Last Update 18 Feb 26

Fair value Increased 0.41%TRST: Upgraded Rating And Buybacks Will Support Stronger Future Returns

Analysts have nudged their price target on Trustpilot Group higher to £2.20, reflecting updated views on fair value, discount rate, revenue growth, profit margin and future P/E assumptions following recent research, including an upgrade to Hold.

Analyst Commentary

Bullish analysts see the move to a £2.20 target as a reset that better lines up the share price with their assumptions on revenue growth, margins and future P/E, rather than a call on short term trading.

The shift to a Hold rating signals a more balanced stance, where upside and downside appear more evenly matched at current levels.

Bullish Takeaways

- Bullish analysts view the £2.20 target as reflecting a clearer link between the company’s growth profile and its assumed earnings power, which they see as reasonably captured in their updated P/E framework.

- The upgrade to Hold suggests that, at current prices, the discount rate and risk assumptions used in their model no longer point to a clear valuation gap on the downside.

- They see execution on revenue and margin targets as sufficiently credible to support the new fair value estimate, even if expectations are now more measured than before.

- The revised stance reduces the emphasis on prior concerns around overvaluation, implying that the risk reward trade off looks more balanced to these analysts.

Bearish Takeaways

- Bearish analysts still stop short of a Buy call, highlighting that, at £2.20, the implied valuation already bakes in meaningful progress on growth and profitability.

- They point to execution risk around turning revenue assumptions into consistent earnings, which could put pressure on the targeted P/E if delivery falls short.

- The use of a specific discount rate in their models underlines that perceived risk around cash flow timing and quality remains a key watchpoint for more cautious investors.

- Some remain wary that, with the rating only at Hold, there may be limited cushion if sentiment weakens or if forecasts on revenue and margin are revised lower.

What's in the News

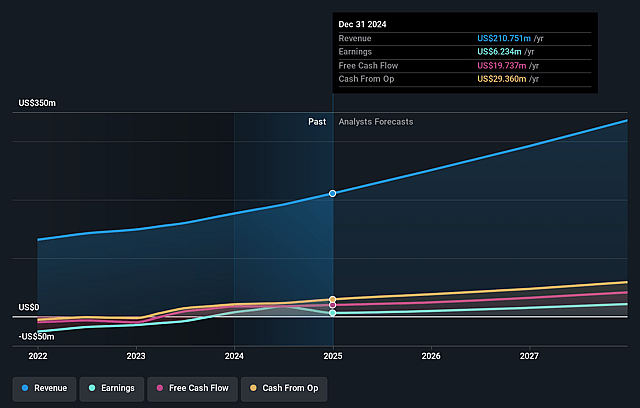

- Trustpilot Group issued earnings guidance for fiscal 2025, with expected revenue of $261 million compared with actual revenue of $211 million in fiscal 2024 (Key Developments).

- On January 13, 2026, Trustpilot Group increased its equity buyback authorization by £10 million, bringing the total to £40 million (Key Developments).

Valuation Changes

- Fair Value: updated estimate moves from £3.06 to £3.07, a very modest upward adjustment in the modelled equity value.

- Discount Rate: revised from 8.55% to 8.65%, a small increase in the required rate of return applied to future cash flows.

- Revenue Growth: assumption shifts from 16.31% to 17.84%, indicating a slightly higher expected top line growth rate.

- Net Profit Margin: moves from 9.12% to 9.64%, reflecting a small uplift in assumed profitability on each $1 of revenue.

- Future P/E: brought down from 62.55x to 59.35x, implying a slightly lower multiple being used for projected earnings.

Key Takeaways

- Trustpilot's product innovation and pricing strategies enhance retention and future revenue growth, alongside strong market expansion, particularly in the U.S.

- Increased profitability is driven by operating leverage and a strategic shift towards enterprise clients with higher value contracts.

- Foreign exchange volatility, growth deceleration, competition, macro-economic uncertainties, and innovation challenges could collectively strain Trustpilot's revenue stability and operational efficiency.

Catalysts

About Trustpilot Group- Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

- Trustpilot's SaaS business model is supported by product innovation, resulting in new product launches within pricing plans that have improved net dollar retention from 99% to 103%, which is expected to drive future revenue growth.

- Bookings have grown by 21% in constant currency, particularly with strong growth in key markets like the U.S., which saw a 26% increase. This growth is expected to sustain revenue increases in the future.

- Consumer adoption of Trustpilot is strong, with active reviews up by 23% and TrustBox impressions up by 19%, enhancing brand awareness and potential earnings through increased engagement.

- Operating leverage has led to a 260 basis point increase in adjusted EBITDA margin to 11.4%, which signals an expectation of improved profitability going forward.

- Strategic focus on enterprise clients and higher service packages is shifting the customer mix towards higher contract values, likely improving the company’s net margins and overall revenue.

Trustpilot Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trustpilot Group's revenue will grow by 16.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 6.3% in 3 years time.

- Analysts expect earnings to reach $21.3 million (and earnings per share of $0.05) by about September 2028, up from $6.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $29.8 million in earnings, and the most bearish expecting $12.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 110.6x on those 2028 earnings, down from 172.9x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 27.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Trustpilot Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of foreign exchange volatility, particularly with the euro and sterling against the dollar, could adversely influence reported revenue despite strong bookings growth, affecting earnings.

- The anticipated deceleration of growth, following the one-time benefit from migrating customers to new pricing plans, could challenge sustained revenue growth if not compensated by upsells within the new pricing bands, impacting future revenue stability.

- Increasing competition and evolving market dynamics could strain Trustpilot's ability to maintain high retention rates and expand market share, potentially impacting net margins if customer acquisition costs rise relative to revenue.

- Macro-economic uncertainties, like inflation or downturns, particularly in the U.S., could affect SME clients more significantly, leading to higher churn rates and impacting overall revenue and financial projections.

- The need to continuously innovate while minimizing distractions from new ventures such as TrustLayer could strain resources, which may affect operational efficiency and net earnings if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.353 for Trustpilot Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.18, and the most bearish reporting a price target of just £1.99.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $335.8 million, earnings will come to $21.3 million, and it would be trading on a PE ratio of 110.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of £1.94, the analyst price target of £3.35 is 42.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Trustpilot Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.