Last Update 06 Nov 25

Fair value Increased 11%ARIS: Future Profits Will Benefit From Margin Improvements And Merger Opportunities

The analyst price target for Aris Mining has been raised from $21.28 to $23.57. Analysts cite an improved profit margin outlook, which offsets slower revenue growth and a slightly higher discount rate in their updated forecasts.

Analyst Commentary

Recent analyst updates signal a mix of optimism and caution surrounding Aris Mining's future prospects. Research commentary reveals both areas of strength and lingering uncertainties in the company's outlook.

Bullish Takeaways

- Some bullish analysts have raised price targets, citing improved profit margin expectations and the company’s ability to adapt its model following recent financial results.

- Valuation appears supported by anticipated synergies from pending mergers and acquisitions, which could unlock further operational efficiencies and scale.

- The company’s revised forecasts factor in a resilient business model that has maintained stable ratings from analysts, despite changing sector dynamics.

- Bulls note Aris Mining's proactive response to broader market pressures. This strengthens confidence in management's execution capabilities.

Bearish Takeaways

- Bearish analysts have lowered their ratings or maintained cautious price targets, highlighting concerns about softening crude oil and natural gas prices that could impact top-line growth.

- Uncertainty related to macroeconomic factors and inventory build-ups represents ongoing headwinds that may weigh on valuation multiples.

- A slightly higher discount rate in updated models reflects heightened risk perceptions and more conservative growth assumptions.

- Pending sector consolidation introduces execution risk. Integration efforts and strategic shifts could disrupt expected performance.

What's in the News

- Aris Mining announced positive results from the preliminary economic assessment of its 100% owned Toroparu Gold Project in Guyana, outlining a 21.3-year mine life and robust economics with projected average annual gold production of 235,000 ounces. (Key Developments)

- Third quarter results showed consolidated production of 73,236 ounces, bringing total production for the first nine months of 2025 to 186,651 ounces. (Key Developments)

- The company reaffirmed 2025 production guidance and remains on track to achieve annual output between 230,000 and 275,000 ounces. (Key Developments)

- Aris Mining was added to the S&P/TSX Capped Composite, S&P/TSX Completion, and S&P/TSX Composite Indexes. (Key Developments)

- Ramp-up at the Segovia Operations progressed strongly following the commissioning of a second mill, which boosted processing capacity and supported year-to-date gold production of 161,168 ounces as of August 31, 2025. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased from CA$21.28 to CA$23.57. This reflects improved expectations for the company’s value.

- Discount Rate has risen slightly, moving from 7.15% to 7.46%. This indicates analysts are applying a more cautious risk assessment.

- Revenue Growth projections have fallen significantly, revised down from 57.42% to 35.86% in updated models.

- Net Profit Margin forecasts have improved, climbing from 37.96% to 50.49%, which supports the higher valuation.

- Future P/E multiple estimates have increased from 4.83x to 5.27x. This suggests the market expects stronger earnings relative to price.

Key Takeaways

- Expansion and new projects are set to significantly increase production capacity, enhance earnings, and support long-term revenue growth.

- Strong gold prices, improved liquidity, and proactive ESG efforts position the company for margin expansion and future development opportunities.

- Heavy reliance on Colombian operations, regulatory stability, and gold prices exposes Aris Mining to geopolitical, operational, and market volatility risks impacting growth and valuation.

Catalysts

About Aris Mining- Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

- The ongoing expansion at the Segovia operations-with the new second ball mill increasing processing capacity by 50% and a targeted production ramp-up to 300,000 ounces in 2026-is set to drive sustained revenue growth and structurally higher operating margins as fixed costs are leveraged over larger output.

- Progress on the Marmato Lower Mine project remains on track, with first ore and production ramp-up expected in the second half of 2026; upon completion, the combined Marmato complex is positioned to contribute over 200,000 ounces of gold annually, nearly doubling companywide production capacity and greatly enhancing future earnings.

- Elevated and resilient gold prices, alongside rising geopolitical and economic risks worldwide, continue to bolster demand for gold as a hard asset, supporting topline revenue potential and providing a favorable backdrop for margin expansion.

