Key Takeaways

- Accelerating direct consumer bookings and dominant online competitors are undermining market share, revenue growth, and pricing power across core agency channels.

- Digital transformation and international expansion are driving persistent cost pressures, structural overhead risks, and ongoing profitability volatility amidst regulatory and environmental headwinds.

- Strategic investments in technology, revenue diversification, and global growth initiatives position the company for improved efficiency, earnings stability, and long-term expansion.

Catalysts

About Flight Centre Travel Group- Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

- The ongoing acceleration of direct bookings by consumers, enabled by wider adoption of digital platforms, is expected to continue eroding Flight Centre's core agency business over the long term. This threatens transaction volumes and client retention, making it increasingly difficult for the company to deliver meaningful revenue growth in traditional channels.

- Intensifying environmental regulation, rising carbon taxes, and the growing prevalence of flight shame in key developed markets-including regions where Flight Centre is heavily exposed-pose an ongoing risk to overall travel demand and could structurally reduce discretionary travel volumes, weighing on long-term revenue and compressing profit margins.

- The company's ongoing transition from physical stores to digital channels is leading to persistent IT, marketing, and transformation costs, and management concedes that achieving global best-in-class digital efficiency remains challenging; sustained cost pressure may drive net margin contraction well into the future, especially if digital platforms fail to fully offset lost in-person revenues.

- Increasing operational complexity from international expansion, particularly ongoing underperformance in Asia and EMEA as well as significant write-downs and restructuring provisions, indicates a heightened risk that overheads remain structurally high, which could result in ongoing earnings volatility and undermine consistency in long-term profit delivery.

- Intensifying competition from dominant online travel agencies, the direct sales push by airlines and hotels, and the industry's susceptibility to geopolitical shocks are all expected to further erode Flight Centre's intermediary market share. This structurally threatens the company's ability to maintain pricing power and sustain topline growth, with direct negative implications for both revenue growth and profitability.

Flight Centre Travel Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Flight Centre Travel Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Flight Centre Travel Group's revenue will grow by 3.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.9% today to 8.9% in 3 years time.

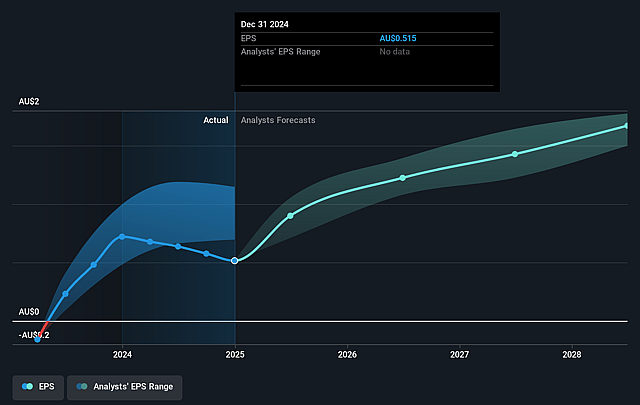

- The bearish analysts expect earnings to reach A$278.9 million (and earnings per share of A$1.26) by about August 2028, up from A$109.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 24.5x today. This future PE is lower than the current PE for the AU Hospitality industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

Flight Centre Travel Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's continued investment in digital platforms, AI-enabled productivity initiatives, and proprietary technology such as the Melon platform and new loyalty programs suggests that net margins and operational efficiency could improve considerably in the long term.

- Diversification of revenue streams across geographies, customer segments, and service offerings-including fast-growing areas like luxury, cruise, and specialist brands-reduces reliance on any single market or segment and may result in more stable long-term revenue growth.

- Robust growth initiatives in the U.S. and other key international markets, combined with a low current market share but improving competitive position, indicate significant potential for expansion in revenue and profit over the coming years.

- The company's strong balance sheet, ongoing capital management initiatives, and a cost-out program provide resilience, flexibility for future investments, and the ability to maintain or even grow dividends and buybacks, collectively supporting earnings stability and potential for share price appreciation.

- Long-term secular tailwinds, such as the growing global middle class, travel market expansion in emerging economies, and increased demand for experiential and bleisure travel, could drive higher transaction volumes and average basket sizes, boosting both revenues and profit margins in the medium

- to long-term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Flight Centre Travel Group is A$12.95, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flight Centre Travel Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$20.75, and the most bearish reporting a price target of just A$12.95.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$3.1 billion, earnings will come to A$278.9 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 8.7%.

- Given the current share price of A$12.38, the bearish analyst price target of A$12.95 is 4.4% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Flight Centre Travel Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.