Key Takeaways

- Lower funding costs, digital expansion, and market consolidation position the company for stronger margins and accelerated loan growth, outpacing industry peers.

- Backing from LIC enables scaling of high-margin affordable products, driving sustainable profitability gains and increased market share amidst regulatory shifts.

- Reliance on costly funding, slow digital adoption, lack of diversification, and competitive rate wars threaten LIC Housing Finance's margins, growth prospects, and long-term competitiveness.

Catalysts

About LIC Housing Finance- A housing finance company, provides loans for the purchase, construction, repair, and renovation of houses/buildings in India.

- Analyst consensus sees margin improvement through cost of funds, but the pace is likely understated; accelerating monetary easing and abundant system liquidity are set to sustain a multi-quarter decline in borrowing costs, supporting a step-change in net interest margins above market expectations over the next several quarters.

- Analysts broadly expect a recovery in disbursements post Q1, but June and July run rates indicate a sharper-than-expected pickup, and with festival season and growing urban demand, LIC Housing could achieve loan growth well above double digits, driving substantial revenue and AUM upside.

- Rapid expansion in Tier 2 and 3 cities, supported by digital onboarding and targeting first-time home buyers, is poised to dramatically increase LIC Housing Finance's addressable market, unlocking industry-leading growth in loan originations and fee-based revenues.

- Ongoing market consolidation among NBFCs and HFCs, accelerated by regulatory tightening, is creating an opportunity for LIC Housing Finance to capture market share at an unprecedented pace, leading to long-term structural gains in both volume and earnings resilience.

- The brand equity and low-cost funding advantage from LIC backing is enabling LIC Housing Finance to aggressively scale new and higher-yield affordable housing products-well ahead of peers-resulting in a sustained mix shift toward high-margin segments, compounding positive impacts on profitability and long-term net margin expansion.

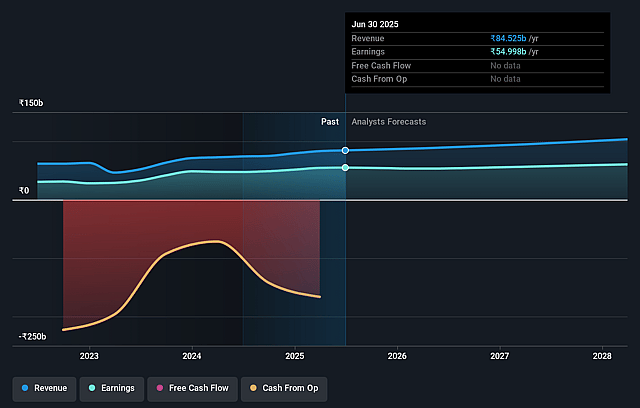

LIC Housing Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LIC Housing Finance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LIC Housing Finance's revenue will grow by 10.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 65.1% today to 58.6% in 3 years time.

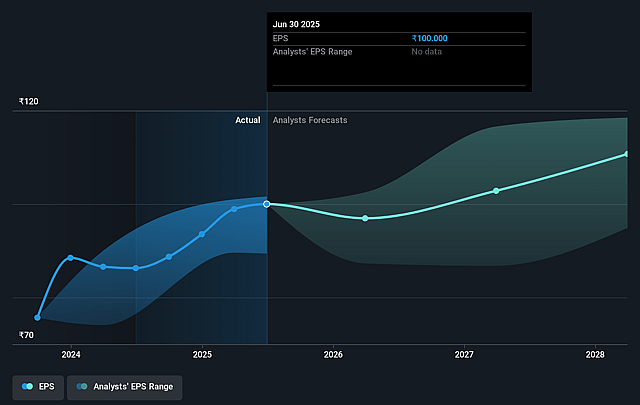

- The bullish analysts expect earnings to reach ₹66.2 billion (and earnings per share of ₹120.16) by about September 2028, up from ₹55.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 5.6x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.33%, as per the Simply Wall St company report.

LIC Housing Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LIC Housing Finance's persistent dependence on higher-cost funding sources versus new-age and agile competitors may keep its net interest margins structurally lower and compress bottom-line profitability over time, especially if industry competition further intensifies and funding rates do not decline as much as anticipated.

- The company acknowledges a slower pace of digital transformation relative to leading private sector peers and fintech lenders, which could result in ongoing operational inefficiencies, customer attrition, and higher cost-to-income ratios, negatively impacting both revenue growth and long-term competitiveness.

- LIC Housing Finance remains highly concentrated in traditional Individual Home Loans, with 85% of its loan book in this segment and limited product diversification; this exposes it to secular trends such as reduced home ownership demand among younger generations, which could lead to stagnating loan growth and revenue pressure as preferences shift to rental models.

- There is increasing evidence of competitive rate wars with banks, particularly PSU and private sector banks aggressively repricing loans to attract customers-this not only puts sustained downward pressure on lending rates and yields but forces LIC Housing Finance to choose between preserving margins or pursuing growth, putting future earnings and book growth at risk.

- The company's historical asset quality challenges in project finance (including a prior period where over half the construction finance book became NPA) have led it to restrain growth in these segments, and any future economic or real estate cycle volatility poses a continued risk of higher NPAs, rising credit costs, and less predictability in reported profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LIC Housing Finance is ₹840.84, which represents two standard deviations above the consensus price target of ₹665.11. This valuation is based on what can be assumed as the expectations of LIC Housing Finance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹480.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹113.1 billion, earnings will come to ₹66.2 billion, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹560.8, the bullish analyst price target of ₹840.84 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.