMC to retain market leadership, and generate high returns on invested capital.

Slowdown in TSMC Revenues and Earnings Is Only Temporary

For the fourth quarter, TSMC reported sales of TWD 625.5 million ($19.6B), which was flat YoY. Net income was TWD 238,712 million ($7.1B) compared to TWD 295,904 million ($8.8B) a year ago.

For the full year, sales were TWD 2,161,736 million ($69.3B) compared to TWD 2,263,891 million ($67.9B) a year ago. Net income was TWD 838,498 million ($25.1B) compared to TWD 1,016,530 million ($30.5B) a year ago. Full year net income margin is 38%, down from 45% YoY.

In the fourth quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue; 5-nanometer accounted for 35%; 7-nanometer accounted for 17%. Advanced technologies, defined as ≤7-nanometer, accounted for 67% of total wafer revenue.

TSMC presentation: Q4 ‘23 Revenue by platform

The revenue stagnation was caused by the end of the 5G upgrade cycle in smartphones, the PC market's pullback, and macro headwinds for data center chips. The company expects continued headwinds from smartphone seasonality (which impacts 43% of their business), partly offset by high performing compute chips demand.

While the smartphone market is maturing and has led to the past 12 months performance being slower, the future seems more bright. TSMC will likely see future revenue growth from other areas in its business such as AI, EV and HPC. However, I am aware that future volatility in the tech retail market could have significant impacts on future revenues.

Huge Growth To Come From High Performing Compute

In the next few years, the company expects 15% to 20% revenue CAGR (p. 4), with server AI processor contribution (within HPC) 5-year CAGR expected to be the key driver with growth between 18% to 20% — possibly higher (56:00 to 58:00).

TSMC: Revenue Growth By Platform

For 2024, TSMC expects its revenue to increase more than 20% as it ramps up the production of its latest 3-nanometer chips, continues to sell more 5 nm chips and benefits from the “robust” expansion of the AI market. Conversely, for Q1 '24 TSMC expects revenue to be between $18B and $18.8B, roughly the same as Q4. Operating profit margin is expected to be between 40% and 42%.

TSMC: Revenue By Semiconductor Class

Fab utilization rate is expected to rise as the company is preparing to capture growth from AI, 5G, and high performing compute (HPC).

Analysts’ estimates slightly differ from management guidance, as they expect revenue to grow 14% p.a. on average during the next 3 years, compared to a 15% growth forecast for the Semiconductor industry in Taiwan. Trading at 20x PE, analysts expect a 19% FY’24 earnings growth, indicating a forward PE of 17x.

Regardless of whether it’s low teens or high teens growth in revenue and earnings, the company’s year of stagnation in 2023 is likely over, given the upward trajectory in earnings, I’m much more optimistic on the company.

Innovation & Specialization Are Driving TSMC’s Growth Strategy

TSMC’s 2 nm technology is expected to be their most dense semiconductor yet. It’s expected to be introduced in 2025, and ramp up in the following years. The item is suitable for expensive, high-performing use cases, which is why I anticipate strong demand and sustained margins. Cutting edge innovation and their pure play fab approach also allows TSMC to entice new customers that are looking to design their in-house chips. This may entice cloud giants like Amazon, Google, Microsoft with large data centers.

While Intel is preparing to compete with their 1.8 nm chips, TSMC management indirectly speculated that Intel’s technology will only be useful for Intel’s products, while TSMC will provide 2 nm for all of their customers’ products and possibly capture a larger market. Note that TSMC’s management is presenting the scenario that benefits them the most, but they also have a history with more leading edge customers and have the opportunity to use their feedback to improve production. This has likely informed them in making the right calls on innovation in the past.

The next phase of TSMC’s development includes engaging in a specialized chip production strategy that focuses on optimizing chips for specific use cases. This will shift the focus from building the smallest chips to building the best chips for a specific purpose, such as HPC or EVs. This strategy will enable them to drive domain knowledge for specific use cases and maintain an edge over competitors.

I believe that the specialization strategy is a natural progression in the semiconductor race, as making smaller chips becomes increasingly difficult, and companies start optimizing production for specific chip architecture.

