Last Update 17 Nov 25

Fair value Increased 0.80%VLO: Future Performance Will Reflect Industry Cyclicality And Robust Capital Return

Valero Energy's analyst price target has increased modestly from $180.78 to $182.22 per share. Analysts cite the company's strong earnings momentum, robust operating margins, and a constructive outlook for high-quality product demand as key drivers of the upward revision.

Analyst Commentary

Recent Street research highlights a generally constructive tone from the analyst community regarding Valero Energy's business model and outlook. Current price target revisions and coverage initiations underscore robust market sentiment, while acknowledging several balanced considerations that may affect future performance.

Bullish Takeaways

- Bullish analysts point to Valero's highly complex refineries. This allows the company to process lower-cost crude oils and efficiently produce high-quality products such as diesel and jet fuel, supporting operational advantages and margin growth.

- There have been multiple price target increases from leading firms. These reflect growing confidence in Valero's earnings trajectory, capital return strategy, and relatively tight global product markets that are likely to persist into 2026.

- Strong quarterly earnings beats and encouraging management commentary indicate resilient demand and well-positioned supply dynamics. This has helped justify upward valuation revisions and buy ratings.

- Valero's disciplined approach to capital returns and leadership in dividend growth are seen as key differentiators that could drive relative outperformance through varying commodity environments.

Bearish Takeaways

- Bearish analysts highlight expectations for softer demand indicators and the potential for a seasonal decline in refining margins, both of which could pressure near-term profitability.

- Some projections anticipate earnings results that may fall slightly below consensus estimates. This reflects ongoing volatility in refining fundamentals and challenges in consistently exceeding market expectations.

- Uncertainty remains around volatility and margin reversion, especially regarding anticipated market shifts from 2025 into 2026 and the cyclical nature of refining.

What's in the News

- Wells Fargo initiated coverage of Valero Energy with an Overweight rating and a $216 price target. The firm highlighted its focus on companies with strong return of capital strategies and leadership in dividend growth (Periodical).

- Valero Energy appointed Homer Bhullar as Chief Financial Officer, effective January 1, 2026. He will succeed Jason Fraser, who will retire at the end of 2025 (Key Development).

- The company repurchased 5.66 million shares for $920.61 million in the third quarter of 2025. This action completes its previously announced share buyback program, totaling 30.69 million shares and $4.57 billion (Key Development).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $180.78 to $182.22 per share, reflecting a modest upward revision.

- Discount Rate has edged down marginally from 6.97% to 6.96%, signaling a slightly lower perceived risk profile.

- Revenue Growth projections have declined from -0.29% to -0.36%, suggesting a more conservative outlook for top-line expansion.

- Net Profit Margin estimates have increased from 3.32% to 3.41%, pointing to expectations of improved profitability.

- Future P/E has decreased modestly from 15.69x to 15.66x, indicating a marginally lower valuation multiple on forward earnings.

Key Takeaways

- Strategic investments and a strong balance sheet may boost future earnings through growth and higher-value product yields.

- Shareholder returns could improve from increased dividends and buybacks, while renewable diesel segment earnings benefit from market factors.

- Asset impairments, renewable segment struggles, operational cost pressures, and regulatory uncertainties threaten Valero's financial stability and profitability.

Catalysts

About Valero Energy- Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

- The SEC unit optimization project at St. Charles, expected to start up in 2026, is projected to increase the yield of high-value products, potentially boosting future revenues and earnings.

- Anticipated tight product supply and demand balances, with low product inventories, are expected to support refining fundamentals during the driving season, possibly enhancing refining margins and revenues.

- A strong balance sheet and $5.3 billion of available liquidity provide Valero with operational and financial flexibility to invest in growth and optimization projects, potentially improving future earnings.

- The potential for higher D4 RIN prices and an increase in the RIN obligation could positively impact the renewable diesel segment's earnings by improving margins.

- Continued commitment to capital discipline and shareholder returns, such as the 6% increase in the quarterly cash dividend, could support per-share earnings growth through ongoing share buybacks.

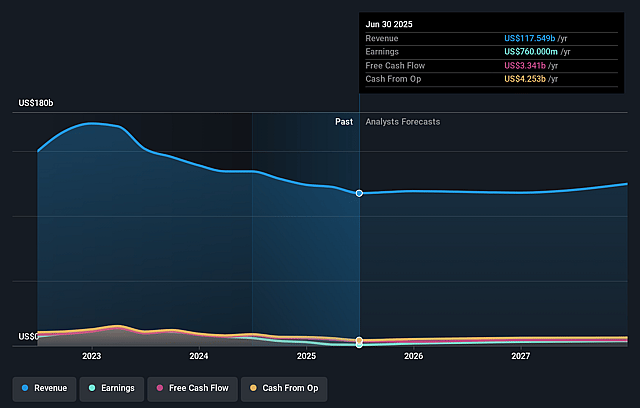

Valero Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Valero Energy's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 3.3% in 3 years time.

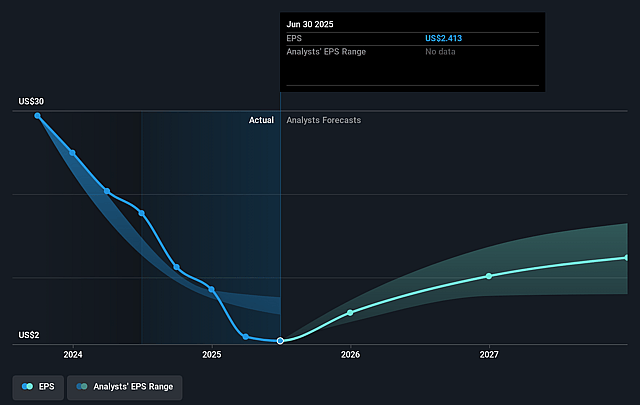

- Analysts expect earnings to reach $3.8 billion (and earnings per share of $13.76) by about September 2028, up from $760.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $4.9 billion in earnings, and the most bearish expecting $2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 66.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.14%, as per the Simply Wall St company report.

Valero Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant net loss attributed to asset impairments, particularly related to West Coast operations, could negatively impact future earnings and financial health.

- The renewable diesel segment struggled with high operating losses, reflecting challenges in maintaining profitability amidst shifting regulatory and market dynamics, thereby affecting net margins.

- With the intent to close the Benicia refinery due to stringent regulations, there could be substantial costs related to plant closure, negatively affecting cash flow and future earnings.

- Uncertainty around policy changes, such as potential increases to RIN obligations and California LCFS adjustments, introduces risk to revenue stability in the renewable segment.

- High operational cost pressures, particularly from maintenance and potential fluctuations in natural gas prices, may constrain margin improvements, thus impacting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $158.333 for Valero Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $181.0, and the most bearish reporting a price target of just $133.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $116.8 billion, earnings will come to $3.8 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of $161.83, the analyst price target of $158.33 is 2.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.