Last Update 29 Nov 25

Fair value Decreased 3.12%SQNS: Share Buybacks And Expanding Design Wins Will Drive Q4 Recovery

Analysts have lowered their price target for Sequans Communications from $21.33 to $20.67, citing near-term sales headwinds. However, they maintain a positive view on future design wins and an improving revenue growth outlook.

Analyst Commentary

Analysts continue to weigh both positive and negative factors as they update their outlook for Sequans Communications. These viewpoints highlight critical elements affecting the company's valuation, execution, and growth trajectory.

Bullish Takeaways

- Analysts remain positive on the company's expanding pipeline of design wins over the next three years. This development could drive improved long-term revenue growth.

- Valuation is considered attractive by optimistic analysts. They see the current pullback in the share price as an opportunity for potential upside as sales recover.

- Analysts believe that near-term sales headwinds are likely to be temporary. They expect a rebound in the next quarter due to better project timing and component availability.

- Some note that strategic initiatives such as redeeming bitcoin holdings for share buybacks could further enhance shareholder value.

Bearish Takeaways

- Bears are concerned about the recent miss on quarterly sales, attributing it partly to project delays and supply chain challenges that may persist in the near term.

- There is caution around the lack of broader market recognition for some of Sequans' strategic initiatives. This could limit near-term investor enthusiasm.

- Price targets have been adjusted downward to reflect uncertainty regarding the pace of execution and recovery in upcoming quarters.

What's in the News

- Sequans Communications announced a 1-for-10 stock split or significant stock dividend. This event is scheduled for September 17, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased from $21.33 to $20.67, reflecting a modest downgrade.

- Discount Rate remains largely unchanged at 13.46%.

- Revenue Growth projection has increased significantly, rising from 24.90% to 38.13%.

- Net Profit Margin is up slightly from 14.61% to 14.73%.

- Future P/E ratio has declined substantially, moving from 65.94x to 46.84x.

Key Takeaways

- Accelerating IoT product launches, new RF transceivers, and 5G platform development are positioning Sequans for revenue growth and expansion into high-margin, diversified markets.

- Increased focus on IP monetization and disciplined cost control could improve margins and earnings quality, reducing concerns about sustained losses.

- Sequans' shift to a Bitcoin-focused treasury strategy raises earnings volatility, shareholder dilution, heightened financial risk, and uncertainty around profitability and future cash flow.

Catalysts

About Sequans Communications- Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets.

- Product revenue from the IoT business is expected to ramp significantly through the second half of 2025 and into 2026, as a large pipeline of design wins (~$250 million) transitions to mass production-this dynamic aligns with robust adoption of connected devices across industries, set to drive meaningful revenue growth.

- Sequans' launch of new RF transceiver products targeting high-value markets such as defense, drones, and automotive, combined with strong early design win momentum, supports long-term expansion into diversified verticals with premium gross margins and higher earnings potential.

- Ongoing development of next-generation 5G IoT platforms (eRedCap 5G), with customer interest fueled by seamless upgrade paths from 4G, positions Sequans to capture additional share in the accelerating 5G/IoT buildout, expanding its addressable market and future revenue base.

- Expanded focus on monetizing the company's intellectual property portfolio through licensing and royalty arrangements-including new agreements and anticipated recurring royalties starting in 2026-has the potential to boost high-margin income streams, improving net margins.

- Management's continued discipline in cost containment, government R&D support, and progress toward expected operational cash flow breakeven in the second half of 2026 could catalyze a re-rating of earnings quality and reduce perceived risk around sustained losses.

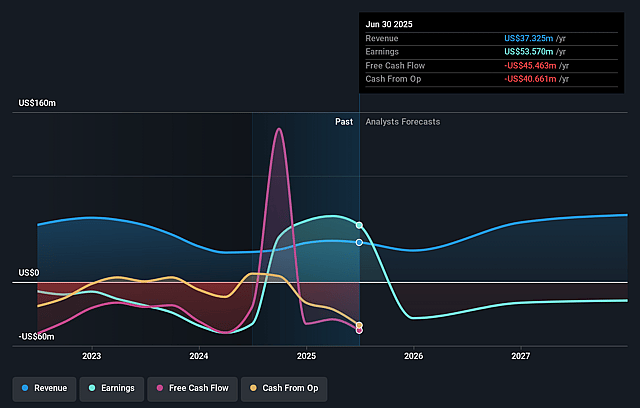

Sequans Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sequans Communications's revenue will grow by 27.0% annually over the next 3 years.

- Analysts are not forecasting that Sequans Communications will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sequans Communications's profit margin will increase from 143.5% to the average US Semiconductor industry of 14.1% in 3 years.

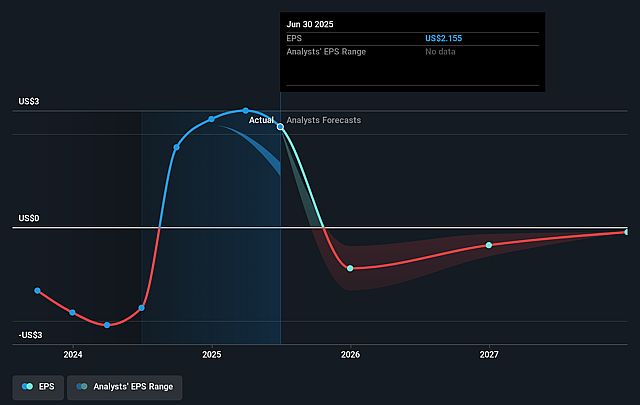

- If Sequans Communications's profit margin were to converge on the industry average, you could expect earnings to reach $10.8 million (and earnings per share of $0.07) by about September 2028, down from $53.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 106.5x on those 2028 earnings, up from 2.3x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.17%, as per the Simply Wall St company report.

Sequans Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sequans' heavy pivot to a Bitcoin treasury strategy introduces significant earnings volatility and risk of impairment losses, as its financials will become exposed to Bitcoin price swings and accounting rules limit the recognition of unrealized gains, increasing potential for reported net losses and reducing predictability for shareholders.

- The company plans to continue growing its Bitcoin holdings through ongoing equity and debt issuance, resulting in repeated shareholder dilution, higher interest costs, and growing leverage-all of which could erode EPS, compress net margins, and heighten financial risk in the long term.

- Reliance on monetizing intellectual property and future licensing income to support both its operating business and Bitcoin strategy creates uncertainty; if anticipated licensing and royalty revenues fail to materialize, Sequans may face cash flow constraints, impairing its ability to fund operations and further Bitcoin purchases, which would affect overall revenue and margins.

- Sequans' IoT business, while showing some growth and design win momentum, remains relatively small compared to larger competitors, with recent quarterly net losses and shrinking cash balances; persistent inability to achieve sustained profitability and cash-flow breakeven could undermine investor confidence and pressure future earnings.

- Long-term industry trends of accelerating integration and custom silicon by major device makers, coupled with intensifying competition from larger, vertically integrated semiconductor firms, pose a risk of margin compression and loss of market share, negatively impacting both revenue growth and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.5 for Sequans Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.5, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $76.4 million, earnings will come to $10.8 million, and it would be trading on a PE ratio of 106.5x, assuming you use a discount rate of 11.2%.

- Given the current share price of $0.85, the analyst price target of $5.5 is 84.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sequans Communications?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.