Massive CapEx And Geo Diversification Will Maintain The Lead For TSMC

The semiconductor industry is capital intensive, technology turnover is rapid, new and expensive fabs have to be built to accommodate and then scale up chip production. Old fabs can rarely be repurposed to produce new chips or components, making the investment cycle for semiconductors short and very expensive. So it is no surprise when we see TSMC announcing a CapEx budget between $28B and $32B, 70% to 80% of which will be allocated for advanced process technology, 10% to 20% on specialty technologies, and 10% advanced packaging, testing, etc. In fact, this is on the lower end of CapEx in the past 4 years when it ranged between $30B and $35B.

TSMC is also slated to benefit from the “Chips Act”, which has around $50B allocated for semiconductor production, and companies are expecting the allocation announcement this quarter. TSMC has commissioned two factories to be built in Arizona as a collaboration between the company and the US. The company is also planning and working on fabs in Germany, Japan, and further expanding their production capacity in Taiwan.

The first US factory is scheduled to open in 2025, while the second has been pushed back to 2026-2027, and the company’s management has indicated that its progress and technological capabilities i.e., ability to produce ≤5 nm semiconductors, will depend on the outcome of US negotiations. The US fabs are a part of a joint onshoring and geo-diversification strategy between the partners, which help alleviate some risk from China’s unification push.

The onshoring or geo-diversification strategy is a mixed proposition. On the upside, the faster TSMC is able to shift assets away from Taiwan, the higher the chance that they will be able to phase out old technology before China can destabilize the region.

On the downside, there are two key bottlenecks to US production: semiconductors need a mix of rare earth materials, which have to be imported, with China having the largest reserves, and second, the industry is in high demand of skilled engineers, which TSMC has managed to procure and train in Taiwan, but a separate solution will be needed in order to bring/train talent in the US.

Reuters: World Reserves Of Rare Earth Metals

Assumptions

TSMC Will Recover Growth After Short-term Cyclicality

Revenue: 2024 will arguably be a slower year for TSMC, and I expect the company to reach around $73B in revenue. However, I do expect sales to pick up after that and grow at a 13.5% CAGR after that, driven by industry innovation and TSMC market leadership position. This results in around $121B revenues for 2029 - 75% more than the $69.3B in 2023.

Competition And Price Wars Will Erode Margins

Margins: Competition is tightening in the industry as more players are approaching advanced production capabilities. This will erode pricing power for market leaders like TSMC, and increase the need for R&D spend. For this reason, I think that profits will start feeling pressure, resulting in a 37% net margin in 2029 or a net income of $45B.

High-Performance Chip Demand Will Sustain Future Growth Expectations

I view that the current PE is low reflecting 2 key factors:

- The capital expenditures needed in this industry, which impacts how much investors have left from the profits, i.e., current profit to free cash flow conversion is 35%

- The mentioned categorical risk from China

I believe TSMC will continue to trade around a 23x PE given the technological leading edge, vast product applicability, and continued growth potential. While smartphones and PC components are currently in a down cycle, the industry will continue expanding from HPC applications, EVs, and general compute demand.

Risks

- TSMC expects continued smartphone seasonality effects and global economy tailwinds. While I have incorporated short-term revenue stagnation in my forecast, I can’t be sure how long the headwind will last. Conversely, the US consumer shouldn’t be underestimated, and as long as the US dollar is the de-facto reserve currency, US consumers may keep surprising on the upside.

- Geopolitics is the categorical risk factor that investors are factoring-in, as China has continued its “Unification” commitments for Taiwan. Investors have been aware of the threat for some time, and mitigation proposals span from moving production, to demolishing key infrastructure in a hostile event. Should this happen and is successfully pulled-off it would arguably eliminate the terminal value of TSMC and investors will lose most of their value - hence the categorical risk.

- Multiple Chinese wafer producers are ramping up their output. They are mostly producing wafers for 28 nm to 65 nm chips, which isn’t high-tech but suitable for most of the average electronic devices. The move serves to solidify China as the factory of the world, and will also have the effect of increasing chip supply, which can impact prices and diminish profit margins.

- After the US banned exports of components used for making high performing ≤7 nm chips to China, Huawei came out with a comparable 7 nm chip in their smartphones. The 7 nm chip was manufactured by SMIC, indicating that China may not be too far behind western technology. This indicates that TSMC will need to keep making high capital expenditures in innovation in order to keep its leadership position which drives their high margins.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NYSE:TSM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.