Key Takeaways

- Rapid technology shifts and rising competition could make the current product line obsolete, leading to less productive R&D spending and shrinking margins.

- Dependence on large contracts, slow software transition, and regulatory risks constrain recurring earnings growth while increasing exposure to compliance costs and reputational harm.

- The company's strategic shift to software, operational focus, and sector tailwinds enhance stability, margin resilience, and long-term growth potential amid evolving industry dynamics.

Catalysts

About Landis+Gyr Group- Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- The rapid emergence of new technology cycles and increasing competition from alternative smart grid solutions threaten to make Landis+Gyr's existing product portfolio obsolete faster than anticipated, forcing the company into higher, less productive R&D spending which could significantly erode net margins over time.

- Ongoing consolidation among utility customers and a growing industry shift toward open-platform, lower-cost solutions in Asia create a risk of intense price competition and unfavorable contract renegotiations, thereby putting persistent downward pressure on revenue and gross profit.

- Persistent geopolitical risks and the rise in protectionism expose Landis+Gyr's global manufacturing and supply chain to unexpected cost increases and delivery delays, undermining both short-term and long-term earnings visibility.

- The company's heavy reliance on a small pool of major utility contracts and the slow pace of transition from hardware to higher margin, recurring software revenues increases revenue concentration risk and limits growth in recurring earnings-even as competitors accelerate their own software pivots.

- Heightened regulatory scrutiny regarding data privacy and cybersecurity adds compliance burdens and legal risk as Landis+Gyr's smart metering hardware and analytics platforms become more deeply integrated within utility infrastructure, threatening margin expansion and future earnings growth through both increased operating costs and potential reputational damage.

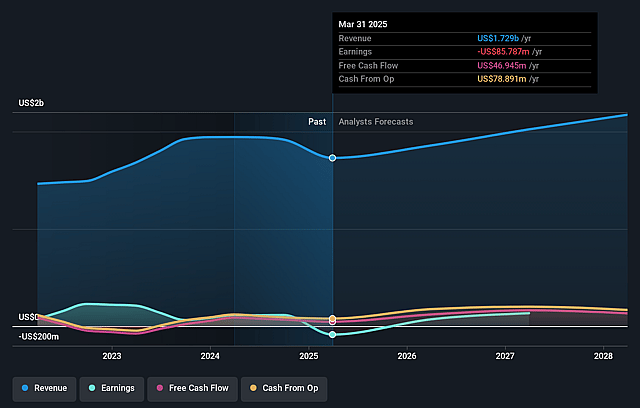

Landis+Gyr Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Landis+Gyr Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Landis+Gyr Group's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -5.0% today to 8.4% in 3 years time.

- The bearish analysts expect earnings to reach $174.3 million (and earnings per share of $5.32) by about September 2028, up from $-85.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -26.8x today. This future PE is lower than the current PE for the GB Electronic industry at 32.5x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.5%, as per the Simply Wall St company report.

Landis+Gyr Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Landis+Gyr reported a record order intake of $2.6 billion and backlog reaching $4.6 billion, providing strong multi-year revenue visibility and supporting long-term growth, which can help stabilize or increase future revenues.

- The company is successfully shifting its business mix, with 35% of backlog now tied to software solutions and recurring revenues, particularly in the Americas where software comprises nearly 50% of the regional backlog, enhancing margin stability and future earnings.

- Strategic initiatives, including the exit from lower-margin businesses such as EV charging and the focus on core smart metering and grid solutions, as well as potential value creation through a sale or restructure of the EMEA business, could further improve profitability and capital returns over time.

- Management demonstrated effective cost discipline, operational efficiencies, and contract clauses that can pass tariff-related or other cost increases onto customers, protecting net margins from external shocks and supporting steady earnings.

- Long-term secular trends, such as accelerating grid digitalization, increased regulatory support for smart infrastructure, and the company's leadership in decarbonization and ESG, position Landis+Gyr to benefit from sustained industry tailwinds, underpinning positive revenue and earnings prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Landis+Gyr Group is CHF56.91, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Landis+Gyr Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF82.04, and the most bearish reporting a price target of just CHF56.91.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $174.3 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 5.5%.

- Given the current share price of CHF64.2, the bearish analyst price target of CHF56.91 is 12.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.