Last Update 21 Dec 25

LAND: Future Margin Resilience And Cash Generation Will Support Upside Potential

Analysts have trimmed their price target on Landis+Gyr Group by CHF 2 to CHF 63, reflecting slightly higher discount rate assumptions and a modestly richer forward earnings multiple. Together, these factors temper near term upside potential.

Analyst Commentary

Recent commentary indicates that the revised CHF 63 price target largely reflects a recalibration of risk and return expectations rather than a fundamental shift in the long term business outlook.

Bullish Takeaways

- Bullish analysts note that the modest target reduction still implies limited upside from current levels, suggesting the valuation remains supported by steady earnings visibility.

- They highlight that the use of a richer forward earnings multiple signals confidence in Landis+Gyr's medium term margin resilience and cash generation.

- Supporters view the neutral stance as a pause rather than a downgrade in conviction, with potential catalysts tied to execution on cost discipline and smart metering project wins.

- Some see the recalibrated target as setting a more achievable bar, which could allow positive earnings surprises to be rewarded more meaningfully.

Bearish Takeaways

- Bearish analysts point to the higher discount rate assumptions as evidence of increased perceived risk around macro conditions and project timing.

- They caution that reliance on a richer multiple leaves less room for error if growth underperforms or contract pipelines weaken.

- More cautious views emphasize that near term upside is constrained, with the stock now seen as fairly valued relative to execution and growth risks.

- There is concern that any operational setbacks or delays in key tenders could lead to further target pressure if earnings momentum stalls.

Valuation Changes

- Fair Value Estimate is unchanged at approximately CHF 66.44 per share, indicating no revision to the intrinsic value assessment.

- Discount Rate has risen slightly from about 5.85 percent to around 5.86 percent, reflecting a marginally higher perceived risk profile.

- Revenue Growth remains essentially unchanged at roughly minus 5.97 percent, signaling a stable view on top line contraction expectations.

- Net Profit Margin is effectively flat at about 17.26 percent, indicating no material adjustment to profitability assumptions.

- Future P/E has increased modestly from roughly 11.76x to about 11.89x, implying a slightly richer multiple applied to forward earnings.

Key Takeaways

- Strategic focus on Americas and expanding software revenue may drive growth in revenue and EBITDA margins through integrated energy management solutions.

- U.S. listing and operational improvements in EMEA and APAC aim to enhance capital access, margins, and regional profitability.

- The company's financial performance is threatened by regional revenue declines, uncertain restructuring, cash flow issues, and instability from key executive departures.

Catalysts

About Landis+Gyr Group- Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- The strategic focus on the highly profitable Americas business could lead to enhanced revenue growth and adjusted EBITDA margins, driven by stronger emphasis on integrated edge-to-enterprise energy management solutions.

- Increasing software revenues, which now represent 24% of total revenues, and the strategic transformation investments signal potential for higher revenue growth and improved net margins through more recurring revenue generation.

- The potential listing in the U.S. may increase access to a larger pool of capital and facilitate comparisons with peers, possibly leading to increased investor interest and potentially impacting earnings positively.

- Supply chain improvements, operational efficiencies, and regional optimization in EMEA could result in higher net margins and increased profitability in the region.

- Expansion in APAC with growing software and services offerings, especially in high-potential markets like Australia and India, is likely to support future revenue and earnings growth.

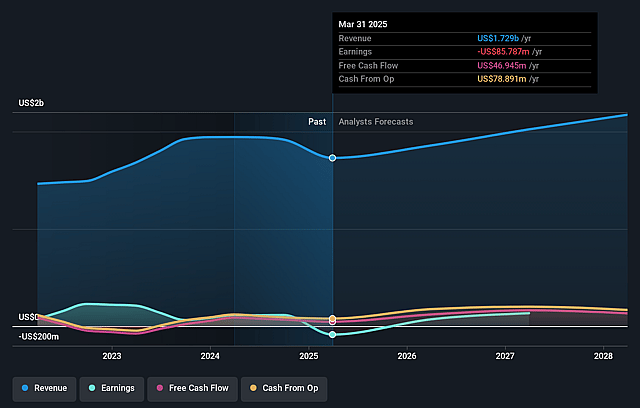

Landis+Gyr Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Landis+Gyr Group's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.0% today to 6.6% in 3 years time.

- Analysts expect earnings to reach $141.2 million (and earnings per share of $4.68) by about September 2028, up from $-85.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from -26.8x today. This future PE is lower than the current PE for the GB Electronic industry at 32.5x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.5%, as per the Simply Wall St company report.

Landis+Gyr Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in the EMEA region's revenue, due to timing of large project rollouts, market softness in key areas like the U.K. and Turkey, and reduced demand for EV solutions, could negatively impact overall net revenue and profitability.

- The strategic review of the EMEA region, which considers options such as selling parts or all of the business, introduces uncertainty and potential restructuring costs that could affect earnings and margins.

- Challenges in the APAC region, such as project timing issues leading to revenue declines, might continue to strain the company's revenue generation capability.

- Elevated inventory levels impacting free cash flow, which was reported as negative, indicate a risk to liquidity and could affect earnings if not normalized as expected.

- The departure of key executives, like the Group CFO and regional heads, poses execution risk that could impact strategic initiatives and financial performance by creating instability within management.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF74.557 for Landis+Gyr Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF82.04, and the most bearish reporting a price target of just CHF56.91.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $141.2 million, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 5.5%.

- Given the current share price of CHF64.2, the analyst price target of CHF74.56 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Landis+Gyr Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.