- China

- /

- Communications

- /

- SZSE:300098

Yangzijiang Financial Holding And 2 Additional Promising Asian Penny Stocks

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a period of cautious optimism. For investors willing to explore beyond the well-known giants, penny stocks—often associated with smaller or newer companies—remain an intriguing prospect. Despite their vintage name, these stocks continue to offer potential growth opportunities at lower price points, particularly when supported by strong financial foundations and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.82 | THB2.99B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.60 | THB2.76B | ✅ 3 ⚠️ 2 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.56 | THB1.62B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.19 | SGD37.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.23 | SGD8.78B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.11 | HK$1.85B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.90 | HK$1.58B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,163 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★☆

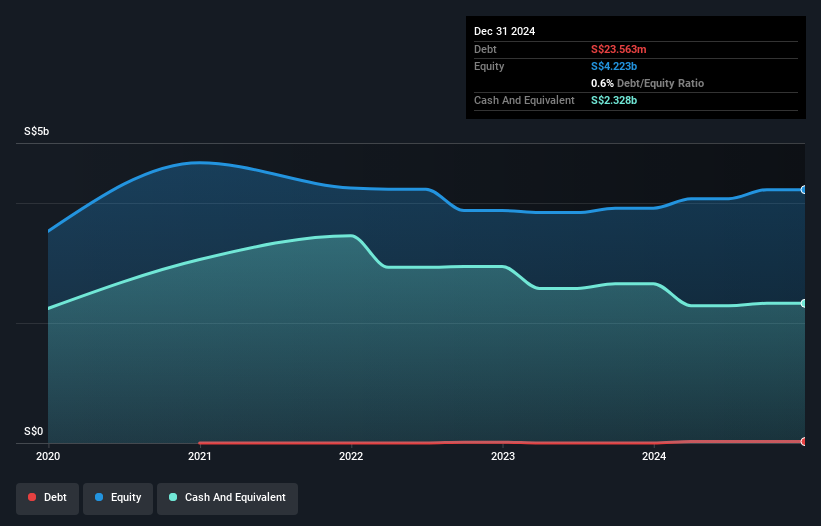

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in the People's Republic of China and Singapore, with a market capitalization of approximately SGD2.47 billion.

Operations: The company generates its revenue primarily from its investment business, amounting to SGD326.23 million.

Market Cap: SGD2.47B

Yangzijiang Financial Holding Ltd. stands out with stable earnings quality and a strong cash position that exceeds its total debt, suggesting financial robustness. Despite a low Return on Equity of 7.3%, the company has shown significant recent earnings growth, surpassing industry averages, and maintains high profit margins. The firm is exploring a strategic spin-off of its maritime investments to unlock further value and focus on growth opportunities in the maritime sector while strengthening its investment platform in Southeast Asia. Additionally, it has approved an increase in dividends, reflecting confidence in future performance despite past revenue declines.

- Dive into the specifics of Yangzijiang Financial Holding here with our thorough balance sheet health report.

- Evaluate Yangzijiang Financial Holding's prospects by accessing our earnings growth report.

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the manufacturing and distribution of mining equipment, with a market cap of CN¥6.51 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Shandong Mining Machinery Group Co., Ltd.

Market Cap: CN¥6.51B

Shandong Mining Machinery Group Co., Ltd. reported a modest increase in first-quarter revenue to CN¥434.74 million, up from CN¥415.67 million the previous year, with net income rising to CN¥53.08 million. Despite a decline in annual earnings and profit margins, its financials reveal strong cash flow covering debt and short-term assets exceeding liabilities significantly. The board's experience is notable, with an average tenure of seven years, although management tenure details are lacking. While earnings growth has been negative recently and Return on Equity remains low at 3.9%, the company benefits from high-quality earnings and stable interest coverage despite increased debt levels over time.

- Take a closer look at Shandong Mining Machinery Group's potential here in our financial health report.

- Evaluate Shandong Mining Machinery Group's historical performance by accessing our past performance report.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Financial Health Rating: ★★★★★☆

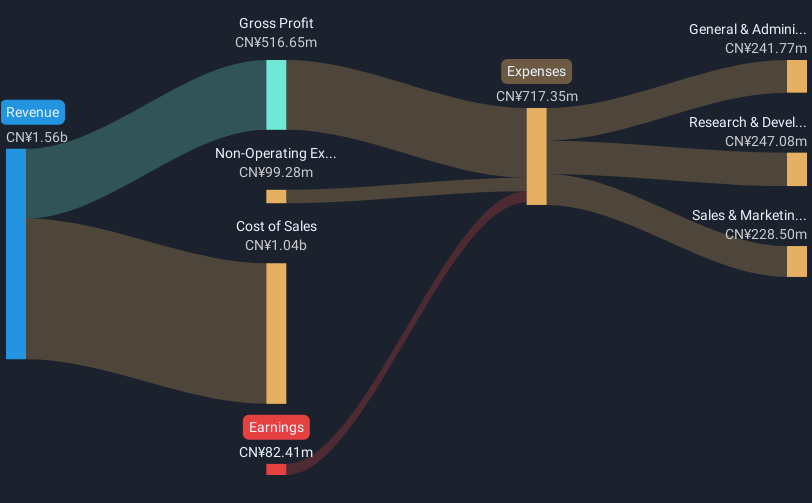

Overview: Gosuncn Technology Group Co., Ltd. offers IoT products and services both in China and internationally, with a market cap of CN¥8.17 billion.

