Key Takeaways

- Regulatory challenges, automation, and user disintermediation threaten profitability, revenue growth, and recurring earnings reliability for Airtasker's expanding global platform.

- Heavy reliance on paid marketing and strong global competition limit organic expansion, weaken pricing power, and risk further margin deterioration.

- Strong revenue momentum, high-margin business model, effective global scaling, and strategic partnerships position Airtasker for sustainable growth and improved profitability.

Catalysts

About Airtasker- Engages in the provision of technology-enabled online marketplaces for local services in Australia.

- Increased regulatory scrutiny of gig economy platforms globally is likely to result in higher compliance and worker reclassification costs, directly squeezing net margins and elevating operational expenses as Airtasker expands beyond Australia.

- Widespread adoption of advanced artificial intelligence and automation tools could significantly reduce demand for basic, repetitive, or entry-level tasks on Airtasker, undermining the platform's long-term addressable market and putting sustained pressure on revenue growth.

- A highly competitive landscape, with intensified rivalry from better-capitalized global players like TaskRabbit, Fiverr, and Upwork, threatens Airtasker's ability to gain or maintain international market share, limiting future top-line growth and weakening pricing power.

- Persistent heavy reliance on paid marketing spend and media partnerships, particularly in unproven U.S. and U.K. markets, exposes Airtasker to a scenario where customer acquisition costs outpace organic growth, leading to continued margin erosion and reduced cash generation if viral, self-sustaining growth does not materialize.

- The risk of user disintermediation remains structurally unresolved, and as repeat usage grows, taskers and clients may increasingly bypass the platform for future transactions, eroding transaction-based revenues and reducing recurring earnings reliability.

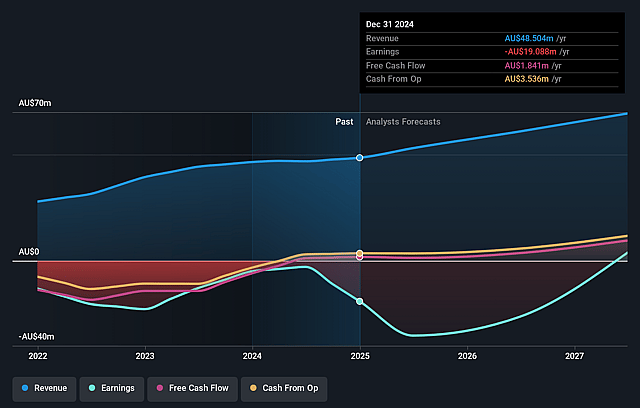

Airtasker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Airtasker compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Airtasker's revenue will grow by 15.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -59.9% today to 14.1% in 3 years time.

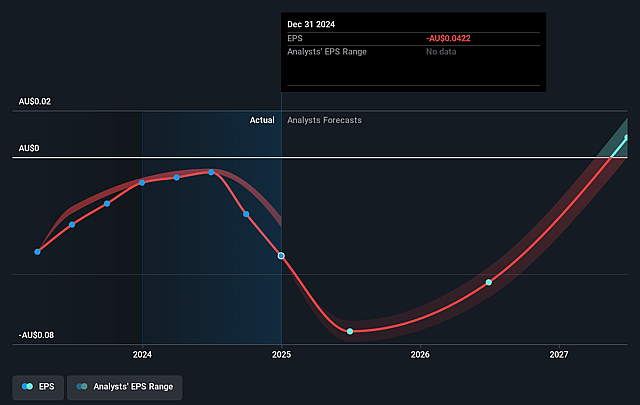

- The bearish analysts expect earnings to reach A$11.5 million (and earnings per share of A$0.02) by about September 2028, up from A$-31.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from -5.5x today. This future PE is lower than the current PE for the AU Interactive Media and Services industry at 47.2x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

Airtasker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating double-digit revenue growth across core Australian operations and especially in international markets such as the UK and US demonstrates strong momentum and the potential for significant top-line expansion, which could drive share price appreciation.

- Proven ability to generate strong free cash flow in the mature Australian marketplace, and effective reinvestment of this cash into scaling overseas markets, supports the case for operational leverage and future earnings growth.

- Unique high-margin and highly flexible marketplace model, with gross margins above 95% and a growing take rate, positions Airtasker to benefit from the secular trend of consumers increasingly adopting digital task-based services, supporting long-term profitability.

- Strategic media partnerships in Australia, the UK, and the US have successfully boosted brand awareness, accelerated user acquisition, and provided low-cost marketing, which will likely enhance organic demand, reduce future customer acquisition costs, and improve EBITDA margins as the business scales.

- Significant total addressable market expansion opportunities are present due to ongoing urbanization, increasing repeat booking initiatives, brand enhancements, and synergistic partnerships (such as with Argos in the UK), each of which supports higher transaction volumes and recurring revenues over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Airtasker is A$0.23, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Airtasker's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.75, and the most bearish reporting a price target of just A$0.23.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$81.2 million, earnings will come to A$11.5 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$0.38, the bearish analyst price target of A$0.23 is 67.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Airtasker?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.