Last Update 26 Nov 25

Fair value Decreased 1.66%RNO: Negative Stub Valuation Will Unlock Value Amid Industry Uncertainty

Renault's analyst price target has been revised downward from €46.78 to €46.00, reflecting cautious sentiment among analysts in light of heightened industry headwinds and shifting fundamental forecasts.

Analyst Commentary

Analyst perspectives on Renault present a mix of optimism and caution, reflecting the complex dynamics facing European auto manufacturers. The following summarizes the key bullish and bearish takeaways from recent research coverage.

Bullish Takeaways- Bullish analysts note that Renault is currently trading at a negative industrial stub valuation. This is viewed as premature and potentially offering attractive value relative to premium-sector peers.

- Some coverage reinstatements have come with an Outperform rating and a price target above current levels. This indicates confidence in Renault's ability to capitalize on industry shifts.

- Renault’s unique positioning within a challenging European market provides opportunities for relative outperformance compared to competitors lacking a similar mix of scale and brand strength.

- There is recognition that the company can benefit from ongoing transition to electric vehicles, leveraging its established footprint and technological investments.

- Bearish analysts highlight "tumultuous times" for the European automotive sector, with pressures from Chinese entrants and sustained battery electric vehicle momentum challenging established players.

- Ongoing concerns about tariffs, currency fluctuations, and tightening emission regulations in the European Union are cited as adding significant execution risks for Renault.

- The sector's current negative valuations suggest investor skepticism about medium-term growth and earnings outlook, impacting sentiment on Renault as well.

- Concerns remain that Renault may not yet offer the level of "attractive value" seen in some of its premium peers, particularly given external headwinds.

What's in the News

- European carmakers, including Renault, are facing severe chip shortages. Despite progress with China on export restrictions, this situation threatens to disrupt production lines (Financial Times).

- Renault has ended its EV motor project with Valeo and is instead seeking a more cost-effective Chinese supplier. The company is shifting its electric vehicle component sourcing strategy (Reuters).

- The company is considering a reduction of up to 3,000 jobs worldwide, with a focus on support services as part of efforts to simplify operations and reduce fixed costs (Bloomberg).

- Renault is evaluating options to support France’s defense initiatives. Discussions are ongoing with the French defense ministry, and no final decision has been announced (Bloomberg).

Valuation Changes

- Consensus Analyst Price Target has decreased slightly, moving from €46.78 to €46.00.

- Discount Rate has risen modestly from 12.1% to 12.3%, which reflects slightly higher perceived risk.

- Revenue Growth expectations have declined, updated from 2.46% to 2.36%.

- Net Profit Margin forecasts have lowered, changing from 4.08% to 3.97%.

- Future P/E ratio has edged up from 7.26x to 7.39x. This suggests a modest increase in relative valuation.

Key Takeaways

- Strategic brand realignment and product innovation drive Renault's competitiveness in the EV and hybrid market, potentially boosting revenue and improving net margins.

- Operational efficiency, strategic partnerships, and model expansions aim to enhance market penetration and financial health through cost synergies and increased market reach.

- Renault faces revenue unpredictability from volatile markets, regulatory cost pressures on margins, and strategic risks from joint ventures and negative associate contributions.

Catalysts

About Renault- Engages in the design, manufacture, sale, repair, maintenance, and leasing of motor vehicles in Europe, Eurasia, Africa, the Middle East, the Asia Pacific, and the Americas.

- Renault is leveraging its brand realignment and product innovation to capture market share in the EV and hybrid market, with a focus on making these vehicles more affordable and appealing to consumers. This strategy is expected to boost revenue and potentially improve net margins through enhanced product mix.

- The significant reduction in development time and costs due to the Ampere initiative allows Renault to bring competitive EVs to market more rapidly. This operational efficiency should contribute positively to earnings by decreasing production costs while maintaining high product quality.

- Renault's strategic partnerships, such as those with Geely and Aramco, are designed to enhance scale and competitiveness, particularly in regions where Renault seeks greater market penetration. These alliances are expected to enhance earnings through cost synergies and expanded market reach.

- The introduction of new models, such as the Renault 5 and Twingo, and the expansion into segments like C-segment SUVs and smaller urban vehicles are positioned to tap into unmet consumer demand, which should drive revenue growth.

- Renault is positioning itself for operational agility in a volatile market, with plans for cost reductions and productivity enhancements, such as shrinking fixed costs in collaboration with partners. This will likely support net margins and bolster free cash flow, ensuring robust financial health.

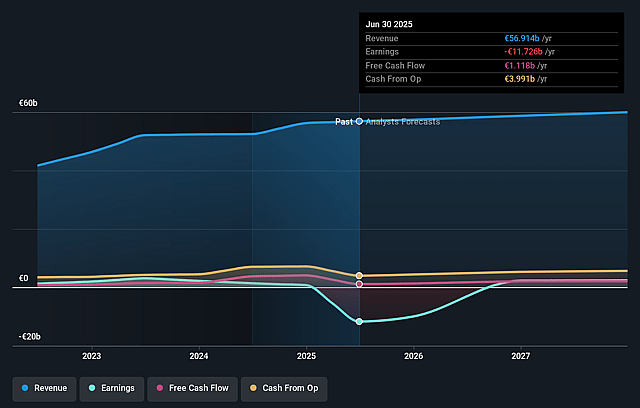

Renault Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Renault's revenue will grow by 1.7% annually over the next 3 years.

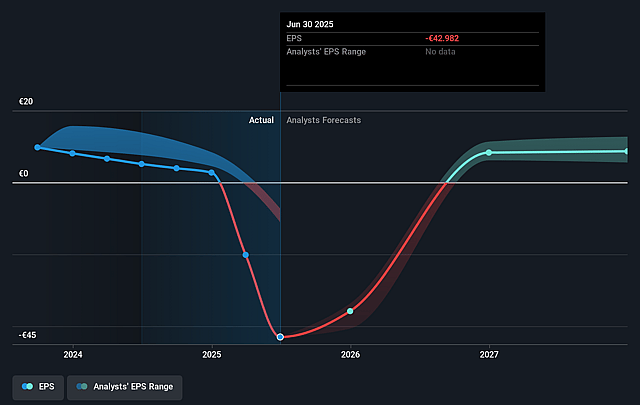

- Analysts assume that profit margins will increase from -20.6% today to 4.1% in 3 years time.

- Analysts expect earnings to reach €2.5 billion (and earnings per share of €8.92) by about September 2028, up from €-11.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €3.5 billion in earnings, and the most bearish expecting €1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the GB Auto industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

Renault Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Renault's reliance on volatile markets such as Argentina and Turkey, with negative currency impacts from the Argentinian peso and Turkish lira devaluations, could affect revenue unpredictably, impacting the company's financial results.

- The company's need to incentivize EV sales to meet the strict CAFE (Corporate Average Fuel Economy) regulations in 2025 may lead to lower profit margins due to potential price cuts, thereby impacting net margins.

- Renault's joint ventures and partnerships, especially the reliance on Geely for certain platforms, may expose it to strategic risks, including integration challenges and potential for disagreements, which could affect earnings.

- The necessity to meet stringent regulatory requirements like CAFE within a short timeline could lead to increased costs, affecting Renault's ability to maintain robust net margins.

- Negative contributions from associated companies, like Nissan, and impairments, such as those on Nissan shares, might continue to impact Renault's net earnings if this does not stabilize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €47.333 for Renault based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €63.7, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €59.9 billion, earnings will come to €2.5 billion, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 12.1%.

- Given the current share price of €32.56, the analyst price target of €47.33 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.