- Poland

- /

- Electrical

- /

- WSE:VLT

European Penny Stocks Spotlight: KH Group Oyj Among 3 Key Players

Reviewed by Simply Wall St

As European markets experience a positive shift, with the STOXX Europe 600 Index climbing 2.77% amid easing trade tensions, investor interest in diverse opportunities is on the rise. Penny stocks, often seen as relics of past market eras, continue to present viable investment avenues when backed by solid financials and growth potential. This article sheds light on three European penny stocks that exemplify strong balance sheets and promising prospects for investors seeking hidden value in smaller companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.17 | SEK2.08B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK248.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.76 | SEK281.94M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Tesgas (WSE:TSG) | PLN2.56 | PLN29.06M | ✅ 2 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.59 | €54.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.9746 | €32.64M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.07 | €23.56M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

KH Group Oyj (HLSE:KHG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: KH Group Oyj is a conglomerate involved in supplying construction and earth-moving equipment, with a market cap of €31.36 million.

Operations: The company generates revenue through its KH-Koneet segment, which supplies construction and earth-moving equipment, amounting to €149.78 million, and the Nordic Rescue Group segment, contributing €44.20 million.

Market Cap: €31.36M

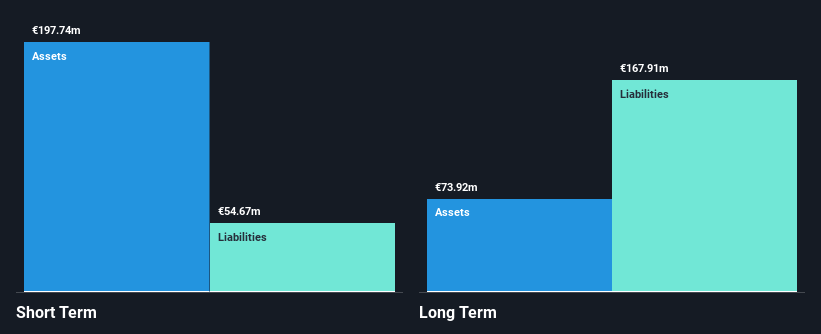

KH Group Oyj, with a market cap of €31.36 million, has recently become profitable despite reporting a net loss of €24.6 million for 2024. The company’s revenue reached €194 million, up from €124 million the previous year. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. However, its interest coverage is low at 1.1x EBIT, suggesting potential financial strain if profitability doesn't improve further. While trading at a good value relative to peers with a Price-To-Earnings ratio of 4.6x against the Finnish market's 19.7x, its management team lacks experience with an average tenure of just 0.8 years.

- Jump into the full analysis health report here for a deeper understanding of KH Group Oyj.

- Assess KH Group Oyj's future earnings estimates with our detailed growth reports.

VOOLT Spólka Akcyjna (WSE:VLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VOOLT Spólka Akcyjna produces and sells electricity through renewable energy sources in Poland, with a market cap of PLN40.26 million.

Operations: The company generates revenue from its Electric Equipment segment, amounting to PLN0.06 million.

