Last Update 14 Dec 25

Fair value Increased 0.76%CHRW: Operating Margin Discipline And AI Supply Chain Investments Will Support Future Resilience

Analysts have nudged their average fair value estimate for C.H. Robinson Worldwide slightly higher, from about $152 to roughly $153, citing recent price target increases that reflect operating margin expansion, raised 2026 income goals, and the company’s resilient, defensive positioning in a still-choppy freight market.

Analyst Commentary

Street research remains broadly constructive on C.H. Robinson, with most recent updates skewing toward higher price targets and supportive ratings even as the freight backdrop stays mixed.

Bullish Takeaways

- Bullish analysts are lifting price targets into the mid 150s to mid 160s range, arguing that the stock deserves a higher valuation multiple as operating margins continue to expand and profitability trends improve.

- Several research notes frame C.H. Robinson as one of the more defensive operating models in transportation, with strategic initiatives and cost discipline viewed as key to protecting earnings power in a choppy freight market.

- Higher 2026 operating income targets, reiterated even as the outlook for next year softens, are cited as evidence of management confidence in execution and long term earnings growth.

- Analysts previewing Q3 expect management to emphasize network efficiency, cost control, and potential macro catalysts, supporting a thesis that earnings leverage will emerge as demand normalizes.

Bearish Takeaways

- Bearish analysts caution that after a sharp share price run up, valuation now limits upside. This has prompted some to move to more neutral stances despite raising price targets.

- Sector wide estimate cuts and commentary that pricing and margin improvement remain some distance away highlight the risk that a slower than expected freight recovery could cap earnings growth.

- Concerns that a still soft truckload market will weigh on near term results keep some investors wary of paying peak like multiples ahead of a more definitive demand rebound.

What's in the News

- Raised 2026 operating income guidance by roughly $50 million, setting a new target range of $965 million to $1.04 billion. The low end of this range implies about $6 in earnings per share even under flat market volume assumptions (company guidance).

- Announced the Agentic Supply Chain, an AI driven logistics ecosystem built around its Always On Logistics Planner digital workforce. The platform is aimed at real time decision making, cost optimization, and more resilient global supply chains (company product announcement).

- The board authorized a $2 billion increase to the long running share repurchase program, expanding capital return capacity following substantial historical buybacks (company board action).

- Repurchased 958,100 shares for $112.18 million in the third quarter of 2025, bringing total buybacks under the program announced in 2007 to more than 77 million shares for about $5.86 billion (company buyback update).

- Declared an increase in the regular quarterly cash dividend to $0.63 per share, payable January 5, 2026, reinforcing a commitment to returning cash to shareholders (company dividend declaration).

Valuation Changes

- The fair value estimate has risen slightly, increasing from approximately $152.20 to about $153.36 per share.

- The discount rate has edged higher, moving from roughly 7.77 percent to about 7.78 percent, implying a modestly higher required return.

- The revenue growth assumption has increased meaningfully, from about 4.51 percent to roughly 5.62 percent, reflecting a more optimistic top line outlook.

- The net profit margin expectation has dipped slightly, easing from around 4.04 percent to about 3.91 percent, indicating a modestly more conservative profitability view.

- The future price-to-earnings multiple has inched up, from roughly 29.06 times to about 29.27 times, signaling a marginally richer valuation framework.

Key Takeaways

- AI-driven automation and digital tools are boosting margins, efficiency, and customer retention while supporting scalable growth and market share gains.

- Investments in integrated, data-rich logistics and global expansion position the company to benefit from outsourcing trends and increased supply chain complexity.

- Exposure to trade policy risks, rising technology-driven competition, and dependence on volatile customs revenue threaten sustainable margins and future earnings stability.

Catalysts

About C.H. Robinson Worldwide- Provides freight transportation and related logistics and supply chain services in the United States and internationally.

- Acceleration in AI-driven automation across the full lifecycle of shipments is driving evergreen productivity and efficiency gains, enabling the company to decouple headcount from volume growth and deliver sustained gross margin and operating margin expansion, supporting higher long-term earnings and net margins.

- Scaling of proprietary digital capabilities and deployment of automated, self-serve logistics tools improves data-driven pricing, rapid quote response, and customer supply chain visibility, leading to market share gains and higher wallet share, positively impacting future revenue growth.

- The increasing complexity of global supply chains, driven by tariff volatility and trade uncertainties, is elevating customer demand for integrated, data-rich solutions-areas where C.H. Robinson is investing and expanding-resulting in strong customer retention and a more resilient recurring revenue base.

- Expansion of advanced automation and real-time optimization tools to global forwarding operations is expected to unlock additional productivity and gross margin gains outside the core North American business, supporting further top-line growth and improved overall margins.

- Persistent industry shift toward outsourcing logistics and supply chain management, alongside customer "flight to quality" amid volatility, positions C.H. Robinson to capture incremental market share and deliver above-market revenue and earnings growth as demand recovers.

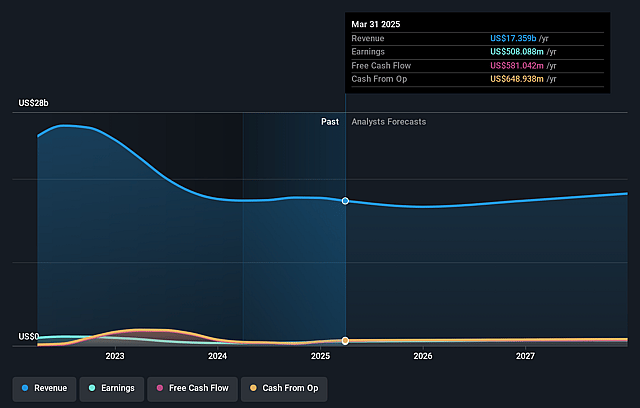

C.H. Robinson Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming C.H. Robinson Worldwide's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 3.7% in 3 years time.

- Analysts expect earnings to reach $677.2 million (and earnings per share of $5.82) by about September 2028, up from $534.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.1x on those 2028 earnings, down from 27.9x today. This future PE is greater than the current PE for the US Logistics industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

C.H. Robinson Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing uncertainty and volatility in global trade policy, including elevated tariffs and trade negotiations, is making planning and forecasting more difficult for C.H. Robinson and its customers, which could dampen net revenue growth and drive unpredictable earnings volatility if these trade frictions persist or worsen.

- There is increasing democratization of freight brokerage technology-smaller brokers now have easier access to advanced digital tools, which could intensify competition, limit differentiation based on technology, and potentially erode C.H. Robinson's market share and gross margin over time.

- While current profitability gains are supported by process automation and AI-driven workforce reductions, any failure to keep pace with rapid advances in AI, agentic AI, or autonomous supply chain technology (especially if rivals out-innovate C.H. Robinson) could lead to higher operational costs and compress net margins in the longer term.

- Strong recent financial results are partly reliant on the elevated complexity in customs and tariffs, which may be transitory rather than structural; any simplification of global trade or resolution of tariff disputes could reduce the high-margin customs revenue stream, negatively impacting future operating income and earnings quality.

- C.H. Robinson's non-asset-based model limits its control over underlying carrier quality and cost structure; during elongated industry downturns or tightening regulatory environments (e.g., emissions, labor standards), this exposes the company to greater rate volatility and cost inflation that could compress net margins and reduce earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $117.56 for C.H. Robinson Worldwide based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $136.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.4 billion, earnings will come to $677.2 million, and it would be trading on a PE ratio of 25.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $126.05, the analyst price target of $117.56 is 7.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on C.H. Robinson Worldwide?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.