Last Update 23 Feb 26

Fair value Increased 8.56%MXL: Higher Earnings Margins And Buybacks Will Support Bullish Repricing

Analysts have lifted their price target on MaxLinear by $1.70 to $21.55, reflecting updated assumptions around fair value, discount rate, revenue growth, profit margins, and future P/E multiples discussed in recent research.

Analyst Commentary

Bullish Takeaways

- Bullish analysts see the higher US$21.55 target as consistent with updated views on what they consider a fair value range for MaxLinear, given current assumptions around revenue growth and profit margins used in their models.

- The refined discount rate assumptions are viewed by bullish analysts as better aligned with MaxLinear’s risk profile, which they see as supporting a higher present value for future cash flows.

- Some bullish analysts are comfortable assigning richer future P/E multiples, arguing that MaxLinear’s earnings profile could justify paying more per dollar of earnings than previously assumed in their work.

- Bullish analysts generally frame the US$1.70 upward move in the target as a reflection of improved conviction in the company’s ability to execute against the revenue and margin levels embedded in their forecasts.

Bearish Takeaways

- Bearish analysts focus on the fact that the updated target still relies on specific assumptions for revenue growth and profit margins, which may be difficult to achieve if execution falls short.

- There is caution around the dependence on higher future P/E multiples, with some bearish analysts flagging that any reset in sector valuations could pressure the fair value they assign to MaxLinear.

- Some bearish analysts see the sensitivity of the target to the chosen discount rate as a risk, since any change in perceived risk or funding costs could weigh on the valuation.

- Bearish analysts also point out that the adjustment in fair value inputs narrows the margin of safety for new buyers, given that the target now embeds more optimistic assumptions than before.

What's in the News

- MaxLinear issued earnings guidance for the first quarter of 2026, expecting net revenue in a range of US$130 million to US$140 million (company guidance).

- The company reported completion of a buyback tranche, repurchasing 1,150,069 shares, or 1.32% of shares, for US$20 million between November 24, 2025 and December 31, 2025 under its previously announced program (company filing).

Valuation Changes

- Fair Value: the price target has risen from $19.85 to $21.55, a modest upward revision of around $1.70 per share.

- Discount Rate: the rate has edged higher from 10.52% to about 10.79%, signaling slightly higher required return assumptions in the model.

- Revenue Growth: the projected rate has been trimmed from roughly 18.62% to about 13.33%, indicating a more conservative outlook for top line expansion.

- Net Profit Margin: the forecast has moved up from about 14.11% to roughly 15.51%, implying expectations for stronger profitability on each $ of revenue.

- Future P/E: the assumed forward multiple has been reduced from about 28.59x to roughly 23.87x, reflecting a lower valuation multiple applied to future earnings.

Key Takeaways

- Expanding partnerships with major telecom and cloud customers, plus strong design wins in data center and wireless, position MaxLinear for sustained, broad-based growth.

- Ongoing innovation and cost efficiency in advanced connectivity and AI-focused solutions bolster the company's pricing power, profit margins, and market reach.

- Heavy reliance on maturing broadband markets, industry commoditization, geopolitical risks, acquisition distractions, and rapid technological change threaten growth, margins, and long-term competitiveness.

Catalysts

About MaxLinear- Provides communications systems-on-chip solutions in the United States, Asia, Europe, and internationally.

- Accelerating demand for high-speed data center optical interconnects and next-generation PAM4 DSP solutions (Keystone and Rushmore), supported by robust design win momentum with major module makers and hyperscale customers, positions MaxLinear to capture a significant share of growing global data/AI infrastructure spend, likely driving meaningful revenue growth from late 2025 through 2027.

- Recovery and expansion in wireless infrastructure, including design wins with Tier 1 North American telecom operators for Sierra-based 5G base station products and increasing carrier CapEx, are expected to fuel sustained growth across 5G/future wireless networks, supporting top-line expansion and improved earnings visibility.

- Strong order rates, backlog, and rising service provider CapEx in broadband access-including significant gateway SoC wins for fiber PON and WiFi 7 platforms-reflect rising investment in broadband upgrades, indicating a multi-year opportunity for revenue growth and improved margin contribution as new platforms ramp.

- Continued investment in low-power high-performance analog and mixed-signal innovation, cost reduction initiatives, and the expansion of differentiated product offerings (e.g., Panther storage accelerators for data center/cloud AI use-cases) are set to enhance MaxLinear's technology edge, enabling premium pricing, margin improvement, and the potential for higher recurring earnings.