- Strengthened balance sheet liquidity-thanks to robust operating cash flow, warrant exercises, and decreased leverage-positions Aris Mining for accelerated project development, potential M&A, and further margin improvements via lower financing costs.

- Proactive engagement with local communities and regulators, as evidenced by the formalization agreement with artisanal and small-scale miners in Marmato, aligns the company with modern ESG standards and de-risks permitting for future expansions, which can support higher valuation multiples and long-term earnings growth.

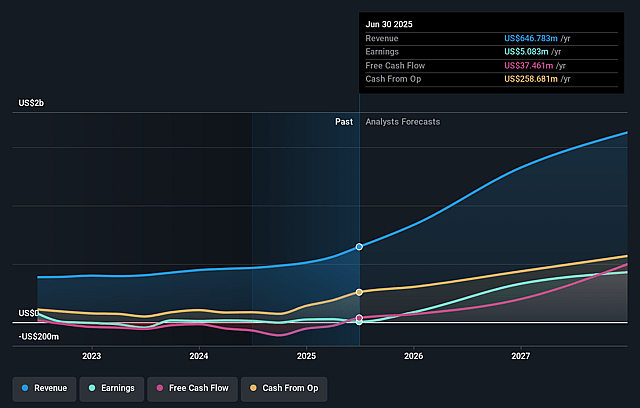

Aris Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aris Mining's revenue will grow by 32.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 46.3% in 3 years time.

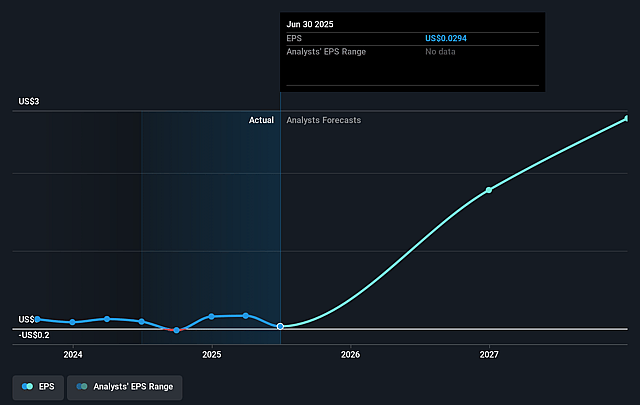

- Analysts expect earnings to reach $695.3 million (and earnings per share of $2.7) by about September 2028, up from $5.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.6x on those 2028 earnings, down from 362.7x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

Aris Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Aris Mining's operational concentration in Colombia exposes it to significant geopolitical, regulatory, and social risks, including potential policy shifts, tax changes, stricter permitting processes, or disruptions due to evolving ESG standards, which could negatively impact revenues and increase operating costs.

- Expansions at Segovia and Marmato, while progressing, face significant execution risks including delays, cost overruns, and technical challenges such as the decline development slowdown due to poor ground and water ingress; these could negatively affect margins and strain cash flow, especially given high capex commitments and fixed timelines.

- Aris Mining's profitability is highly sensitive to gold prices, and management acknowledged that margins for Contract Mining Partners are directly tied to gold price volatility; a sustained decline in gold prices caused by changes in investment demand or dollar strength could lead to materially lower revenues and earnings.

- The company's ambitious growth plan (doubling production by 2026) relies on maintaining favorable relationships with local communities and governments and assumes regulatory stability-any deterioration in community support or increased scrutiny around environmental or social issues could slow or halt project development, reducing future revenue streams and increasing compliance costs.

- Secular pressures such as a global shift in investor allocation toward green energy metals (like lithium and copper) or growing anti-mining and environmental activism could limit access to capital, raise financing costs, and eventually depress the valuation multiples for traditional gold miners like Aris, impacting long-term share price appreciation prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$14.662 for Aris Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$17.01, and the most bearish reporting a price target of just CA$12.51.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $695.3 million, and it would be trading on a PE ratio of 4.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of CA$12.57, the analyst price target of CA$14.66 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.