Narratives are currently in beta

- Transition to v9 product could increase revenue but poses risks regarding customer adaptation and competitive landscape, affecting long-term growth.

- Introduction of Compute Subsystems strategy may save validation time but increase operational costs, impacting net margins if expectations are not met.

- ARM Holdings' shift to v9 products, expansion in AI and diverse markets, and introduction of Compute Subsystems are driving revenue growth and market share expansion.

What are the underlying business or industry changes driving this perspective?

- The significant transition from Arm's v8 product to v9 product, with v9 garnering approximately 2x the royalty rate of the equivalent v8 product, indicates a potential for increased revenue. However this also raises concerns about customer adaptation rates and the competitive landscape affecting long-term growth.

- Strong momentum and tailwinds from AI deployments on Arm's platform could drive licensing growth, but reliance on rapidly evolving AI technology sectors poses risks to sustainable revenue growth if technological advancements or market demands shift unexpectedly.

- The introduction of Compute Subsystems strategy, offering complete blocks of designs to end customers, while promising to save validation time and accelerate time to market, might increase operational and development costs, impacting net margins if uptake does not meet expectations.

- Guidance for a significant increase in both Q4 revenues and full-year revenue anticipates continued growth, yet sets high expectations that might be challenging to meet if market conditions change or if competition intensifies, potentially affecting earnings.

- The forecast of non-GAAP OpEx increase for Q4 and the full year, driven by slightly higher Research & Development spend, suggests rising costs that could compress net margins if revenue growth does not surpass expense growth rates, impacting long-term profitability.

Figures in the charts may differ slightly from those mentioned in the narrative

How have these above catalysts been quantified?