Market Cap: PLN40.26M

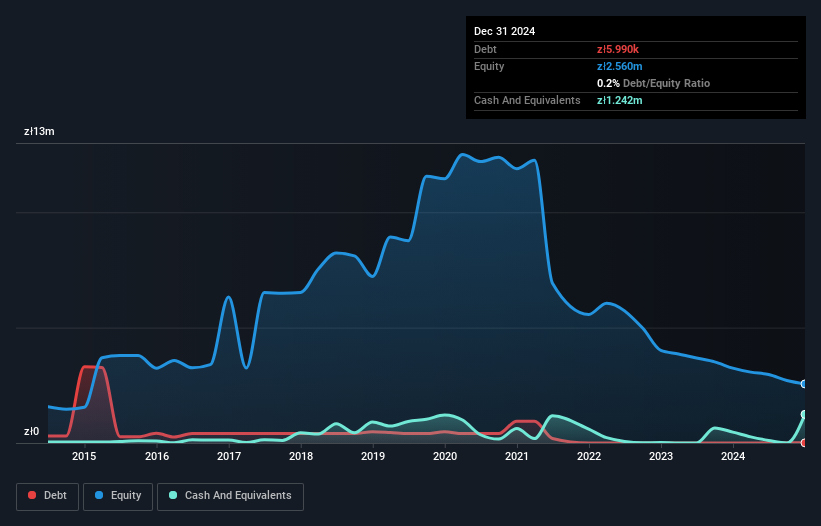

VOOLT Spólka Akcyjna, with a market cap of PLN40.26 million, is currently pre-revenue and unprofitable, generating only PLN0.06 million in revenue from its Electric Equipment segment. Despite having more cash than debt and short-term assets exceeding liabilities, the company faces significant challenges including negative operating cash flow and high share price volatility. Recent auditor concerns about its ability to continue as a going concern add further uncertainty. The board is experienced with an average tenure of 3.8 years, but financial stability remains questionable given declining earnings and increased losses over the past five years.

- Take a closer look at VOOLT Spólka Akcyjna's potential here in our financial health report.

- Understand VOOLT Spólka Akcyjna's track record by examining our performance history report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €99.66 million.

Operations: The company generates revenue through its Consulting segment, which accounts for €57.26 million, and its Managed Services segment, contributing €135.33 million.

Market Cap: €99.66M

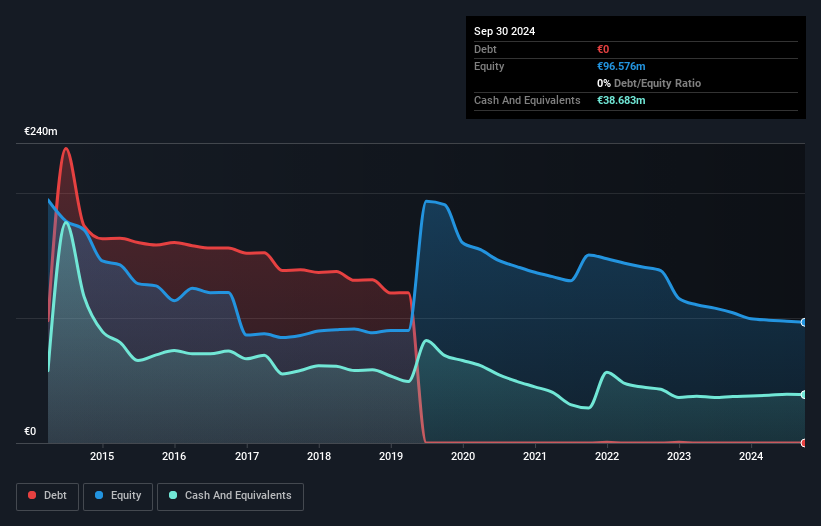

q.beyond AG, with a market cap of €99.66 million, operates in the cloud and AI sectors, generating significant revenue from its Consulting (€57.26 million) and Managed Services (€135.33 million) segments. Despite being unprofitable with a net loss of €4 million in 2024, the company has reduced losses from €16.4 million previously and forecasts positive net income for 2025. It offers innovative AI solutions like Private Enterprise AI to enhance client value creation securely. The company holds more cash than debt, maintains stable weekly volatility at 6%, and possesses sufficient cash runway exceeding three years due to positive free cash flow growth.

- Get an in-depth perspective on q.beyond's performance by reading our balance sheet health report here.

- Evaluate q.beyond's prospects by accessing our earnings growth report.

Where To Now?

- Click this link to deep-dive into the 432 companies within our European Penny Stocks screener.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VLT

VOOLT Spólka Akcyjna

Engages in the produces and sells electricity through renewable energy sources in Poland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives