Last Update 25 Feb 26

OSS: Bressner Sale And M&A Plans Will Shape Measured Forward Outlook

Narrative Update on One Stop Systems

Analysts nudged their price target on One Stop Systems to $9 from $8.50, citing the $22.4m sale of Bressner Technology at a higher than expected price and the view that proceeds could be redeployed into M&A that they see as more supportive of shareholder value.

Analyst Commentary

Recent research focuses heavily on the sale of Bressner Technology and how that capital might shape the next phase for One Stop Systems. Here is how bullish and cautious analysts are framing the situation.

Bullish Takeaways

- Bullish analysts point to the $22.4m sale price as a positive surprise, arguing that it signals investor willingness to pay up for non core assets and supports the updated $9 price target.

- They view the exit from a low contribution margin value added reselling business as a cleaner setup, with a higher quality revenue mix seen as more aligned with shareholder value.

- The cash proceeds are seen as giving the company more flexibility for M&A, which bullish analysts think could be directed toward opportunities they view as higher margin or more scalable.

- Some see the decision to sell as a sign of management discipline on capital allocation, which they believe can be supportive of valuation if replicated in future decisions.

Bearish Takeaways

- Bearish analysts highlight that proceeds earmarked for M&A introduce execution risk, since the benefit to shareholders depends on the quality, timing, and pricing of any transactions.

- They point out that the low contribution margin nature of Bressner means the sale does not automatically translate into stronger overall profitability without effective redeployment of capital.

- Some cautious views focus on the potential for overpaying for future acquisitions, which could dilute returns if expected synergies or growth do not materialize as planned.

- There is also a concern that investors may be giving the company credit in valuation for M&A driven growth that has not yet occurred, which could limit upside if execution is slower than expected.

What's in the News

- Aggregate new awards of $10.5m from the U.S. Navy and a U.S.-based prime defense contractor to supply rugged data storage units for P-8A Poseidon reconnaissance aircraft, with revenue contribution expected in 2026 and continuing into 2027 (company announcement).

- Initial purchase order from a leading autonomous construction and mining equipment manufacturer, with approximately $2m in expected aggregate orders in 2026 and a five year pipeline estimate of about $10m to $15m for Gen5 ruggedized, liquid cooled servers supporting autonomous heavy equipment (company announcement).

- New $1.1m initial order from a top tier aerospace prime contractor for 200 ADB-10G ruggedized Ethernet switches for next generation in flight entertainment systems, with management indicating potential for more than $6.5m in total revenue over five years (company announcement).

- Approximately $1.2m pre production order from a new U.S. defense prime contractor for ruggedized compute and visualization systems for U.S. Army combat vehicles, expanding OSS hardware use in Army vision and sensor programs across multiple vehicle platforms (company announcement).

- $1.2m production order from Safran Federal Systems for 4U short depth servers for military applications, bringing current aggregate orders on this program to about $1.9m, with the company indicating the contract could contribute over $7.0m in cumulative sales over five years (company announcement).

Valuation Changes

- Fair Value: $9.00 stays unchanged, with the updated figure in line with the prior $9 estimate.

- Discount Rate: The discount rate is effectively flat, moving slightly from 8.299935% to 8.301048%.

- Revenue Growth: The revenue growth assumption remains the same, recorded as a 15.398513% decline in both periods.

- Net Profit Margin: The profit margin assumption is broadly steady, edging from 12.349691% to 12.343803%.

- Future P/E: The future P/E is stable overall, moving slightly from 76.10x to 76.14x.

Key Takeaways

- Sole-source supplier wins and proprietary platform launches drive long-term revenue growth, higher margins, and enhanced market positioning for AI-driven and autonomous edge platforms.

- Growing demand across defense, autonomous vehicles, and healthcare, plus strategic investments, expand OSS's addressable market and support sustained earnings predictability.

- Dependence on volatile government contracts, rapid tech shifts, integrated competition, supply issues, and weak European growth threaten revenue stability, profitability, and future market position.

Catalysts

About One Stop Systems- Designs, manufactures, and markets rugged high-performance compute, high speed switch fabrics, and storage systems for edge applications of artificial intelligence and machine learning, sensor processing, sensor fusion, and autonomy in the United States and internationally.

- Multi-year defense and commercial platform wins and sole-source supplier agreements provide strong revenue visibility and support higher margins, as OSS becomes the incumbent compute and storage supplier for next-generation AI-driven and autonomous edge platforms. This positions revenue and gross margin for sustained growth.

- Sharply rising demand for high-performance, ruggedized computing and storage, driven by greater AI, machine learning, edge data processing, and sensor fusion initiatives-especially in defense, autonomous vehicles, and healthcare-expands OSS's addressable market and underpins long-term revenue growth.

