Last Update 11 Dec 25

AMA: Upcoming Stock Split Will Support Bullish Outlook And Share Liquidity

Analysts have trimmed their price target on AMA Group slightly to $1.30, reflecting marginally higher discount rate assumptions while leaving revenue growth, profit margin and valuation multiples effectively unchanged.

What's in the News

- Announced a 1-for-10 stock split or significant stock dividend effective November 5, 2025, aimed at improving share liquidity and accessibility for investors (Key Developments)

Valuation Changes

- Fair Value: Unchanged at A$1.30 per share, indicating no material revision to the intrinsic valuation.

- Discount Rate: Risen slightly from 7.95 percent to 7.96 percent, reflecting a marginal increase in perceived risk or funding costs.

- Revenue Growth: Effectively unchanged at around 4.76 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin: Essentially flat at approximately 2.52 percent, implying no meaningful shift in margin assumptions.

- Future P/E: Edged up marginally from 26.62 times to 26.63 times, with the change considered immaterial for the valuation thesis.

Key Takeaways

- Focus on complex repairs, in-house calibrations, and specialized B2B agreements is driving higher margins, revenue growth, and predictable earnings amid vehicle technology trends.

- Continued efficiency gains, sector consolidation, and diversification into adjacent markets enhance resilience, growth opportunities, and reduce market concentration risk.

- Declining repair volumes, rising operational complexity, and strategic uncertainty in non-core divisions threaten growth, margins, and financial flexibility amid ongoing high capital expenditure needs.

Catalysts

About AMA Group- Engages in the development and operation of collision repair business in Australia and New Zealand.

- The increasing complexity of new vehicles and wider adoption of ADAS is driving up the severity and complexity of repairs. AMA Group is capturing higher average revenue per job through its focus on in-house calibrations (e.g., TechRight business expansion), extended repair scopes, and ability to service higher-end, technology-laden vehicles; this is expected to deliver further revenue and margin growth as the car parc continues to evolve.

- The shift toward large, repeat B2B customers (major insurers and fleets) is deepening, evidenced by improved and repriced long-term agreements (Suncorp, transport fleets) and rising demand for specialized, high-capacity repair solutions. AMA's growing national scale and optimized network are likely to drive both revenue predictability and margin resilience.

- AMA's ongoing operational efficiency, site/network optimization, and technology-driven workflow integration have begun to deliver meaningful margin expansion (core EBITDA margin up to 6.9%, with a medium-term target of 10%). These programs are expected to compound benefits for net margins and cash generation as volumes stabilize and the business cycles out of catch-up capex.

- Sector consolidation remains robust, positioning AMA as a leading multi-site operator. Recent refinancing and strengthened balance sheet (through equity raising and debt reduction) provides AMA with financial flexibility to pursue further organic and acquisition-driven growth-enhancing revenue, EBIT and reinforcing negotiating power with suppliers/insurers.

- Diversification into adjacent verticals (heavy vehicles, mechanical/parts with Wales and ACM Parts businesses), combined with growth in value-added adjacencies (e.g., calibration, consumables), should broaden AMA's addressable market and reduce concentration risk. This is expected to support more stable top-line and earnings growth through sector cycles.

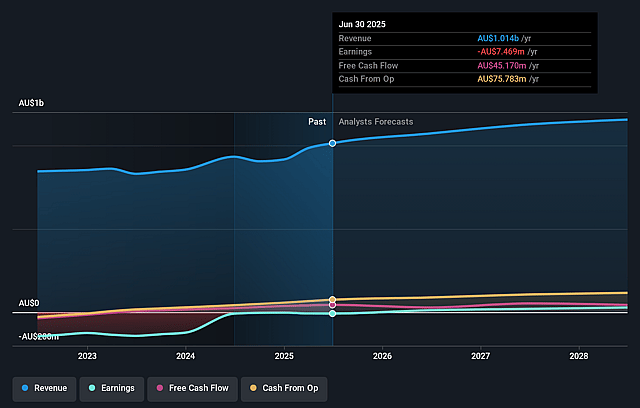

AMA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMA Group's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 2.5% in 3 years time.

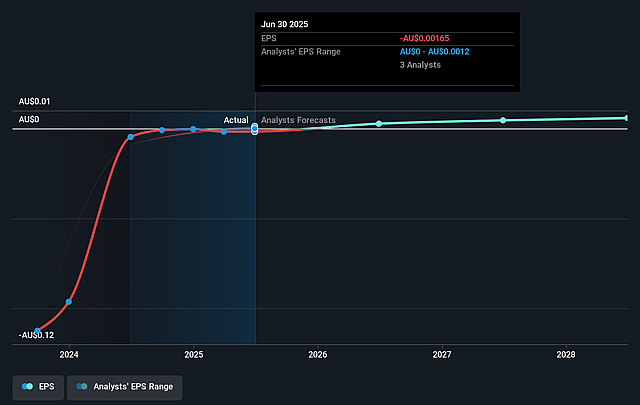

- Analysts expect earnings to reach A$29.2 million (and earnings per share of A$0.01) by about September 2028, up from A$-7.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$32.2 million in earnings, and the most bearish expecting A$26.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from -63.4x today. This future PE is lower than the current PE for the AU Commercial Services industry at 33.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.67%, as per the Simply Wall St company report.

AMA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management flagged declining vehicle repair volumes in some metro areas, with lower claim frequency for minor work driven by cost-of-living pressures and broader market changes-posing a risk of stagnant or shrinking revenues even as severity per job rises.

- The company recognizes that in the Capital SMART division, revenue growth is not expected to keep pace with previous years due to ongoing contraction in vehicle repair volumes in key markets, limiting future earnings expansion and margin growth.

- The increasing complexity and diversity of vehicle technology, especially with rapid changes in car park mix and more brands/OEMs, is making it more difficult to insource calibrations and keep up with repair requirements, potentially driving up operational costs and reducing net margins if scale and technical expertise cannot match industry evolution.

- ACM Parts remains a strategic uncertainty, with management indicating they do not believe AMA is the "rightful owner," creating potential for costly asset sales, underperformance, or internal distraction, impairing net profit and financial flexibility.

- Ongoing capital expenditure "catch-up" programs, which are expected to peak in FY26, keep cash requirements and risk of future maintenance spend high, raising potential for margin and free cash flow pressure if operational improvements do not offset these elevated costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.13 for AMA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.15, and the most bearish reporting a price target of just A$0.11.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.2 billion, earnings will come to A$29.2 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$0.1, the analyst price target of A$0.13 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AMA Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.