Key Takeaways

- Scaling international markets and platform enhancements aim to boost user engagement, repeat business, and improve long-term unit economics and retention.

- Investments in trust, AI, and reinvesting domestic cash flow drive growth, reduce reliance on cash burn, and position the platform to benefit from broader digital adoption.

- Heavy reliance on marketing, early-stage international growth, competitive pressures, regulatory risks, and challenges at Oneflare all threaten sustainable revenue and profitability.

Catalysts

About Airtasker- Engages in the provision of technology-enabled online marketplaces for local services in Australia.

- The acceleration of revenue growth in both the U.S. and U.K. markets, driven by successful brand marketing and strategic media partnerships, suggests that Airtasker's international expansion is beginning to scale and could provide significant top-line revenue upside as these large, underpenetrated markets continue to mature.

- Investments in platform trust and safety-such as universal ID verification, tax compliance integration, and new customer-facing features-directly address consumer concerns, enabling broader adoption and engagement in line with increasing digital platform penetration, which is likely to lift transaction volumes and support revenue growth.

- Recent platform enhancements focused on driving repeat business and reducing friction for re-bookings (e.g., fee restructuring, user incentives, improved app usability) are positioned to unlock higher customer lifetime value, decrease platform leakage, and potentially expand GMV at scale, which should improve overall revenue and user retention economics.

- The company's ability to generate solid free cash flow from the Australian market, and to reinvest these funds into high-impact international market launches, demonstrates an operating model that can internally fund growth while gradually reducing reliance on cash burn, thus improving long-term earnings visibility and margin profile.

- Leveraging AI advancements both in user matching and task creation, as well as benefiting from increased referral traffic from AI-powered platforms, places Airtasker in a strong position to capitalize on the growing gig economy and the secular shift to online marketplaces, providing a durable growth engine that can expand both gross margins and earnings over time.

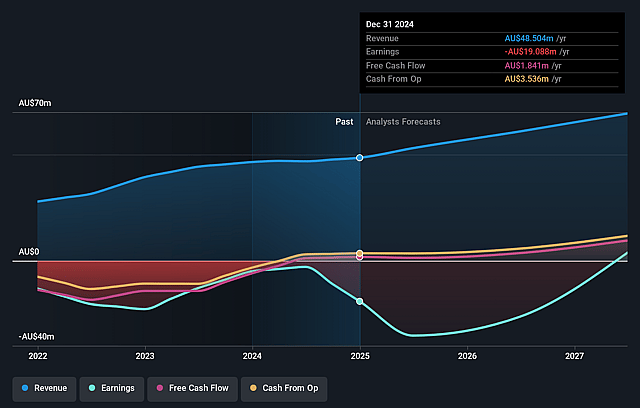

Airtasker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Airtasker's revenue will grow by 14.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -59.9% today to 13.1% in 3 years time.

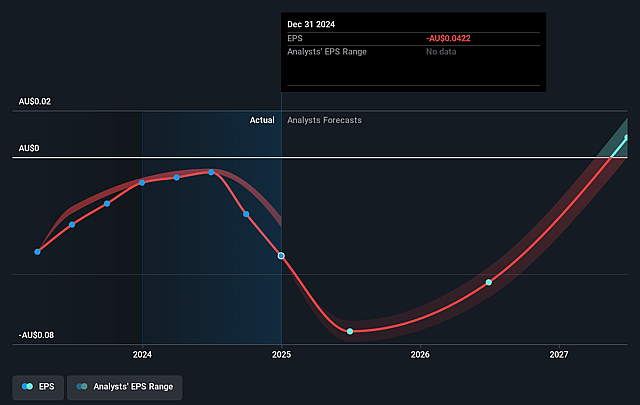

- Analysts expect earnings to reach A$10.5 million (and earnings per share of A$0.02) by about September 2028, up from A$-31.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.0x on those 2028 earnings, up from -5.5x today. This future PE is lower than the current PE for the AU Interactive Media and Services industry at 46.4x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

Airtasker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained high marketing spend-both cash and contra media-underpins much of the recent and forecasted revenue growth. If media partnerships prove less effective or can't be renewed on favorable terms, maintaining top-line momentum may prove costly and squeeze long-term net margins and free cash flow.

- International growth (U.S. and U.K.) remains in early stages, with revenues and GMV coming off a low base and concentrated in only a few cities (e.g., Los Angeles, London). Failure to replicate the Australian market's escape velocity and achieve meaningful network effects in diverse geographies risks stalling growth, threatening both future revenue and earnings scalability.

- The company's "infinitely horizontal" model depends on facilitating a wide range of non-traditional service jobs. Any long-term shifts in consumer trust, tightening of regulatory environments, or data privacy concerns in digital marketplaces could reduce user retention and acquisition, impacting growth in transaction volumes and overall platform revenue.

- Increasing competition from global and local platforms (such as TaskRabbit, Upwork, Fiverr), as well as the potential commoditization of gig work marketplaces, could drive down take rates and force fee reductions, eroding gross margins and long-term profitability.

- Oneflare, the group's lead generation business, faces structural headwinds from changing Google search and advertising economics and a high-cost sales model. If efforts to reposition and simplify pricing fail, it could become a drag on consolidated revenue growth and group-level operating earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.515 for Airtasker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.75, and the most bearish reporting a price target of just A$0.23.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$79.8 million, earnings will come to A$10.5 million, and it would be trading on a PE ratio of 28.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$0.38, the analyst price target of A$0.52 is 25.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.