Key Takeaways

- Rapid software integration and U.S.-focused leadership are set to propel margin expansion and profitability through operational scale and increased recurring revenue.

- Leading grid modernization solutions and regulatory momentum enable recurring revenues and contract acceleration, while manufacturing shifts de-risk supply chains and boost margin visibility.

- Heavy dependence on utility contracts, technology obsolescence, and industry shifts toward software solutions threaten revenue stability, margins, and long-term competitiveness.

Catalysts

About Landis+Gyr Group- Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- Analysts broadly agree that the Americas business will drive higher margins and growth, but accelerating software integration and the newly U.S.-centric leadership could create a step change in profitability, leveraging operational scale and capital availability to push EBITDA margins well above current guidance in the medium term.

- While consensus sees higher recurring software revenue as a margin tailwind, current order backlog data shows software now exceeds one third of total backlog and nears half in the Americas, indicating net margins may expand dramatically and much faster than anticipated as these long-term, high-margin projects are executed.

- Surging adoption of advanced grid edge solutions-especially the rapid scaling of Revelo and DERMS platforms-positions Landis+Gyr as the go-to provider for utilities investing in grid modernization, unlocking multi-year recurring revenues as smart infrastructure spending accelerates globally.

- The transition to 100% USMCA-compliant manufacturing in Mexico is being achieved more rapidly than expected, materially de-risking supply chain costs and facilitating faster recovery of tariff-impacted revenue, which should directly lift future gross margins and cash generation sooner than the market projects.

- Growing regulatory momentum for mandatory smart grid and cybersecurity upgrades, combined with Landis+Gyr's leading brand and installed base, creates an environment where large, multi-year contracts are likely to accelerate, supporting sustained double-digit revenue growth and superior earnings visibility.

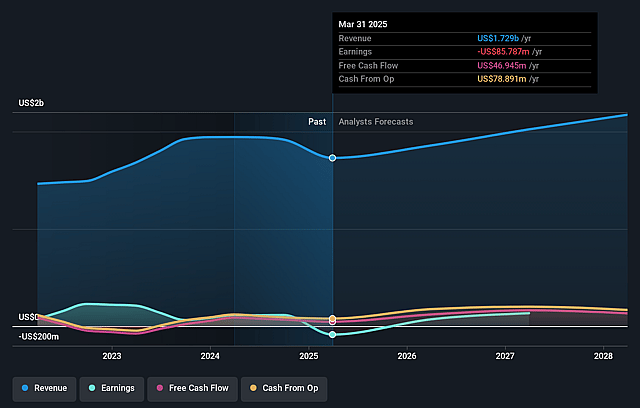

Landis+Gyr Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Landis+Gyr Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Landis+Gyr Group's revenue will grow by 12.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -5.0% today to 7.3% in 3 years time.

- The bullish analysts expect earnings to reach $180.7 million (and earnings per share of $6.15) by about September 2028, up from $-85.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from -26.7x today. This future PE is lower than the current PE for the GB Electronic industry at 32.5x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.59%, as per the Simply Wall St company report.

Landis+Gyr Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Industry commoditization and the rapid adoption of non-meter-based energy management solutions, like advanced software platforms, threaten to dilute Landis+Gyr's hardware-centric business model, which could shrink their addressable market and cause long-term revenue erosion.

- The company is heavily reliant on large, multi-year contracts with major utilities, exposing it to customer concentration risk; any loss or delay from major clients could lead to significant volatility in top-line results and cash flow, making future revenues less predictable.

- The $20 million inventory obsolescence charge and references to accelerated product adoption highlight potential risks from aging product lines and slow innovation cycles; if Landis+Gyr's technology becomes outdated relative to competitors, gross margins and future earnings may face sustained downward pressure.

- Ongoing restructuring charges, strategic transformation costs, and non-recurring expense items tied to divestments and business model changes, such as the exit from EV charging, continue to weigh on net margins and limit the company's ability to invest in organic growth or return capital to shareholders in the medium term.

- Increasing regulatory scrutiny around data privacy, cybersecurity requirements, and changing industry standards could drive up compliance costs, prolong sales cycles, or even delay product deployments, all of which threaten to pressure profitability and slow growth in both revenues and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Landis+Gyr Group is CHF82.04, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Landis+Gyr Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF82.04, and the most bearish reporting a price target of just CHF56.91.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $180.7 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 5.6%.

- Given the current share price of CHF63.4, the bullish analyst price target of CHF82.04 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.