Key Takeaways

- Early leadership and rapid scaling in next-generation data center and broadband segments position MaxLinear to outpace competitors and consolidate market share in high-growth areas.

- Strong technology portfolio and fabless model enhance pricing power, supporting structurally higher margins and more resilient free cash flow through industry cycles.

- Heavy reliance on major customers, industry shifts, geopolitical risks, and slow diversification threaten MaxLinear's growth, margin stability, and long-term competitiveness.

Catalysts

About MaxLinear- Provides communications systems-on-chip solutions in the United States, Asia, Europe, and internationally.

- Analyst consensus expects Keystone and Rushmore deployments to drive strong growth, but they may be underestimating MaxLinear's penetration-the company is positioned to exceed $100 million in annual optical DSP revenues as 800-gigabit and 1.6-terabit transitions accelerate globally, especially as design wins quickly convert to multi-year production ramps, potentially doubling revenues in data center segments and meaningfully growing earnings per share through 2027.

- While the consensus sees broadband and PON wins driving growth, the pace of North American and global fiber investment, alongside MaxLinear's early leadership in 10-gigabit WiFi gateway SoCs and multi-gigabit PON, positions the company to consolidate market share in next-generation broadband, which could lift gross margins and deliver high-teens earnings growth, outpacing current Street models.

- MaxLinear's rapid scale in the Ethernet switch and PHY upgrade cycle-enabled by edge cloud expansion, growing IoT adoption, and the industry move from 1-gigabit to 2.5-gigabit-creates a long runway for annual recurring revenues of $100 million or more by 2028, transforming the connectivity segment into a structurally higher-margin contributor.

- Accelerated AI/ML and cloud infrastructure buildouts are increasing demand for MaxLinear's Panther storage accelerator SoC, with the company now having proof-of-concept traction at multiple hyperscale data centers; if adoption in AI-centric workloads continues, Panther could become a $150–200 million product line with industry-leading profitability, potentially adding hundreds of basis points to blended net margin.

- Global supply chain localization, the push for North American silicon and the ongoing shift to system-on-chip integration favor MaxLinear's advanced fabless model and robust technology portfolio, enabling pricing power and more resilient operating leverage-which are set to translate into expanding operating margins and structurally stronger free cash flow through industry cycles.

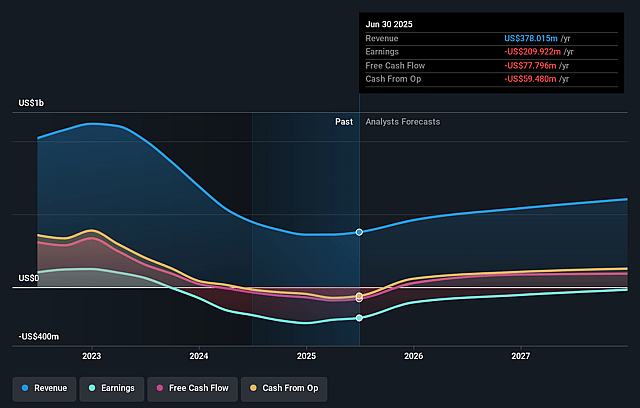

MaxLinear Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MaxLinear compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MaxLinear's revenue will grow by 21.9% annually over the next 3 years.

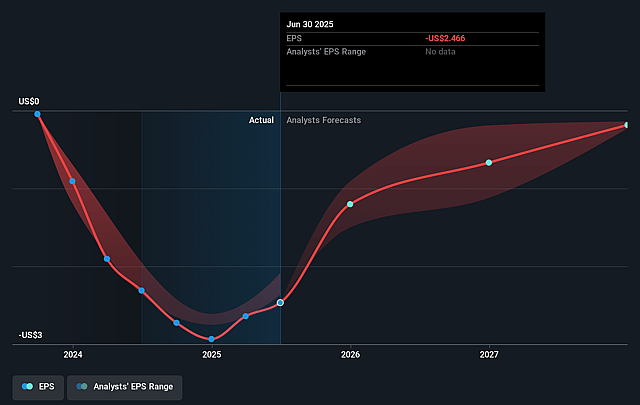

- Even the bullish analysts are not forecasting that MaxLinear will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate MaxLinear's profit margin will increase from -55.5% to the average US Semiconductor industry of 14.1% in 3 years.

- If MaxLinear's profit margin were to converge on the industry average, you could expect earnings to reach $96.5 million (and earnings per share of $1.02) by about September 2028, up from $-209.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 36.4x on those 2028 earnings, up from -6.7x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 3.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.4%, as per the Simply Wall St company report.

MaxLinear Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MaxLinear faces persistent customer concentration risk, as noted by their dependence on major design wins with Tier 1 carriers and module makers; the loss or delay of a key customer or the inability to win significant new contracts could lead to significant revenue declines and sharp swings in earnings.

- The semiconductor industry's move toward system-on-chip integration and larger players offering custom silicon for hyperscale data centers could marginalize MaxLinear's merchant, analog, and mixed-signal products, directly threatening their addressable market and long-term revenue growth.

- Rising geopolitical tensions and the potential escalation of trade restrictions between the US and China could disrupt MaxLinear's access to critical supply chains and fast-growing Chinese data center markets, while increased compliance costs or retaliation may add persistent pressures to net margins.

- Sustained cost pressures from foundry suppliers and the need for continued high R&D and operational investment to remain competitive with larger, vertically integrated players could squeeze MaxLinear's gross margins and result in margin compression if new products do not ramp as quickly or broadly as expected.

- A slow pace of diversification beyond current broadband, optical, and infrastructure markets or setbacks integrating new technology platforms such as silicon photonics and co-packaged optics may leave MaxLinear exposed to rapid industry shifts, contributing to revenue volatility and hindering long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MaxLinear is $27.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MaxLinear's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.5, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $684.3 million, earnings will come to $96.5 million, and it would be trading on a PE ratio of 36.4x, assuming you use a discount rate of 10.4%.

- Given the current share price of $16.08, the bullish analyst price target of $27.5 is 41.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MaxLinear?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.