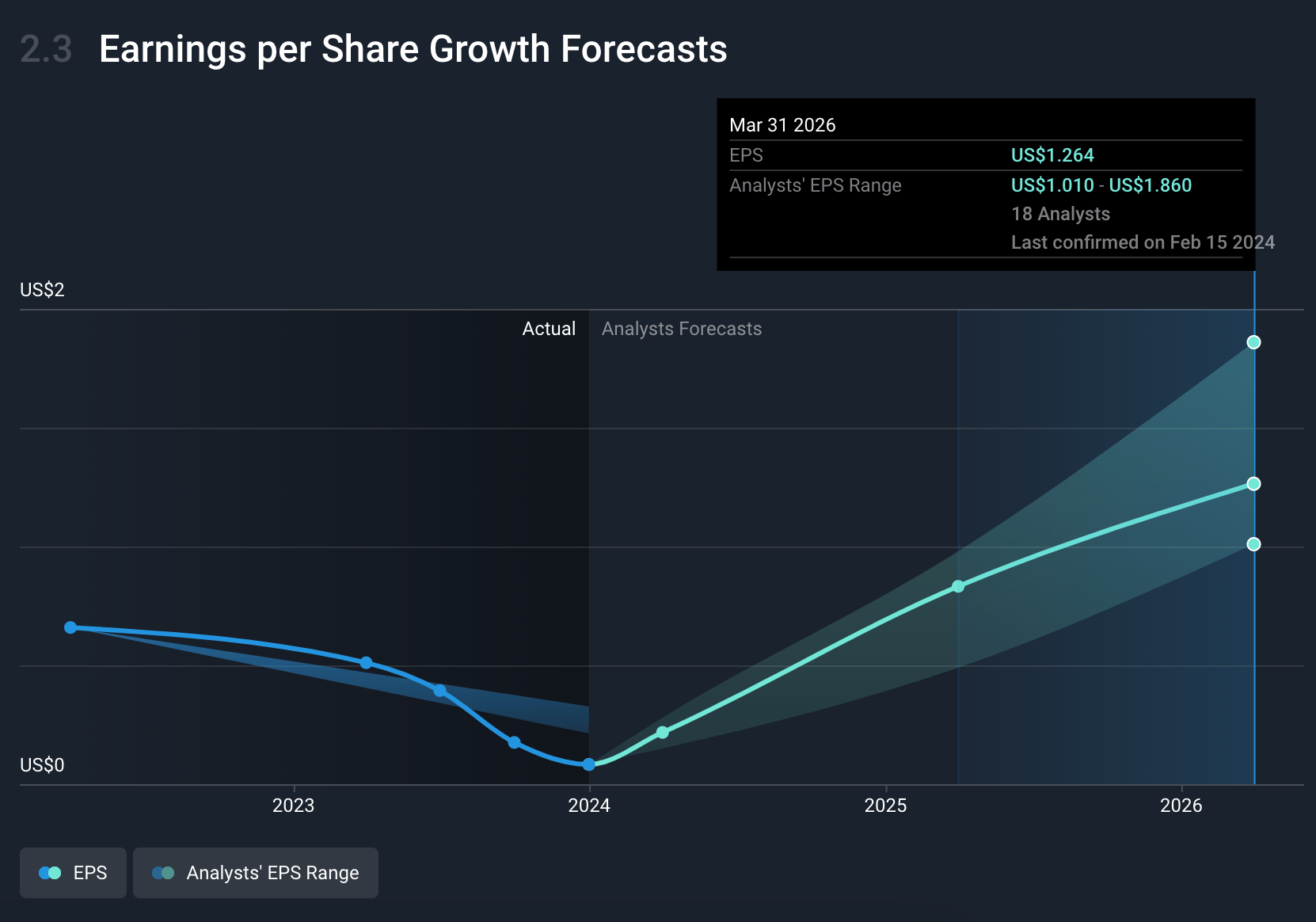

- Analysts are assuming Arm Holdings's revenue will grow by 22.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 29.6% in 3 years time.

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $1.54) by about March 2027, up from $85.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.7x on those 2027 earnings, down from 1569.3x today.

- To value all of this in today’s dollars, we will use a discount rate of 9.57%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

What could happen that would invalidate this narrative?

- ARM Holdings' transition from v8 to v9 products has resulted in an approximately doubling of the royalty rate for v9 products compared to v8, enhancing revenue growth. This shift, with v9 now making up 15% of ARM's total royalty revenue, signals strong future revenue potential as adoption increases.

- The company has witnessed substantial growth in AI applications across various sectors, including both high-performance computing and edge devices. This growing demand for AI capabilities is driving the need for more ARM technology in new designs, positively impacting licensing growth.

- ARM Holdings’ introduction of Compute Subsystems could reduce time-to-market for their clients, potentially increasing ARM's attractiveness to customers and impacting future revenue and market share positively.

- The substantial revenue growth from ARM China and diversification into automotive and infrastructure markets beyond mobile signal strong market share gains and increased revenue streams.

- The company's forecast of continued momentum into Q4 and beyond, supported by increasing royalty rates and adoption of v9 technology, indicates a positive outlook for revenue growth, countering the belief in a share price decrease.

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $102.17 for Arm Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $5.4 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 79.7x, assuming you use a discount rate of 9.6%.

- Given the current share price of $129.75, the analyst's price target of $102.17 is 27.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 34 Analysts

Adoption Of V9 Architecture And AI Demand Will Strengthen Future Market Position

Key Takeaways Adopting Arm's v9 architecture and expanding CSS licensing in key sectors drive royalty revenue and market reach, boosting future earnings. Growing data center engagements and AI demand bolsters Arm's market share and long-term revenue, enhancing overall financial prospects.

View narrativeUS$145.28

FV

10.7% undervalued intrinsic discount22.36%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

31users have followed this narrative

1 day ago author updated this narrative

GO

Equity Analyst

Patent Expirations And Competition May Limit ARM’s Market Share

Key Takeaways ARM is a leader with a saturated number of customers limiting future growth. It’s in a highly competitive landscape and needs to innovate beyond patent expirations in the 2030s.

View narrativeUS$39.16

FV

231.2% overvalued intrinsic discount16.00%

Revenue growth p.a.

12users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

4 months ago author updated this narrative