Last Update04 Aug 25Fair value Increased 21%

Driven by an improvement in net profit margin despite slightly lower revenue growth forecasts, the consensus analyst price target for Vertiv Holdings Co has been raised significantly from $131.00 to $154.96.

What's in the News

- Vertiv raised full-year 2025 earnings guidance, now expecting net sales of $9,925 million to $10,075 million with organic net sales growth of 23% to 25%, previously 18%.

- Q3 2025 earnings guidance provided: net sales expected between $2,510 million and $2,590 million, with organic net sales growth of 20% to 24%.

- Announced advanced 142kW cooling and power reference architecture for NVIDIA GB300 NVL72, enabling accelerated AI infrastructure deployment, enhanced energy efficiency, and collaboration via NVIDIA Omniverse.

- Confirmed strategic alignment with NVIDIA’s AI roadmap and announced 800 VDC power architecture portfolio for next-gen AI-centric data centers, launching in 2026.

- CFO David Fallon to retire following successor appointment in H2 2025, continuing as consultant through 2026; Vertiv continues to seek acquisitions and invest in R&D and capacity expansion, particularly for AI infrastructure.

Valuation Changes

Summary of Valuation Changes for Vertiv Holdings Co

- The Consensus Analyst Price Target has significantly risen from $131.00 to $154.96.

- The Net Profit Margin for Vertiv Holdings Co has risen from 15.11% to 16.58%.

- The Consensus Revenue Growth forecasts for Vertiv Holdings Co has fallen slightly from 14.1% per annum to 13.7% per annum.

Key Takeaways

- Surging AI-driven data center demand and expanding integration needs are boosting Vertiv's growth prospects and supporting higher pricing power.

- Strategic R&D, industry partnerships, and regulatory trends position Vertiv for sustained innovation and long-term earnings growth despite near-term operational challenges.

- Ongoing supply chain disruptions, regional execution challenges, and customer vertical integration threaten Vertiv's margins, revenue growth, and competitive positioning amid rapid technological change.

Catalysts

About Vertiv Holdings Co- Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- Accelerating global demand for high-density, AI-driven data centers is driving robust growth in Vertiv's sales pipeline and backlog, as evidenced by recurring record order levels, backlog growth, and management's raised organic sales growth guidance-supporting potentially higher future revenue.

- Increasing complexity and scale of data center deployments, including the need for integrated power and advanced liquid cooling solutions, are expanding Vertiv's addressable market and enabling premium pricing, which should support future net margin expansion as temporary operational costs normalize.

- Ongoing investments in R&D and engineering, highlighted by collaborations with industry leaders (e.g., CoreWeave, Dell, Oklo), position Vertiv to deliver next-generation solutions ahead of technology refresh cycles-creating recurring upgrade opportunities and sustaining top-line and earnings growth.

- Regulatory and policy momentum in the U.S. and EMEA is becoming more favorable for AI infrastructure build-outs, improving the long-term demand outlook and revenue visibility, especially as the current "coiled spring" in EMEA is poised to unwind and drive regional reacceleration.

- Operational and supply chain challenges-including costs tied to tariff transitions and rapid scaling-are expected by management to be largely resolved by the end of 2025, supporting management's long-term operating margin targets (25% by 2029) and stronger future earnings growth as scale benefits are fully realized.

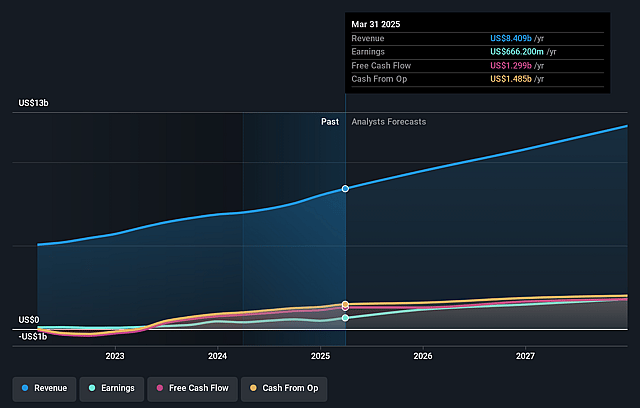

Vertiv Holdings Co Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vertiv Holdings Co's revenue will grow by 14.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 16.2% in 3 years time.

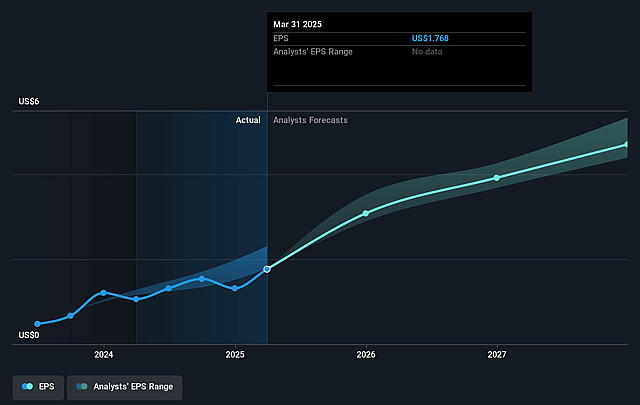

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $5.77) by about August 2028, up from $812.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.0x on those 2028 earnings, down from 60.7x today. This future PE is greater than the current PE for the US Electrical industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 1.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.77%, as per the Simply Wall St company report.

Vertiv Holdings Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global trade tensions and frequently changing tariffs are creating ongoing supply chain and manufacturing disruptions, leading to higher transition costs and operational inefficiencies that can compress net margins and pressure future earnings.

- The company's continued reliance on margin expansion from operational efficiencies is challenged by temporary but recurring execution issues, including cost overruns from supply chain reconfiguration and growth acceleration, which may result in lower-than-expected margin improvement and weigh on long-term earnings growth.

- Ongoing execution challenges in EMEA, compounded by flat sales forecasts and upfront investments in anticipation of future demand, create a risk that regional underperformance may persist, dragging on overall revenue growth and regional profitability.

- The risk of hyperscale and large cloud customers pursuing vertical integration or developing in-house cooling and power solutions could diminish Vertiv's ability to maintain win rates and may ultimately compress revenues and reduce market share over time.

- Rapid technological change in the data center sector means Vertiv must sustain high R&D spending and product innovation; failure to keep up with next-generation cooling/power technologies or an inability to differentiate amid increasing commoditization can erode pricing power, compress margins, and limit long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $158.337 for Vertiv Holdings Co based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $173.0, and the most bearish reporting a price target of just $119.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.7 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 37.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $129.05, the analyst price target of $158.34 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.