- Introduction of proprietary PCIe Gen5 platforms like Ponto, tailored for the fast-growing composable infrastructure market and data center upgrades for high-wattage GPU workloads, creates new product/revenue streams and strengthens average selling prices, supporting both top-line growth and gross margin enhancement starting in 2026.

- Strong sequential and year-over-year growth in bookings, a robust book-to-bill ratio (above 2), and a diversified pipeline of platform-level opportunities indicate increasing predictability in future earnings and operating leverage, as a higher mix of production contracts move through the margin expansion life cycle.

- Ramping investments in R&D, strategic hiring from the defense sector, and increased bid/proposal activity with new government and commercial opportunities position OSS to benefit from the ongoing shift to modular, scalable HPC architectures and government onshoring/regulatory requirements, further supporting revenue and margin expansion in the medium-to-long term.

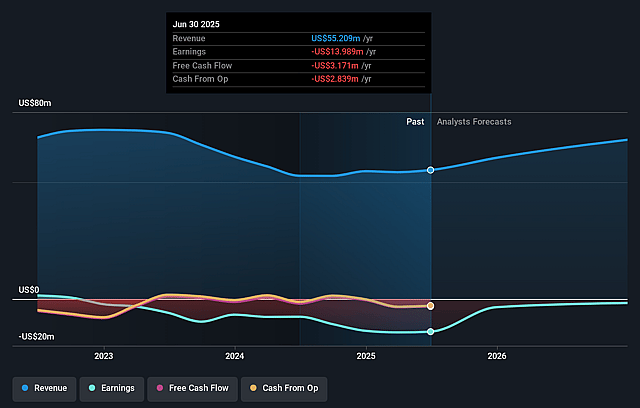

One Stop Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming One Stop Systems's revenue will grow by 14.7% annually over the next 3 years.

- Analysts are not forecasting that One Stop Systems will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate One Stop Systems's profit margin will increase from -25.3% to the average US Tech industry of 6.9% in 3 years.

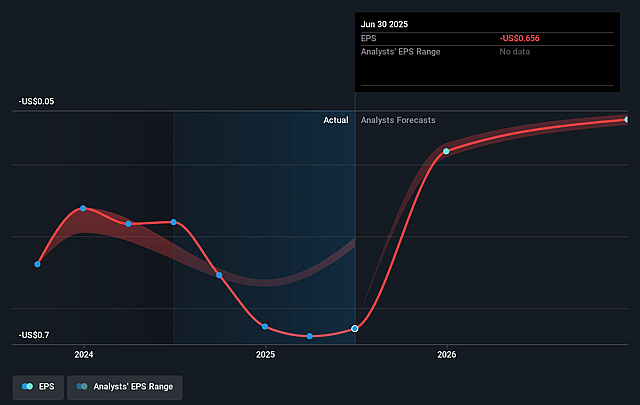

- If One Stop Systems's profit margin were to converge on the industry average, you could expect earnings to reach $5.7 million (and earnings per share of $0.24) by about September 2028, up from $-14.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.3x on those 2028 earnings, up from -9.0x today. This future PE is greater than the current PE for the US Tech industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 3.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

One Stop Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on large, lumpy government and defense contracts means OSS is exposed to delays and unpredictability from budget cycles, continuing resolutions, and shifting government funding timelines; such volatility could negatively impact revenue stability and growth visibility.

- OSS's core business remains highly concentrated in specialized high-performance hardware for rugged and edge applications, exposing the company to rapid technological obsolescence and significant R&D investment requirements, which may compress future net margins and dilute profitability.

- Accelerated industry transition to integrated solutions and commoditization-especially as hyperscalers and larger OEMs move toward fully integrated end-to-end platforms-threatens OSS's position as a niche supplier, risking a loss of market share and downward pressure on ASPs (average selling prices), hitting gross margin and earnings potential.

- Ongoing supply chain disruptions and lengthening component lead times, highlighted by the company's own remarks, pose substantial risks to execution of the second-half ramp and future production scaling; such headwinds could increase costs, delay deliveries, and adversely impact both revenue growth and net earnings.

- The Bressner segment's very modest growth rate (projected at 2–9%) contrasts with OSS's higher target, and ongoing weakness in European IT spend and international economic uncertainty may drag consolidated performance, potentially dampening overall revenue growth and limiting operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.0 for One Stop Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $83.4 million, earnings will come to $5.7 million, and it would be trading on a PE ratio of 37.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $5.73, the analyst price target of $7.0 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on One Stop Systems?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.