Key Takeaways

- Accelerating IoT adoption and high-margin licensing deals position the company for outsized profitability and sustained revenue growth across diverse connected markets.

- Strategic Bitcoin holdings and rapid entry into new sectors could quickly enhance margins, shareholder value, and the company's reputation as an innovation-driven leader.

- A risky strategic shift toward Bitcoin, ongoing losses, shareholder dilution, and industry headwinds threaten Sequans' financial stability, competitiveness, and long-term growth prospects.

Catalysts

About Sequans Communications- Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets.

- Analyst consensus anticipates robust IoT product revenue as design wins transition to mass production, but this could be a significant underestimate: management commentary points to 50% of the $250 million design win pipeline entering mass shipments by year-end 2025 and a total IoT pipeline of $485 million, suggesting an even steeper revenue inflection as adoption of connected devices accelerates industry-wide.

- While analysts broadly expect the new RF transceiver product line to enable expansion into defense, drone, and automotive markets, the immediate monetization of ACP's portfolio-with no incremental R&D investment-could drive $10 million or more in ultra-high margin revenue as soon as 2026, meaning gross profit and margin improvements could materialize much faster than consensus models.

- Sequans' Bitcoin treasury strategy positions the company for potential NAV re-rating and capital inflows, as rising institutional and international demand for Bitcoin exposure could create a shareholder base revaluation, with Bitcoin yield generation introducing a new avenue for boosting net asset value and overall earnings.

- The company is uniquely leveraging global government R&D support and established strategic partnerships to aggressively pursue recurring licensing-current royalty streams from Chinese Taurus partners and upcoming deals could rapidly scale high-margin, predictable income, improving profitability beyond existing forecasts.

- Sequans' leadership in power-efficient cellular connectivity directly benefits from the accelerating adoption of 5G and digital transformation across cars, factories, and smart infrastructure worldwide; their position as an innovation-focused enabler of mass IoT builds ensures multi-year revenue tailwinds and increasing pricing power as demand for premium, energy-saving solutions overtakes generic alternatives.

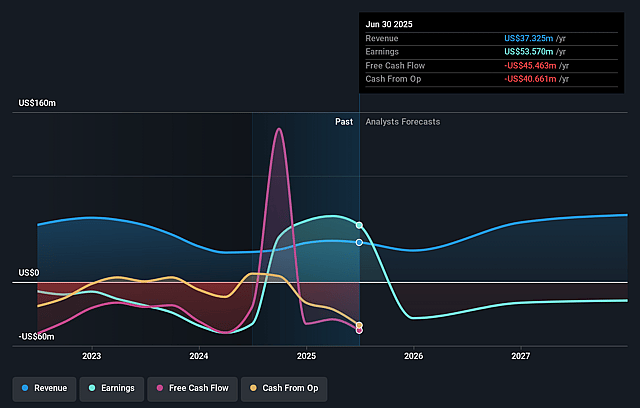

Sequans Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sequans Communications compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sequans Communications's revenue will grow by 25.9% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Sequans Communications will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sequans Communications's profit margin will increase from 143.5% to the average US Semiconductor industry of 14.1% in 3 years.

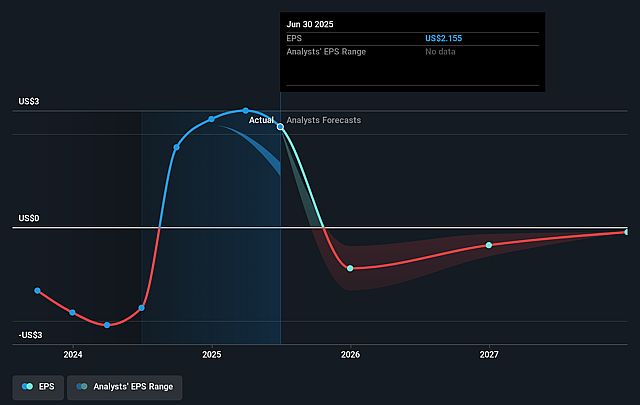

- If Sequans Communications's profit margin were to converge on the industry average, you could expect earnings to reach $10.5 million (and earnings per share of $0.07) by about September 2028, down from $53.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 148.8x on those 2028 earnings, up from 2.3x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.06%, as per the Simply Wall St company report.

Sequans Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sequans' heavy strategic pivot toward a Bitcoin treasury reallocates substantial company capital into a highly volatile asset, exposing both the balance sheet and future earnings to significant crypto market risk and potential mark-to-market losses, which could amplify net income volatility and threaten shareholder equity if Bitcoin underperforms.

- The large $384 million equity and debt issuance used to fund the Bitcoin purchase has materially diluted existing shareholders and increased financial leverage, raising concerns about the company's long-term capital structure, especially as ongoing net losses and debt service obligations could pressure future net margins and earnings.

- Ongoing negative cash flow and operating losses, with Q2 2025 showing a net loss of $9.1 million and persistent cash burn, challenge Sequans' ability to consistently invest in research and development, undermining innovation and competitiveness in rapidly evolving IoT and semiconductor markets, thereby posing a threat to long-term revenue growth and profit margins.

- Sequans' IoT business remains exposed to sector-wide trends of shrinking semiconductor margins and aggressive competition from larger, better-capitalized players, increasing the likelihood of continued revenue and margin pressure, especially if consolidation or rapid technological change shortens product cycles and further compresses prices.

- Heightened supply chain disruptions, geopolitical uncertainties, and increasingly strict climate regulations-compounded by Sequans' dependence on key customers and a limited intellectual property portfolio-could lead to production delays, increased operational costs, or litigation, each capable of reducing both revenue and bottom-line profitability over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sequans Communications is $7.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sequans Communications's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.5, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $74.5 million, earnings will come to $10.5 million, and it would be trading on a PE ratio of 148.8x, assuming you use a discount rate of 11.1%.

- Given the current share price of $0.87, the bullish analyst price target of $7.5 is 88.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.