Last Update 05 Nov 25

Fair value Decreased 3.08%INGR: Fertilizer Market Upside Will Drive Outperformance Despite Near-Term Market Challenges

Analysts have recently lowered their price target for Ingredion by approximately $4.50 per share. They cite ongoing caution about earnings prospects due to a muted consumer environment and challenging pricing conditions in the ingredient market.

Analyst Commentary

Recent analyst reports present a balanced perspective on Ingredion, reflecting both optimism around specific market segments and caution amid ongoing challenges in the sector. Below are some key takeaways from their commentary:

Bullish Takeaways- Bullish analysts maintain a positive long-term outlook for Ingredion, emphasizing the company’s ability to outperform within its sector despite near-term uncertainties.

- The machinery segment is highlighted as an area with a mixed but potentially favorable setup. This could provide opportunities for upside in operational execution.

- Fertilizer markets are noted as holding the most opportunity to surprise positively. Favorable trends in this area could support ingredient companies like Ingredion if they continue.

- Price targets have been revised downward due to tepid consumer demand and muted growth expectations in the ingredient space. This signals headwinds for valuation recovery.

- Bullish expectations are tempered by a challenging pricing environment and difficult year-over-year comparisons in the second half of the year, which may restrict earnings growth.

- Bearish analysts express caution regarding the broader market backdrop and emphasize persistent caution around near-term earnings potential and overall sector execution.

- Some analysts have moved to a Neutral stance. This reflects uncertainty around the company's ability to navigate current market pressures and maintain its growth trajectory.

What's in the News

- Ingredion announced a share repurchase program authorizing the buyback of up to 8,000,000 shares through December 31, 2028 (Key Developments).

- From July 1, 2025 to November 3, 2025, the company repurchased 625,768 shares for $79.05 million. This brings the total shares repurchased under the September 2022 buyback to 3,687,768 for $448.82 million (Key Developments).

- The Board of Directors of Ingredion approved an additional buyback plan on November 3, 2025 (Key Developments).

- Ingredion held an Analyst/Investor Day and provided updates to shareholders and analysts (Key Developments).

- The board declared a quarterly dividend of $0.82 per share, marking the 11th consecutive year of dividend increases in the third quarter (Key Developments).

Valuation Changes

- Fair Value Estimate has fallen from $146.33 to $141.83 per share, reflecting a slight downward revision in projected intrinsic value.

- Discount Rate remains unchanged at 6.78%, signaling consistent risk and return assumptions in the valuation models.

- Revenue Growth Projection has risen slightly from 2.03% to 2.20%, indicating a marginal improvement in top-line growth expectations.

- Net Profit Margin has edged down from 9.57% to 9.56%, representing a negligible decrease in profitability projections.

- Future P/E Ratio has declined from 14.61x to 13.74x, suggesting lowered expectations for future earnings multiples.

Key Takeaways

- Expanding specialty portfolio, innovation, and sustainability focus are driving growth, higher margins, and new business opportunities across strategic food industry segments.

- Operational efficiencies, cost optimization, and targeted investments are boosting profitability and positioning the company for sustained international and long-term expansion.

- Global economic and trade instability, input cost pressures, and declines in legacy product demand threaten revenue and margin growth, heightening reliance on specialty ingredient expansion.

Catalysts

About Ingredion- Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

- Strong consumer and customer demand for health and wellness-focused, clean label, and sugar reduction solutions continues to drive double-digit growth in Ingredion's higher-value specialty portfolio, including clean label starches, high-intensity sweeteners, and protein isolates. This trend is expected to sustain above-average revenue and margin growth for the Texture & Healthful Solutions segment.

- Ongoing innovation and investments in R&D-especially in customized formulations and proprietary plant-based ingredients-are widening Ingredion's opportunities with small and medium-sized food brands and insurgent category disruptors, expanding future revenues and allowing for premium pricing that elevates net margins.

- Enhanced operational efficiencies, supply chain digitalization, and cost optimization initiatives have resulted in a structural step-change in segment margins (notably in Texture & Healthful Solutions), with management expecting these higher levels of profitability and operating leverage to persist, improving overall net margins and earnings.

