Key Takeaways

- Expansion into new product lines, targeted collaborations, and digital marketing are attracting diverse customers and supporting both revenue growth and omnichannel sales strength.

- Operational efficiencies, cost control, and store optimization are driving improved profitability and positioning the company for sustained margin and earnings growth.

- Heavy reliance on core products, cost pressures, limited international presence, slow online growth, and declining customer loyalty threaten long-term revenue stability and margin sustainability.

Catalysts

About Dusk Group- Dusk Group Limited retails scented and unscented candles, home decor, home fragrances, and gift solutions in Australia.

- Dusk Group's product rejuvenation and expansion into Bath & Body, together with targeted collaborations (e.g. Willy Wonka, Beetlejuice), are attracting younger and male customers and diversifying the sales mix, positioning the company to capitalize on the continued growth in consumer demand for wellness and home ambiance products-likely leading to higher revenue growth.

- Continued investment in digital marketing, personalization (via Salesforce CRM rollout), advanced analytics, and a significantly enhanced online experience has driven strong growth in online sales (up 50.1% YoY), expanding Dusk's reach and setting a foundation for further e-commerce and omnichannel penetration, which should drive incremental sales and improve margin leverage.

- Early success with the AfterGlow store concept and planned measured rollout present an opportunity to drive higher sales productivity per store, appeal to wider customer segments, and create immersive retail experiences-supporting both revenue and operating margin expansion as the concept scales.

- Ongoing cost discipline (lower CODB rate YoY), store portfolio optimization (closures of underperforming stores), and enhanced inventory management are driving margin efficiency and profitability improvements, providing a stronger base for earnings growth.

- Refreshed core product ranges (notably the Signature Collection) and enhanced quality/intake margins, together with improved supply chain efficiencies and category innovation, set the stage for long-term gross margin improvement as promotional pressures moderate-positively impacting net margins and future earnings.

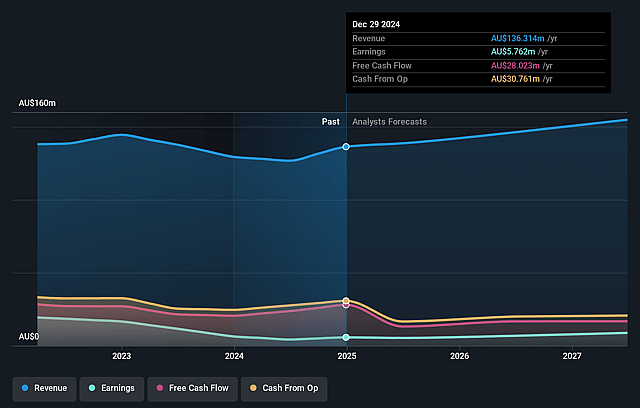

Dusk Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dusk Group's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 6.0% in 3 years time.

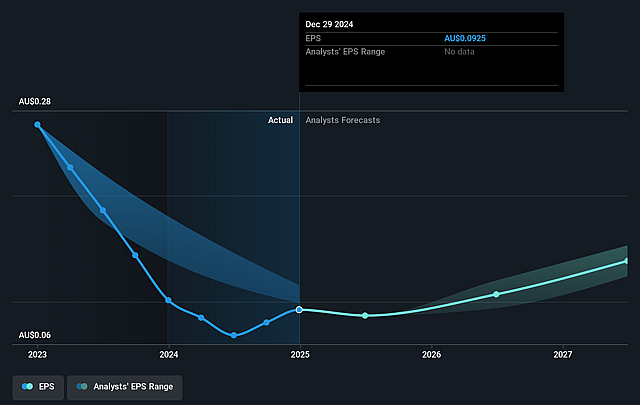

- Analysts expect earnings to reach A$9.7 million (and earnings per share of A$0.16) by about September 2028, up from A$4.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 12.3x today. This future PE is lower than the current PE for the AU Specialty Retail industry at 26.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.22%, as per the Simply Wall St company report.

Dusk Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dusk's core product portfolio remains heavily reliant on home fragrance and candles, with early signals that fashion drops and collaborations (Allen's, Willy Wonka) are driving near-term sales growth-however, a lasting consumer shift away from these categories or a failure of core range rejuvenation efforts could lead to declining like-for-like revenue and increased sales volatility.

- The company's long-term margin profile is under pressure from persistent competitive discounting, promotional activity, FX headwinds, and rising input, wage, and occupancy costs, making it harder to maintain or grow net margins despite efficiency initiatives.

- Geographic concentration in Australia and New Zealand, with minimal international presence, exposes Dusk to local retail cycles and regional economic downturns, thereby increasing earnings volatility and posing a risk to sustainable long-term revenue growth.

- The share of online sales, while rising, is still relatively low compared to pure-play or larger omnichannel competitors, making Dusk vulnerable to accelerating e-commerce trends and potential erosion of foot traffic and profitability in physical stores, especially if experiential store concepts (AfterGlow) fail to deliver tangible, lasting uplift.

- The active membership base for Dusk Rewards continues to trend down post-COVID, and challenges in turning newly acquired, younger customers into loyal long-term buyers could result in weaker repeat sales and lower average transaction values, directly impacting long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.3 for Dusk Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$161.4 million, earnings will come to A$9.7 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 9.2%.

- Given the current share price of A$0.87, the analyst price target of A$1.3 is 33.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dusk Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.