Key Takeaways

- Declining repair volumes and advanced vehicle safety technologies pose ongoing risks to core revenue growth and margins, despite operational improvements and new service investments.

- Labour shortages, high capital expenditure, and insurer bargaining strength could erode margins and constrain capacity, even as industry consolidation and deleveraging efforts continue.

- Structural declines in key markets combined with rising operational costs and strategic uncertainty in parts and premium segments threaten long-term growth, margins, and business stability.

Catalysts

About AMA Group- Engages in the development and operation of collision repair business in Australia and New Zealand.

- While the company is benefitting from operational improvements, reduced net debt, and increased EBITDA margins driven by efficiency programs and stronger insurer partnerships, it is facing a steady decline in repair volumes across major metro areas due to fewer claims and shrinking overall kilometres driven, which could limit revenue growth in the medium to long term.

- Although AMA is investing in new site growth, insourcing of complex repairs, and expanded ADAS calibration capabilities to capture the demand for more technologically advanced vehicle repairs, the accelerated adoption of electric vehicles and growing prevalence of advanced safety features may ultimately reduce collision frequencies, dampening future core business revenue and margin opportunities.

- Despite the boost from industry consolidation favouring scale players and recent success in negotiating improved client terms, margin pressure from insurer bargaining power combined with persistent labour shortages could erode future EBITDA and constrain capacity, particularly as wage inflation and recruitment challenges for skilled technicians remain unresolved.

- While the company's broadening of its service offering (such as through TechRight and TrackRight) is intended to support resilience and long-term growth, rapidly changing vehicle technologies and a more fragmented car parc are necessitating ongoing high levels of capital expenditure. There is a risk that continued elevated capital intensity will weigh on returns and free cash flow as technology requirements accelerate.

- Even though significant deleveraging and refinancing activities have strengthened the balance sheet and lowered finance costs, the company is still exposed to operating leverage risks and integration hurdles-especially in its specialist and ACM Parts segments, where persistent underperformance or failed optimization could result in sustained earnings drag and suboptimal net margin outcomes.

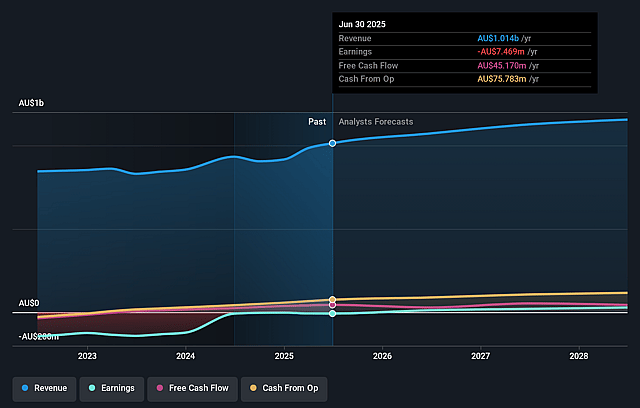

AMA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AMA Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AMA Group's revenue will grow by 3.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.7% today to 2.5% in 3 years time.

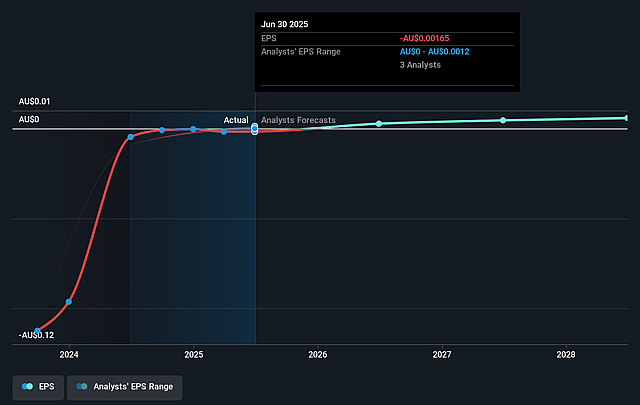

- The bearish analysts expect earnings to reach A$28.1 million (and earnings per share of A$0.01) by about September 2028, up from A$-7.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, up from -63.4x today. This future PE is lower than the current PE for the AU Commercial Services industry at 33.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.67%, as per the Simply Wall St company report.

AMA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management notes a continued decline in repair volumes in key metro areas, attributed to factors such as cost of living and reduced claims for smaller work, indicating a structural shift that could constrain long-term revenue growth.

- The Capital SMART division, a major contributor to earnings, is expected to deliver only stable results rather than further significant growth, signaling a potential plateau in one of AMA's most profitable segments and limiting overall margin expansion.

- Ongoing industry trends such as rising vehicle technology complexity and rapid changes in the car parc are increasing requirements for specialist equipment, ongoing upskilling, and OEM data access, all of which risk escalating capital expenditure and operational costs, potentially compressing net margins.

- Management highlights that business improvement in the Prestige segment is a work in progress following missed financial targets and operational challenges, raising questions about the resilience and earnings reliability in higher-end, higher-margin business lines.

- The ACM Parts division remains in a transitional state, with the CEO publicly questioning whether AMA is the rightful owner, suggesting both strategic uncertainty and risk around the ability to extract value or realize a profitable exit, which could affect group earnings and capital allocation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AMA Group is A$0.11, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AMA Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.15, and the most bearish reporting a price target of just A$0.11.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$1.1 billion, earnings will come to A$28.1 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$0.1, the bearish analyst price target of A$0.11 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.