- The company's commitment to sustainable ingredient sourcing and strong ESG credentials is attracting new business from large CPG customers seeking to reformulate for environmental and regulatory objectives. This alignment with evolving food industry standards opens new revenue streams and supports long-term margin resilience.

- Selective capital allocation to high-return organic growth projects and sustained share buybacks, coupled with further international expansion (even amidst temporary LATAM headwinds), position Ingredion to accelerate both top-line growth and EPS over the long run, as secular themes around a growing middle-class and dietary shifts in emerging markets resume momentum.

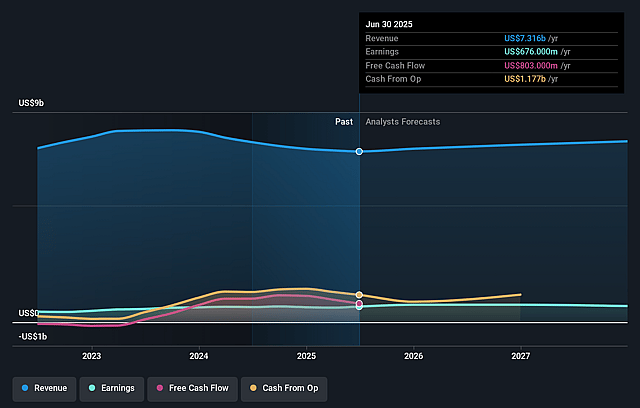

Ingredion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ingredion's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.2% today to 9.0% in 3 years time.

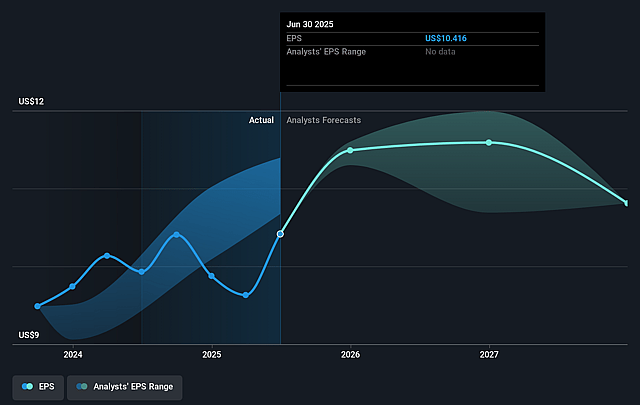

- Analysts expect earnings to reach $696.0 million (and earnings per share of $10.82) by about September 2028, up from $676.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 12.1x today. This future PE is lower than the current PE for the US Food industry at 19.5x.

- Analysts expect the number of shares outstanding to decline by 1.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Ingredion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic and currency volatility in key emerging markets, especially in LATAM (notably Argentina, Brazil, and Mexico), is contributing to declining volumes and negative foreign exchange impacts, which could lead to persistent revenue and earnings headwinds if macroeconomic weakness and currency depreciation continue.

- Ongoing tariff uncertainties and global trade friction create unpredictability for Ingredion and its customers, leading to conservative guidance, customer inventory rebalancing, and the risk of indirect impacts on demand that may pressure near-term and longer-term revenues and margins.

- The company continues to face price/mix headwinds across major business segments due to pass-through of lower corn and input costs, raising concerns that Ingredion's ability to maintain or grow top-line sales and net income will become more challenging if commodity cost deflation persists.

- Weaknesses in legacy product demand-such as industrial starches (impacted by soft box demand and tariffs) and high fructose corn syrup (HFCS; at risk from consumer trends toward natural or clean-label sweeteners)-put pressure on Ingredion's core revenues and increase the company's dependence on breakout growth from new, higher-margin specialty ingredients.

- While margins in Texture & Healthful Solutions have reached record highs, management acknowledged some results reflected exceptional one-time raw material procurement benefits and cost absorption, and they are signaling caution about sustaining current margin levels amid sourcing, transportation, and potential tariff challenges that could lead to net margin contraction in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $148.667 for Ingredion based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $168.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.8 billion, earnings will come to $696.0 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $127.07, the analyst price target of $148.67 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.