- Growing integration into Tier 1 customer roadmaps, both in North America and emerging markets like China (where data center transceiver volumes are forecast to rapidly expand), alongside demonstrated capability in cross-market platforms (optical, Ethernet, storage, wireless), increases MaxLinear's total addressable market and positions the company to benefit from long-term volume growth, supporting sustained revenue and earnings upside.

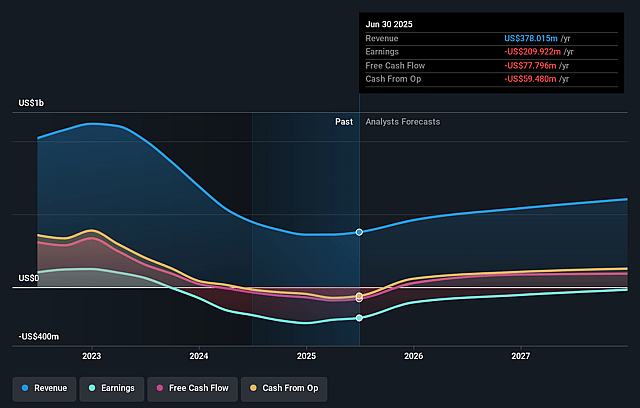

MaxLinear Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MaxLinear's revenue will grow by 18.6% annually over the next 3 years.

- Analysts are not forecasting that MaxLinear will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate MaxLinear's profit margin will increase from -55.5% to the average US Semiconductor industry of 14.1% in 3 years.

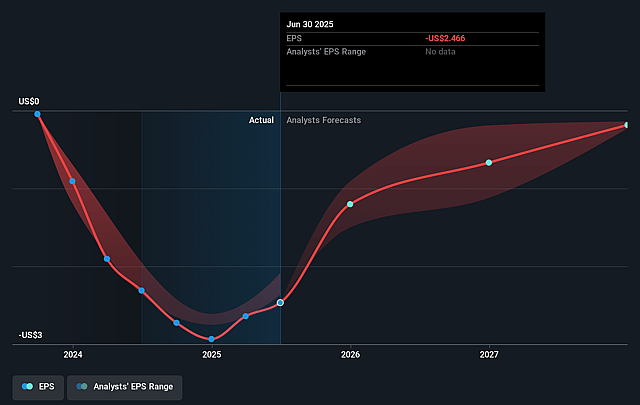

- If MaxLinear's profit margin were to converge on the industry average, you could expect earnings to reach $89.0 million (and earnings per share of $0.94) by about September 2028, up from $-209.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from -6.3x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 3.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.52%, as per the Simply Wall St company report.

MaxLinear Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MaxLinear remains heavily exposed to broadband and connectivity markets, which are maturing and subject to cyclical downturns; this concentration heightens the risk of long-term revenue stagnation if infrastructure CapEx cycles reverse or carrier investment slows. (Revenue)

- The semiconductor industry's ongoing commoditization and intense pricing pressure, particularly from larger competitors and low-cost Asian manufacturers (including China), threaten MaxLinear's ability to maintain premium pricing and healthy gross margins over the long run. (Gross margins, Earnings)

- Geopolitical tensions, rising protectionism (e.g., China's "Made in China" initiatives), and increasing regionalization of supply chains may reduce MaxLinear's access to major non-US markets or force margin-sapping concessions to retain share, exacerbating volatility in its international revenue streams. (Revenue, Net margins)

- MaxLinear's ongoing acquisitive growth strategy (including amortization of acquisition-related intangibles and recurring integration costs) raises the risk of impaired goodwill, unexpected restructuring expenses, and operational distractions, which could undermine net margins and consistent earnings expansion. (Net margins, Earnings)

- The rapid pace of technological evolution (such as the potential shift to custom ASICs, silicon photonics, or co-packaged optics) may outpace MaxLinear's R&D resources, threatening its market relevance and requiring expensive investments that, if unsuccessful, could lead to product obsolescence or missed growth opportunities. (R&D expenses, Revenue growth)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.85 for MaxLinear based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.5, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $630.9 million, earnings will come to $89.0 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 10.5%.

- Given the current share price of $15.23, the analyst price target of $19.85 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MaxLinear?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.