- China

- /

- Electrical

- /

- SZSE:300569

Discover Asian Penny Stocks: 3 Picks Under US$2B Market Cap

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, Asian economies are navigating a complex landscape of economic shifts and policy maneuvers. Amidst this backdrop, the appeal of penny stocks—often representing smaller or newer companies—remains significant for investors seeking growth opportunities at lower price points. With solid financial foundations and promising growth trajectories, these stocks can offer potential upside without many of the risks typically associated with this market segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.74 | THB2.94B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.64 | THB1.67B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.197 | SGD39.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.91 | HK$44.76B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.10 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.12 | HK$1.87B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.97 | HK$1.64B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,155 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. is involved in the research, development, manufacturing, and sales of medicines and general health products in China with a market cap of CN¥11.37 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥11.37B

Zhejiang CONBA Pharmaceutical Co., Ltd. has demonstrated financial stability with earnings growth of 5.2% over the past year, outperforming the broader pharmaceuticals industry, which saw a decline. The company reported sales of CN¥6.52 billion for 2024, slightly down from the previous year, but net income increased to CN¥622.42 million. Its robust cash position surpasses total debt, and operating cash flow comfortably covers its debt obligations by a very large margin. However, its dividend yield of 4.43% is not well supported by earnings, and return on equity remains low at 9.5%.

- Jump into the full analysis health report here for a deeper understanding of Zhejiang CONBA PharmaceuticalLtd.

- Evaluate Zhejiang CONBA PharmaceuticalLtd's historical performance by accessing our past performance report.

Jiangsu JIXIN Wind Energy Technology (SHSE:601218)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. (SHSE:601218) operates in the wind energy sector, focusing on the production and sale of wind turbine components, with a market cap of CN¥3.30 billion.

Operations: Jiangsu JIXIN Wind Energy Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.3B

Jiangsu JIXIN Wind Energy Technology has shown mixed financial performance, with first-quarter 2025 sales rising to CN¥338.14 million from CN¥236.69 million a year ago, and net income increasing significantly to CN¥42.01 million. Despite this, the company experienced a decline in full-year 2024 sales and net income compared to the previous year. The firm maintains more cash than total debt, indicating sound financial health, while its debt-to-equity ratio has improved over five years. However, earnings have declined by 15.8% annually over the past five years, and its return on equity remains low at 2.1%.

- Get an in-depth perspective on Jiangsu JIXIN Wind Energy Technology's performance by reading our balance sheet health report here.

- Understand Jiangsu JIXIN Wind Energy Technology's track record by examining our performance history report.

Qingdao Tianneng Heavy IndustriesLtd (SZSE:300569)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Qingdao Tianneng Heavy Industries Co., Ltd specializes in the manufacturing and sale of wind turbine towers and related equipment both domestically in China and internationally, with a market capitalization of CN¥4.98 billion.

Operations: No specific revenue segments have been reported for Qingdao Tianneng Heavy Industries Ltd.

