Last Update 04 Aug 25

Fair value Decreased 6.69%Digital Platforms And Corporate Travel Expansion Will Shape Future Markets

The downward revision in Flight Centre Travel Group’s consensus price target is primarily driven by reduced revenue growth forecasts and a slight decline in net profit margins, lowering fair value from A$16.76 to A$15.67.

What's in the News

- Flight Centre Travel Group renewed its technology partnership with Serko Limited, continuing to market and distribute Serko's online booking solutions.

- FCTG will contribute to a development fund focused on creating unique product features for its customers.

- FCTG represents a significant portion of Serko's booking volume in Australia and New Zealand for managed travel.

Valuation Changes

Summary of Valuation Changes for Flight Centre Travel Group

- The Consensus Analyst Price Target has fallen from A$16.76 to A$15.67.

- The Consensus Revenue Growth forecasts for Flight Centre Travel Group has significantly fallen from 5.8% per annum to 5.1% per annum.

- The Net Profit Margin for Flight Centre Travel Group has fallen slightly from 9.86% to 9.53%.

Key Takeaways

- Accelerated digital investment, AI integration, and omni-channel expansion should boost operational efficiency, drive margin improvement, and support long-term earnings growth.

- Strategic focus on corporate, luxury, and cruise travel segments, along with scale advantages, will diversify income, stabilize revenue, and reduce earnings volatility.

- Structural industry shifts, digital disruption, and operational headwinds are limiting profitability and margin growth, raising concerns about sustainable recovery and Flight Centre's competitive position.

Catalysts

About Flight Centre Travel Group- Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

- Ongoing investment in proprietary digital platforms (e.g., Melon for Corporate Traveler, revitalized SAM app, and the Echo platform in Leisure) and AI integration is expected to enhance productivity, drive operational efficiency, enable higher self-service rates, and unlock meaningful cost reductions over time, which should strengthen net margins and support long-term earnings growth.

- Expansion into high-growth, higher-margin segments-particularly through accelerated push into corporate travel with a focus on the large U.S. SME market, luxury travel, and cruise/tour specialist businesses-should meaningfully improve revenue mix, provide more stable, recurring income, and drive sustained growth in EPS as these categories outperform lower-margin traditional leisure bookings.

- The company's diversified brand, channel, and geographic portfolio, combined with scale advantages and ongoing acquisition activity, should enable Flight Centre to capture share from smaller players during industry consolidation, increase negotiating power with suppliers, and drive top-line revenue growth while reducing earnings volatility.

- Increased digital capabilities and omni-channel distribution-such as growing online and media-enabled in-store sales, personalized customer engagement through loyalty programs, and enhanced data-driven upselling-are well-placed to meet rising demand for seamless, customized travel experiences, thereby supporting both revenue growth and margin improvement through ancillary services.

- The normalization of remote/hybrid work and the resulting rise in blended business-leisure travel segments (bleisure), alongside secular tailwinds from global travel demand growth driven by the expanding global middle class, are expected to increase overall transaction volumes and basket sizes, directly benefiting revenue and commission-based income streams.

Flight Centre Travel Group Future Earnings and Revenue Growth

Assumptions

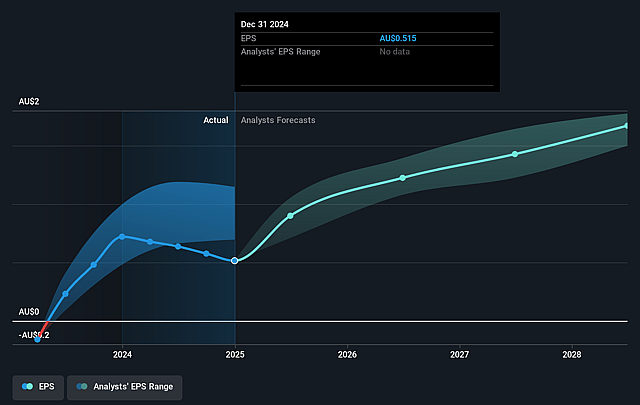

How have these above catalysts been quantified?- Analysts are assuming Flight Centre Travel Group's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 9.2% in 3 years time.

- Analysts expect earnings to reach A$296.4 million (and earnings per share of A$1.41) by about September 2028, up from A$109.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$337.1 million in earnings, and the most bearish expecting A$263.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 24.4x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

Flight Centre Travel Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The business remains highly sensitive to macroeconomic volatility, geopolitical risks, and shifts in international travel demand (such as recent downturns in Europe/UK, Asia, and the impact of U.S. tariffs), all of which create persistent top-line and earnings volatility.

- Revenue and margin growth are constrained by structural shifts toward lower-margin product mixes, destination changes, customers down-trading, and subdued override income, especially in the leisure segment-making recovery to target PBT margins and sustainable margin expansion uncertain.

- The company's physical retail footprint and associated high fixed-cost base face ongoing pressure from the increasing consumer shift to direct and digital channels, with online bookings growing but still lagging online-first rivals-posing a long-term risk of margin compression and revenue erosion if digital transformation is not sufficiently accelerated.

- Ongoing challenges in regions like Asia and underperforming businesses (e.g., recent $30 million Asia headwind mainly from down-trading and operational issues) highlight execution risk, and there is no near-term prospect of regaining pre-pandemic profitability in these segments, directly impacting group profit and net margins.

- Flight Centre's ambitious long-term PBT margin target (2%) has effectively been deprioritized to focus on incremental improvements, indicating that structural and competitive headwinds-including the proliferation of self-serve technology and intensified industry consolidation-may limit the company's ability to sustainably grow earnings and meet ambitious margin goals over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$15.641 for Flight Centre Travel Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$20.75, and the most bearish reporting a price target of just A$12.95.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$3.2 billion, earnings will come to A$296.4 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 8.7%.

- Given the current share price of A$12.32, the analyst price target of A$15.64 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.