Key Takeaways

- Replicating the Australian strategy in the US and UK, supported by innovative partnerships and media assets, could deliver significant, cost-effective growth and margin expansion.

- Platform enhancements and a strong reputation position the company to capitalize on gig economy trends, boosting retention, diversification, and long-term earnings stability.

- Increased regulation, demographic shifts, automation, rising competition, and international expansion risks threaten profitability, market share, and long-term growth prospects.

Catalysts

About Airtasker- Engages in the provision of technology-enabled online marketplaces for local services in Australia.

- Analyst consensus views international expansion as a major growth engine, but the acceleration in US and UK GMV-422% and 111% revenue growth respectively-suggests that, if the existing Australian playbook is successfully replicated, these new markets could yield multiples of current group revenue and propel the company's aggregate net margins much higher, particularly as they approach marketplace escape velocity faster than analysts currently anticipate.

- While the consensus highlights increased marketing efficiency via innovative media partnerships, the untapped $28 million in prepaid media assets, combined with strategic household partnerships like Argos, could unlock explosive, cost-effective top-of-funnel growth in the UK and US, resulting in sharply lower customer acquisition costs and a sustained elevation in long-term ROIC and earnings power.

- Airtasker's high-margin, infinitely horizontal open marketplace model provides unique adaptability to future societal shifts-such as the ongoing rise in gig-based services driven by new urban consumer behaviors-which could drive transaction frequency and average booking value far beyond current forecasts, accelerating both GMV and revenue at minimal incremental cost.

- Recent platform enhancements, including AI-driven task matching, recurring task fee structure, and frictionless payments, are likely to rapidly increase booking retention and rebooking rates. This effect, compounded by a rising pool of "super users" who trust and repeatedly use the platform, could materially lift user lifetime value and compress churn, positively impacting top-line growth and gross margin durability.

- As regulatory certainty around the gig economy improves and digital trust in peer-to-peer services deepens, Airtasker's first-mover scale and robust reputation infrastructure make it uniquely positioned to capture an outsized share of both B2C and untapped B2B service markets, potentially driving step-change increases in revenue diversification and group-level earnings stability.

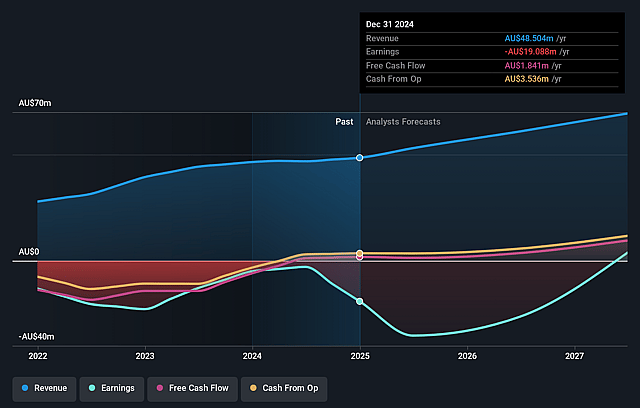

Airtasker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Airtasker compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Airtasker's revenue will grow by 15.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -59.9% today to 14.3% in 3 years time.

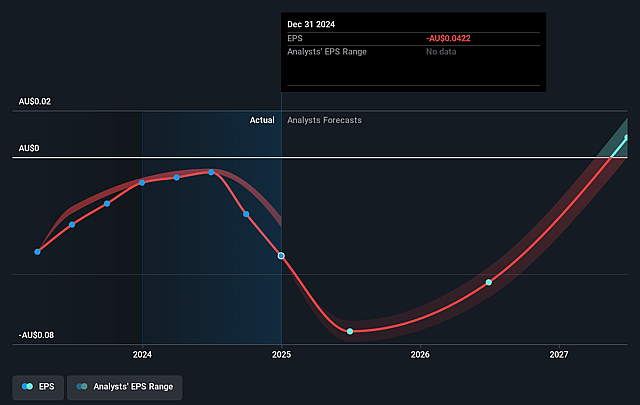

- The bullish analysts expect earnings to reach A$11.6 million (and earnings per share of A$0.02) by about September 2028, up from A$-31.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 36.7x on those 2028 earnings, up from -5.6x today. This future PE is lower than the current PE for the AU Interactive Media and Services industry at 45.9x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Airtasker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing regulatory scrutiny on gig economy platforms poses a risk of increased operating costs and compliance burdens for Airtasker, which could reduce profitability and threaten the currently high gross margins of over 95 percent.

- Demographic trends such as an aging population and declining workforce participation in developed markets may shrink the pool of available taskers and users, limiting long-term growth potential and hindering platform liquidity, which would impact revenue growth and earnings.

- The rapid adoption of automation and AI-driven solutions threatens the demand for routine, low-skill tasks that form the bulk of Airtasker's market, potentially reducing the company's addressable market size and thereby constraining future revenue growth.

- Intensifying competition from global and local service marketplaces such as TaskRabbit and Fiverr increases the likelihood of pricing pressures and requires higher marketing spend for user acquisition, which could compress take rates and lead to lower net margins.

- Airtasker's international expansion strategy faces execution risk due to cultural and logistical challenges and entrenched local competitors, raising the possibility that new markets in the US and UK may not reach profitability or sustainable scale, putting pressure on group earnings and overall cash flow in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Airtasker is A$0.75, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Airtasker's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.75, and the most bearish reporting a price target of just A$0.23.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$81.4 million, earnings will come to A$11.6 million, and it would be trading on a PE ratio of 36.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$0.39, the bullish analyst price target of A$0.75 is 48.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.