Market Cap: CN¥4.98B

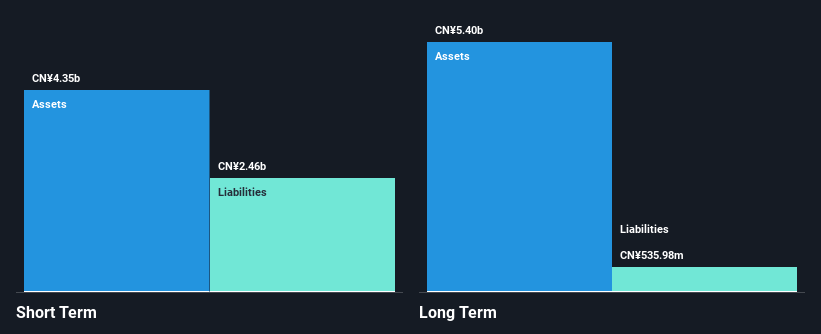

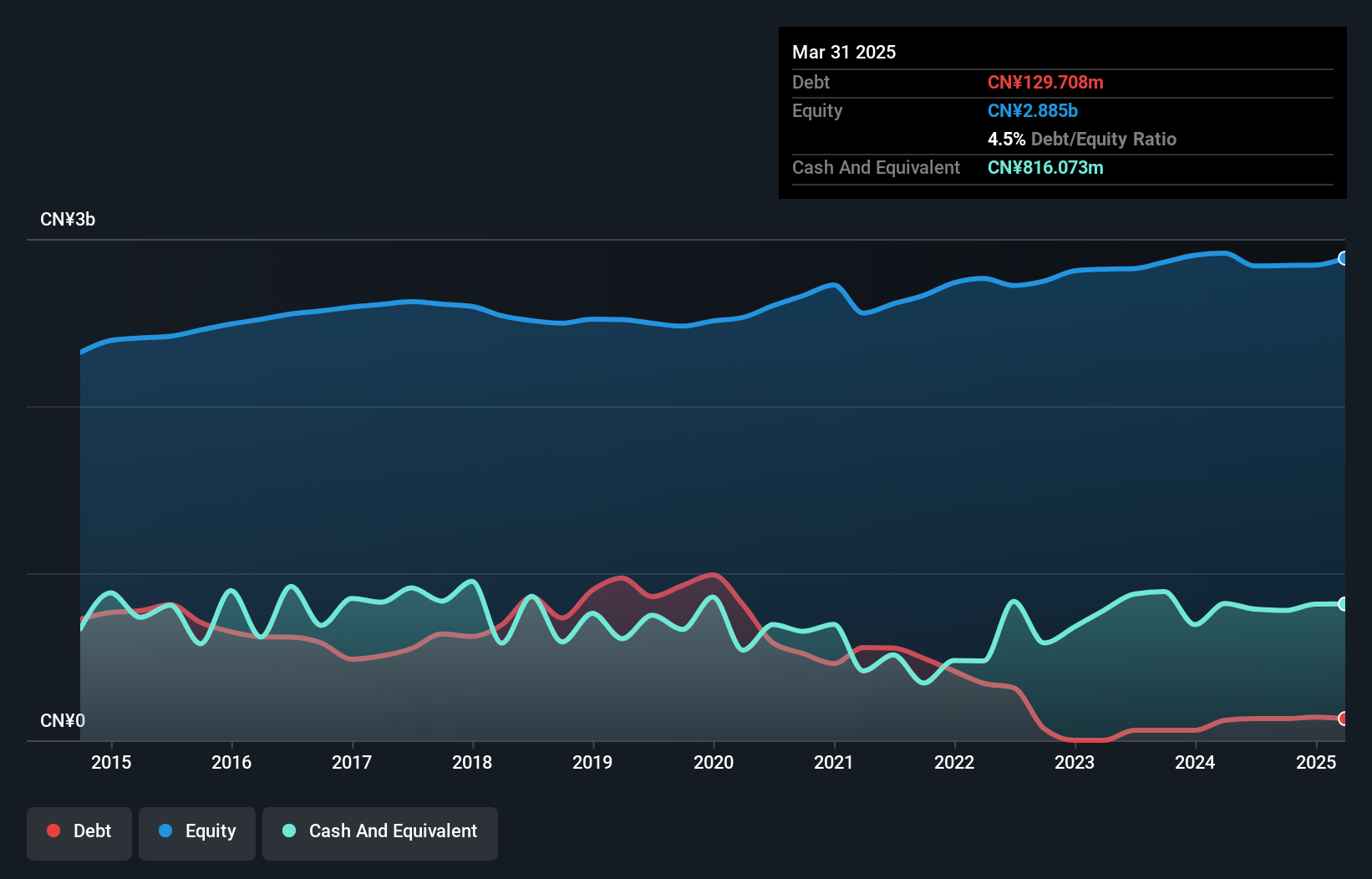

Qingdao Tianneng Heavy Industries Ltd has experienced fluctuating financial results recently, with first-quarter 2025 sales increasing to CN¥564.44 million from CN¥520.45 million a year earlier, and net income rising slightly to CN¥45.7 million. However, the company reported a net loss of CN¥261.51 million for the full year 2024 compared to a profit in the previous year, highlighting ongoing profitability challenges despite its seasoned management team and satisfactory debt levels. The firm’s share buyback program indicates confidence but hasn't stabilized its highly volatile stock price or improved negative return on equity significantly over time.

- Navigate through the intricacies of Qingdao Tianneng Heavy IndustriesLtd with our comprehensive balance sheet health report here.

- Explore historical data to track Qingdao Tianneng Heavy IndustriesLtd's performance over time in our past results report.

Summing It All Up

- Click here to access our complete index of 1,155 Asian Penny Stocks.

- Interested In Other Possibilities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Tianneng Heavy IndustriesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300569

Qingdao Tianneng Heavy IndustriesLtd

Manufactures and sells wind turbine towers and related equipment in China and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives