Key Takeaways

- Accelerating AI-driven transformation and operating leverage could deliver far greater margin expansion and cost reductions than analysts expect.

- Strong positioning in premium, youth, and Asia-Pacific travel, plus balance sheet strength, enables outsized growth through targeted investments and strategic acquisitions.

- Slow digital adaptation and shifting traveler preferences threaten Flight Centre's traditional business, putting long-term margins, revenue stability, and market share at significant risk.

Catalysts

About Flight Centre Travel Group- Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

- While analyst consensus expects TTV and margin expansion from growth in higher-margin corporate and luxury segments, they may be underestimating the scale of earnings improvement as macro headwinds abate and the global platform shift unleashes significant latent operating leverage, driving net margins and earnings above market forecasts.

- The consensus narrative sees AI and automation delivering incremental productivity benefits, but the scope and compounding effects of the ongoing AI-driven overhaul – now touching all operations, platforms, and customer journeys – could yield transformational cost reductions and step-change improvements in margin structure, not just marginal gains.

- Flight Centre is uniquely positioned to capture the accelerating demand for premium and personalized travel among millennials and Gen Z, especially with the imminent relaunch of Top Deck and expansion of loyalty and data-driven platforms, potentially resulting in outsized revenue growth and higher average transaction values as these customer cohorts become a dominant force in global travel.

- The surge in outbound travel from the rapidly growing Asia-Pacific middle class, together with targeted investments in regional capability and proprietary platforms, positions Flight Centre to capture market share far ahead of peers in high-growth travel corridors, meaning revenue growth could significantly outperform both internal and industry expectations.

- The company's strengthening balance sheet and ongoing capital management, including proactive debt reduction and opportunistic M&A, gives it firepower to accelerate growth in luxury, cruise, and specialist segments through strategic acquisitions, enabling faster earnings compounding and higher long-term return on equity than currently reflected in valuations.

Flight Centre Travel Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Flight Centre Travel Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Flight Centre Travel Group's revenue will grow by 11.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.9% today to 9.0% in 3 years time.

- The bullish analysts expect earnings to reach A$347.0 million (and earnings per share of A$1.6) by about September 2028, up from A$109.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 24.0x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

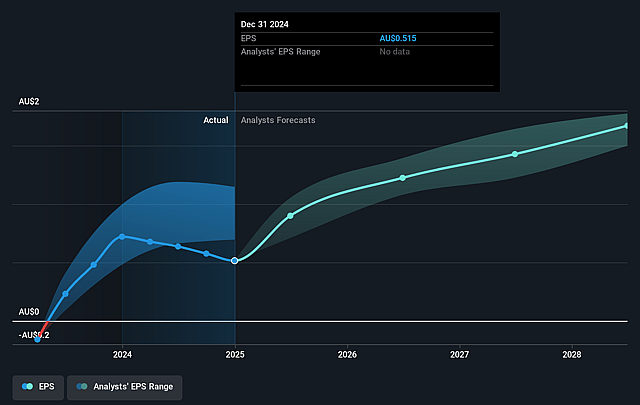

Flight Centre Travel Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise of DIY online travel booking and AI-driven platforms continues to erode Flight Centre's traditional travel agency business, as digital competitors gain market share and younger travelers increasingly bypass traditional channels, threatening long-term revenue and top-line growth.

- Demographic shifts and changing traveler preferences-such as younger generations seeking more individualized experiences over package tours-may undermine the company's core packaged holiday business, risking the stability and predictability of future revenue streams.

- Ongoing rationalization and shrinkage of physical retail networks in response to digital disruption have resulted in elevated restructuring costs, asset write-downs, and margin pressure, all of which are likely to persist, constraining future improvements in net margins and profitability.

- Flight Centre's slow digital transformation and dependence on legacy business models compared to more agile, tech-first rivals leaves it exposed to margin compression and market share loss in the rapidly growing online travel and AI-enabled planning segments, endangering sustained earnings growth.

- Direct-to-consumer strategies by airlines, hotels, and cruise lines, as well as industry consolidation among online booking platforms, intensify competitive pressure and squeeze commission rates, further eroding Flight Centre's intermediary role and negatively impacting both revenue and net profit margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Flight Centre Travel Group is A$19.64, which represents two standard deviations above the consensus price target of A$15.67. This valuation is based on what can be assumed as the expectations of Flight Centre Travel Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$20.75, and the most bearish reporting a price target of just A$12.95.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$3.8 billion, earnings will come to A$347.0 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 8.7%.

- Given the current share price of A$12.18, the bullish analyst price target of A$19.64 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.