Operations: The company's revenue is primarily derived from the Transportation Industry at CN¥930.13 million and the Public Security Industry at CN¥365.23 million, with additional contributions from Other Industries totaling CN¥121.33 million.

Market Cap: CN¥8.17B

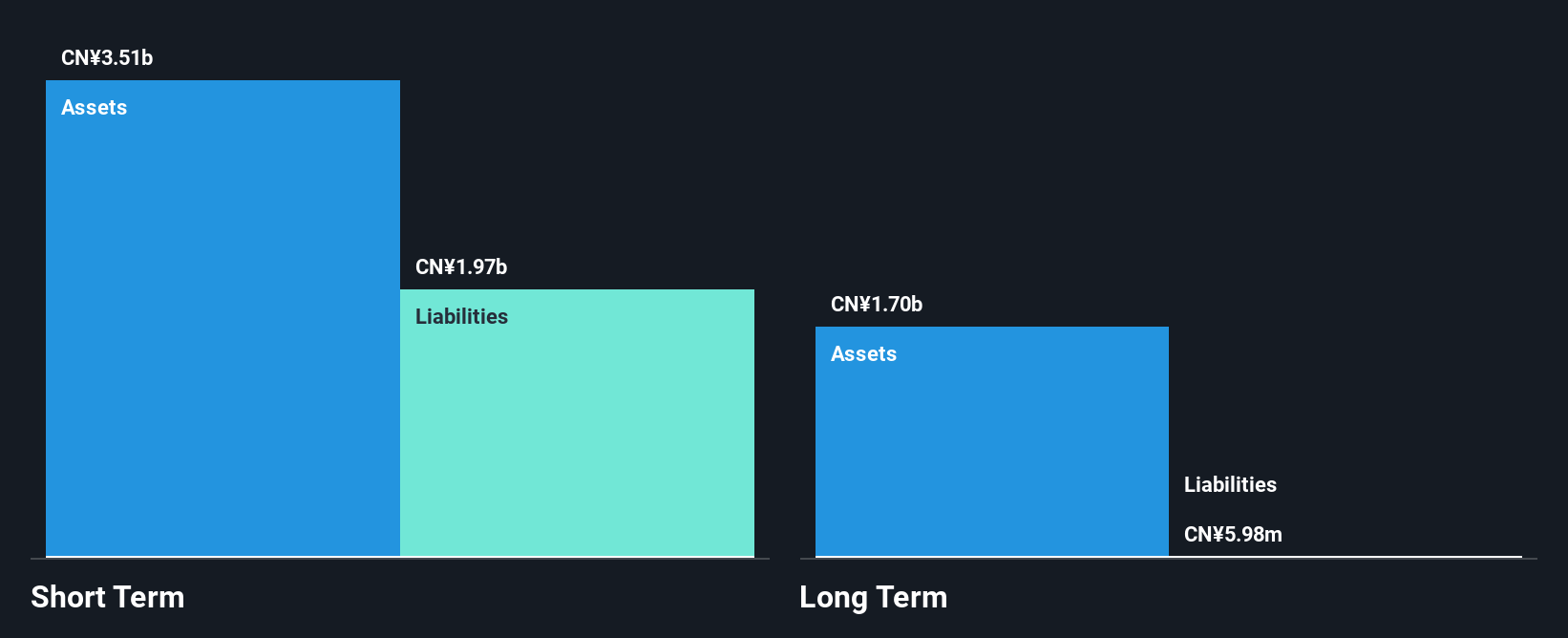

Gosuncn Technology Group Co., Ltd. faces challenges as a penny stock with its recent financial performance showing increased revenue for Q1 2025 at CN¥376.2 million, up from CN¥305.21 million the previous year, yet reporting a net loss of CN¥1.97 million compared to a net income previously. Despite being unprofitable, the company has managed to reduce losses significantly over five years and maintains a strong cash position with short-term assets exceeding liabilities by over CN¥1 billion. The board is experienced with an average tenure of 5.4 years, providing stability amidst volatility in earnings and negative return on equity at -9.08%.

- Click here and access our complete financial health analysis report to understand the dynamics of Gosuncn Technology Group.

- Gain insights into Gosuncn Technology Group's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock our comprehensive list of 1,163 Asian Penny Stocks by clicking here.

- Seeking Other Investments? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Gosuncn Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300098

Gosuncn Technology Group

Provides IoT products and services in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives