Last Update 01 May 25

Fair value Decreased 6.77%Lower Rates And Urbanization In India Will Drive Mortgage Demand

Key Takeaways

- Lower funding costs, government support, and ongoing digitization are expected to drive margin stability, recurring income, and future profitability.

- Asset quality improvement and expansion into affordable housing suggest stronger long-term growth potential despite current competition.

- Conservative approach amid rising competition and asset quality concerns may constrain growth, profitability, and market agility, while cautious lending limits diversification and revenue opportunities.

Catalysts

About LIC Housing Finance- A housing finance company, provides loans for the purchase, construction, repair, and renovation of houses/buildings in India.

- Lower interest rates, government incentives for affordable housing, and ongoing urbanization in India are expected to drive a sustained increase in mortgage demand, which could boost LIC Housing Finance's loan disbursements and revenue over the coming quarters.

- The company's funding costs have declined meaningfully due to recent liquidity infusions and rate cuts by the RBI, while further reductions are expected; this funding advantage, when paired with a strong parent brand (LIC), should help support stable net interest margins and improve future profitability.

- Expanded use of digitized processes, monthly and quarterly loan repricing, and improved customer retention mechanisms (such as internal interest rate rewriting programs) position LIC Housing Finance to defend its loan book, limit balance transfers, and support recurring income, aiding both revenue growth and margin stability.

- Asset quality continues to improve, as seen in lower Stage 3 NPAs YoY, with management focused on intensified recovery operations and prudent, phased project finance disbursal-a trend that, if sustained, should result in lower credit costs and provision expenses, thus aiding net earnings.

- With rising financial inclusion and greater mortgage penetration in tier 2/3 cities and semi-urban/rural locations, coupled with the company's cautious expansion into high-margin affordable housing, there is material long-term potential for loan book growth and higher future earnings if current competitive pressures subside.

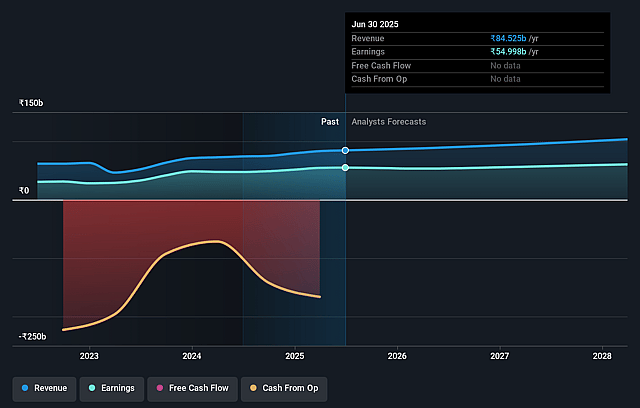

LIC Housing Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LIC Housing Finance's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 65.1% today to 57.7% in 3 years time.

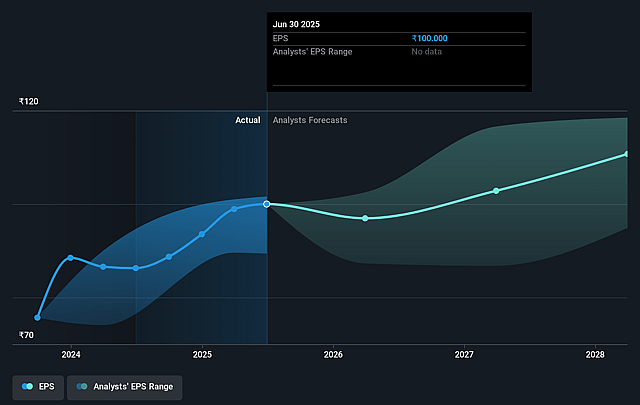

- Analysts expect earnings to reach ₹61.6 billion (and earnings per share of ₹111.97) by about September 2028, up from ₹55.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹52.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, up from 5.6x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 23.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.42%, as per the Simply Wall St company report.

LIC Housing Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both public sector and private sector banks, which can offer home loans at similar or even lower interest rates due to direct repo rate linkage, is pressuring LIC Housing Finance's loan growth and requiring rate cuts; sustained rate wars may squeeze net interest margins and limit revenue growth.

- Management's explicit prioritization of protecting margins over loan growth-in the face of strong competition and balance transfer pressures-could result in below-industry-average loan book growth over the long term, impacting top-line revenue expansion and overall earnings trajectory.

- Asset quality, particularly in the retail/Individual Home Loan segment, showed signs of stress with increased NPAs and Stage 3 assets in Q1, and despite management's optimism, persistent collection inefficiencies or a weaker macro environment could lead to elevated credit costs, higher provisioning, and reduced net profits.

- The company remains cautious and slow on project finance lending due to past high NPAs (over 50% at one point in that segment), which, while limiting risk, may also constrain future growth opportunities relative to peers venturing more aggressively into this potentially higher-margin segment, thus impacting revenue diversification.

- LIC Housing Finance's slower adoption of riskier but growing segments like affordable housing (despite industry tailwinds here) and ongoing reliance on wholesale funding-versus granular retail deposits-could leave it less agile in capturing market share and more vulnerable to funding cost volatility, thereby affecting long-term profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹665.111 for LIC Housing Finance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹480.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹106.7 billion, earnings will come to ₹61.6 billion, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹557.1, the analyst price target of ₹665.11 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.