Last Update 07 Dec 25

Fair value Increased 6.86%SSW: Future Returns Will Depend On Chrome Deals And Leadership Transition

Analysts have nudged their price target on Sibanye Stillwater higher to approximately $50 from about $47, citing slightly stronger expectations for revenue growth and profit margins, despite a modest uptick in the assumed discount rate and a largely unchanged future earnings multiple.

What's in the News

- Sibanye Stillwater agreed to a USD 215 million commercial settlement with Appian Capital Advisory over the terminated Atlantic Nickel and Mineração Vale Verde acquisition, resolving the dispute ahead of a quantum trial that had been set for November 2025 (Key Developments).

- All conditions have been met for new chrome agreements with the Glencore Merafe Venture, enabling accelerated chrome volume delivery, immediate cash flow benefits from most chrome recovery plants, and expected operational cost reductions and synergies (Key Developments).

- The improved economics from the new chrome arrangements are anticipated to enhance the viability of brownfield extension projects at Sibanye Stillwater's South African PGM operations (Key Developments).

- Richard Stewart officially took over as Chief Executive Officer on 1 October 2025, succeeding long-serving CEO Neal Froneman after a 12 year tenure leading the company’s transformation into a major multinational miner (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly, increasing from approximately $46.94 to about $50.16 per share.

- The Discount Rate has edged higher, moving from roughly 19.94 percent to about 20.08 percent, which implies a modestly higher perceived risk profile.

- The Revenue Growth assumption has risen moderately, from around 9.89 percent to approximately 10.76 percent.

- The Net Profit Margin forecast has improved, increasing from about 20.40 percent to roughly 21.55 percent.

- The Future P/E multiple has eased marginally, moving from about 7.58x to roughly 7.52x and indicating a slightly more conservative valuation multiple applied to forward earnings.

Key Takeaways

- Market optimism for Sibanye's growth is challenged by oversupply, price volatility, and risks from costly expansion into battery metals and recycling.

- Regulatory, environmental, and operational pressures threaten to increase costs and limit future earnings despite benefits from high commodity prices and diversification efforts.

- Strategic diversification into battery metals, operational efficiencies, and favorable market dynamics in critical metals position Sibanye Stillwater for stable earnings growth and reduced financial risk.

Catalysts

About Sibanye Stillwater- Operates as a precious metals mining company in South Africa, the United States, Europe, and Australia.

- The market appears to be assuming continued robust demand for Sibanye Stillwater's key commodities (particularly PGMs and lithium) based on expectations around global electrification and the energy transition, yet the company itself highlights significant near-term oversupply and price volatility-especially in lithium-which may result in lower-than-anticipated future revenues if these assumptions prove too optimistic.

- Sibanye's aggressive expansion into battery metals and recycling, while aligned with industry trends, is currently constrained by high upfront costs, integration challenges, and project ramp-up risks (e.g., Keliber's fourth-quartile cost structure and possible delayed start-up), suggesting that future earnings and margin improvements may fall short of bullish projections embedded in the current valuation.

- Elevated basket prices for PGMs and gold have recently benefited earnings, but the sustainability of these high prices is questionable, as recent price rises are partly driven by supply disruptions and temporary inventory movements rather than structural demand-potentially creating downside risk to Sibanye's topline and net margins as markets normalize.

- Persistent regulatory, environmental, and ESG compliance pressures-especially as new global standards tighten-are likely to drive higher ongoing operating and capital expenditures for Sibanye, which could compress net margins and profitability more than currently reflected in consensus expectations.

- Company-specific risks such as mature South African gold asset declines, ongoing operational disruptions, and the need for sustained capital investment in brownfields/battery metals may offset benefits from diversification and recycling, ultimately limiting the pace and durability of revenue and earnings growth going forward.

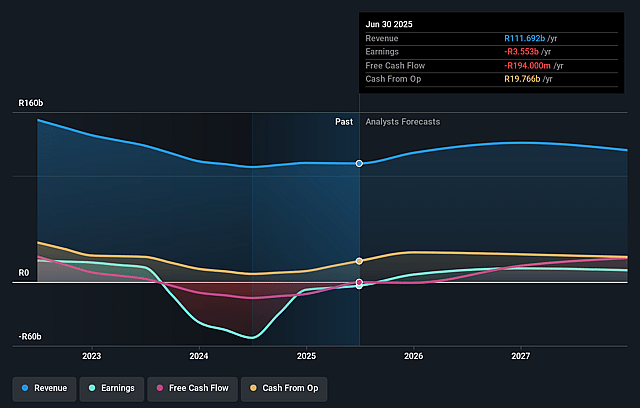

Sibanye Stillwater Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sibanye Stillwater's revenue will grow by 5.2% annually over the next 3 years.

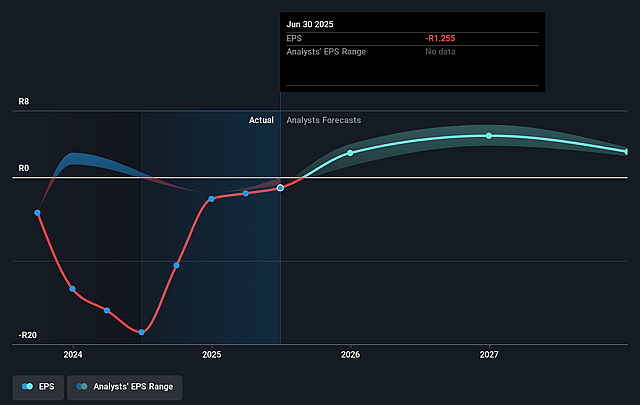

- Analysts assume that profit margins will increase from -3.2% today to 12.2% in 3 years time.

- Analysts expect earnings to reach ZAR 15.8 billion (and earnings per share of ZAR 3.06) by about September 2028, up from ZAR -3.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, up from -31.0x today. This future PE is lower than the current PE for the US Metals and Mining industry at 14.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.07%, as per the Simply Wall St company report.

Sibanye Stillwater Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing global electrification and the energy transition are driving long-term demand for critical metals such as platinum, palladium, and lithium-commodities to which Sibanye Stillwater is strategically exposed. This secular demand is likely to support robust revenue and price levels over the long term.

- The company has made significant investments to expand and diversify into battery metals (like lithium and nickel) as well as into recycling. This diversification reduces earnings cyclicality and creates multiple avenues for stable or growing earnings, benefiting revenue stability and potentially increasing net margins.

- Operational efficiency improvements, cost rationalization, and technology-driven projects (such as mechanization and brownfield developments) are already leading to improved unit costs and higher EBITDA, with more efficiency gains projected-directly supporting profit margins and earnings growth.

- Sibanye Stillwater has a robust balance sheet with low leverage, significant liquidity, and disciplined capital allocation, including the imminent receipt of large tax credits (Section 45X) in the U.S., creating strong free cash flow potential and lower financial risk, which can positively affect future net income and support shareholder returns.

- Long-term deficits in platinum and palladium markets are forecast beyond 2026 due to declining global supply combined with stable or rising demand (including for hybrids and investment purposes). This supply-demand dynamic positions Sibanye as a low-cost, large-scale producer able to capture higher commodity prices, supporting sustainable top-line revenue and EBITDA growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR31.792 for Sibanye Stillwater based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR50.0, and the most bearish reporting a price target of just ZAR19.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR130.0 billion, earnings will come to ZAR15.8 billion, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 19.1%.

- Given the current share price of ZAR38.9, the analyst price target of ZAR31.79 is 22.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.