Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Caleres, Inc. (NYSE:CAL) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Caleres

What Is Caleres's Debt?

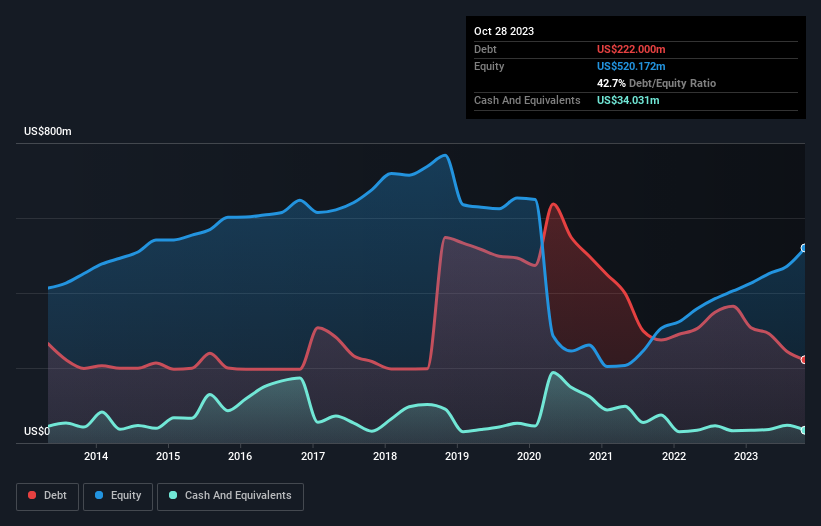

As you can see below, Caleres had US$222.0m of debt at October 2023, down from US$364.5m a year prior. However, because it has a cash reserve of US$34.0m, its net debt is less, at about US$188.0m.

A Look At Caleres' Liabilities

The latest balance sheet data shows that Caleres had liabilities of US$827.9m due within a year, and liabilities of US$478.8m falling due after that. Offsetting these obligations, it had cash of US$34.0m as well as receivables valued at US$166.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.11b.

This deficit is considerable relative to its market capitalization of US$1.28b, so it does suggest shareholders should keep an eye on Caleres' use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 0.76 times EBITDA, Caleres is arguably pretty conservatively geared. And it boasts interest cover of 9.8 times, which is more than adequate. But the bad news is that Caleres has seen its EBIT plunge 20% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Caleres's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Caleres recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Caleres's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its interest cover was refreshing. Taking the abovementioned factors together we do think Caleres's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Caleres you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

가치 평가는 복잡하지만, 저희는 이를 단순화하고자 합니다.

공정가치 추정치, 잠재적 위험, 배당금, 내부자 거래 및 재무 상태를 포함한 자세한 분석을 통해 Caleres 의 저평가 또는 고평가 여부를 알아보세요.

무료 분석에 액세스Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.