Key Takeaways

- Accelerating global data center expansion and stricter energy regulations boost demand for Vertiv’s essential, innovative power and thermal management solutions.

- Expanding high-margin services, strong order backlog, and operational efficiencies position Vertiv for sustained earnings growth and continued market leadership.

- Shifting industry trends, regulatory pressures, and customer concentration expose Vertiv to rising risks in revenue growth, market relevance, and sustainable long-term earnings.

Catalysts

About Vertiv Holdings Co- Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- Vertiv is uniquely positioned to benefit from the sustained surge in global data center buildouts, driven by rapid growth in cloud computing and artificial intelligence adoption, enabling long-term, above-market revenue growth due to the essential nature of its power and thermal management solutions for next-generation digital infrastructure.

- The company is already seeing robust order pipelines and expanding backlog—up $1.6 billion to $7.9 billion year-over-year—with bookings growth in both the near and long term, indicating durable multi-year demand that will drive strong topline revenue acceleration well beyond 2025.

- Growing regulatory focus on energy efficiency and rising power density requirements are leading customers to upgrade to more advanced infrastructure, positioning Vertiv’s innovative and energy-saving solutions as critical, and supporting margin expansion as the company captures higher-value retrofits and new deployments.

- Vertiv’s demonstrated ability to expand its service and software offerings allows for a shift to higher-margin, recurring revenue streams, which will improve net margins and drive consistent earnings growth as predictive maintenance and value-added digital services scale with the installed base.

- Operational execution including resilient global supply chains, ongoing mitigation of cost headwinds such as tariffs, and manufacturing optimization are unlocking operating leverage, which, together with strong pricing power and a flexible balance sheet, will continue to support EBITDA and free cash flow growth, providing the company room for accretive M&A and investment to reinforce secular growth tailwinds.

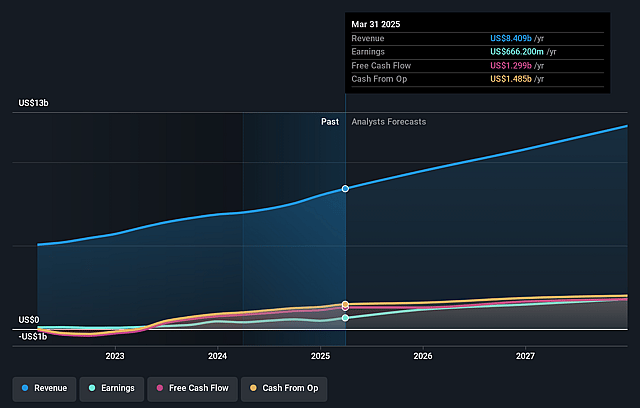

Vertiv Holdings Co Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vertiv Holdings Co compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vertiv Holdings Co's revenue will grow by 16.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.9% today to 16.1% in 3 years time.

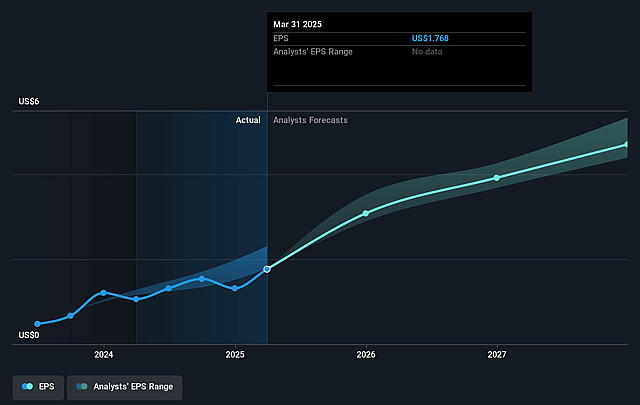

- The bullish analysts expect earnings to reach $2.2 billion (and earnings per share of $5.94) by about July 2028, up from $666.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, down from 71.7x today. This future PE is greater than the current PE for the US Electrical industry at 28.7x.

- Analysts expect the number of shares outstanding to grow by 1.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Vertiv Holdings Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating trend of hyperscale data centers being designed and operated in-house by large technology companies poses a long-term risk to Vertiv, as it could reduce the company's role as a turnkey solutions provider and compress future revenue growth from key enterprise and hyperscaler segments.

- Regulatory scrutiny continues to intensify around energy consumption and carbon emissions in data centers, putting pressure on Vertiv to accelerate investment in next-generation efficiency technologies; failure to keep pace could lead customers to switch to more innovative rivals, result in elevated R&D expenses, or manifest in margin compression over time.

- The rise of edge computing and distributed architectures reduces market reliance on large, centralized data centers—Vertiv’s core business—potentially shrinking the company’s total addressable market and diminishing long-term revenue growth prospects as the industry transitions to smaller, modular facilities.

- Heavy dependence on a limited number of large hyperscaler and cloud customers exposes Vertiv to meaningful customer concentration risk, elevating the threat of revenue instability and profit volatility if even one top client reduces orders or brings operations in-house.

- Despite recent improvements in operating metrics, Vertiv’s legacy product base and historically lower operating margins compared to its top peers limit the company’s operational leverage and its ability to invest in R&D or strategic acquisitions at the scale needed to fend off intensifying competition, putting sustained earnings growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vertiv Holdings Co is $165.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vertiv Holdings Co's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $82.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.4 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $125.29, the bullish analyst price target of $165.0 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Vertiv Holdings Co?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.