Key Takeaways

- Strategic shift to Bitcoin reserves and ongoing funding needs risk weakening IoT innovation and core business growth against better-capitalized competitors.

- Heavy customer reliance and exposure to disruptive technologies reinforce revenue instability, while regulatory and supply pressures may erode long-term shareholder value.

- Sequans faces high financial and regulatory risks from its Bitcoin strategy, ongoing losses, shareholder dilution, and significant execution challenges in a volatile, competitive IoT market.

Catalysts

About Sequans Communications- Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets.

- While Sequans is benefitting from rapid growth in IoT device adoption and expanding digital transformation across enterprises, its substantial recent pivot to a Bitcoin treasury strategy diverts a significant portion of capital away from direct R&D investments and scaling the IoT business, potentially suppressing future revenue growth in its core markets and widening its innovation gap versus better-funded semiconductor peers.

- Despite its leadership in low-power, narrowband IoT technologies and a robust pipeline of design wins moving into mass production-which should structurally improve gross margin and long-term revenue visibility-the company remains exposed to technological disruption from faster-evolving connectivity solutions and faces the risk of its products being made obsolete before meaningful scale is reached, jeopardizing sustained margin improvement and long-term operating leverage.

- While licensing and royalty revenues from its intellectual property, including the forthcoming ramp of 5G and RF-related licensing, could provide high-margin streams to enhance net earnings, Sequans has a history of heavy customer concentration and limited bargaining power, creating earnings volatility if any major customer curtails orders or if competitive dynamics limit new licensing opportunities.

- Although management projects the IoT business turning cash flow positive by the second half of 2026, persistent industry-wide supply chain constraints and increasing pressure from larger, better-capitalized semiconductor firms could result in unpredictable costs and shrinking market share, potentially keeping Sequans reliant on ongoing capital raises and further diluting existing shareholders and limiting net earnings per share improvement.

- Even as the global proliferation of connected devices is expected to expand Sequans' addressable market, its reliance on equity and debt issuance to fund both Bitcoin accumulation and core operations raises the risk of continued shareholder dilution, and the unpredictable regulatory climate regarding both semiconductor supply chain and digital asset custody could add recurring compliance costs, undermining intrinsic value over the long term.

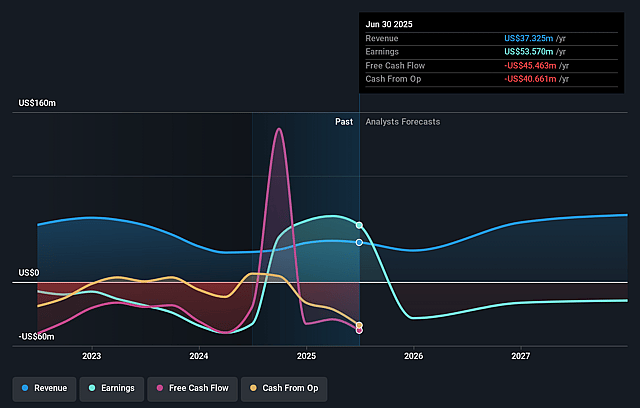

Sequans Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sequans Communications compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sequans Communications's revenue will grow by 25.7% annually over the next 3 years.

- The bearish analysts are not forecasting that Sequans Communications will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sequans Communications's profit margin will increase from 143.5% to the average US Semiconductor industry of 14.1% in 3 years.

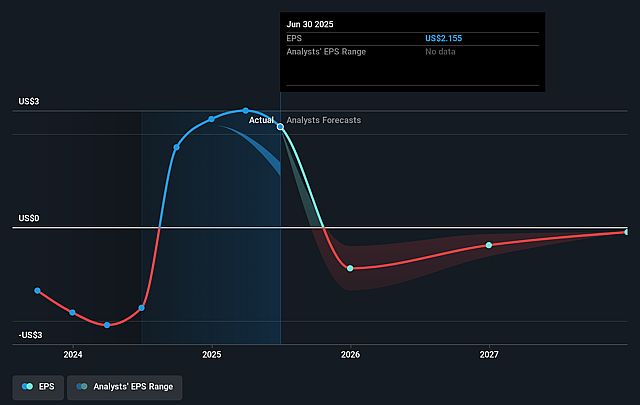

- If Sequans Communications's profit margin were to converge on the industry average, you could expect earnings to reach $10.5 million (and earnings per share of $0.07) by about September 2028, down from $53.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 69.9x on those 2028 earnings, up from 2.3x today. This future PE is greater than the current PE for the US Semiconductor industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.17%, as per the Simply Wall St company report.

Sequans Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sequans' heavy commitment to a Bitcoin treasury strategy exposes shareholders to significant cryptocurrency market risk and extreme volatility, which can directly impact net income and shareholder equity, especially given the company's high average Bitcoin purchase price relative to its current trading level.

- The company plans to fund future Bitcoin purchases and growth through repeated equity and debt issuances, which leads to ongoing shareholder dilution and increased leverage, eroding long-term earnings per share and intrinsic value.

- Persistent operating losses, with a net loss of $9.1 million in the most recent quarter and recurring negative cash flow, suggest the company remains reliant on external capital infusions and successful execution of licensing or asset sales for ongoing liquidity, posing a risk to future revenue and profitability.

- Despite optimistic projections for IoT product ramp-up and royalties, execution risk remains high in the face of intense industry competition, supply chain volatility, and the rapid pace of technological disruption in wireless connectivity, any of which could undermine expected revenue growth and margin improvement.

- Evolving global regulatory scrutiny of cryptocurrency holdings and operations, combined with increasing demands for technological sovereignty in major markets, may raise compliance costs and restrict Sequans' market access, ultimately weighing on net margins and revenue scalability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sequans Communications is $3.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sequans Communications's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.5, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $74.1 million, earnings will come to $10.5 million, and it would be trading on a PE ratio of 69.9x, assuming you use a discount rate of 11.2%.

- Given the current share price of $0.85, the bearish analyst price target of $3.5 is 75.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.