Last Update 20 Sep 25

Fair value Increased 3.84%Motus Holdings’ higher analyst price target reflects notable improvements in future P/E and net profit margin, indicating increased earnings expectations and justifying the new fair value of ZAR137.50.

What's in the News

- Motus Holdings anticipates improved financial performance for the six months ending 31 December 2025, with growth in operating profit and headline earnings per share.

- The company declared a total dividend of 550 cents per ordinary share for the year ended June 30, 2025 (240 cents interim, 310 cents final).

- Guidance for the year ended June 30, 2025: revenue of ZAR 112.1–114.4 billion, operating profit of ZAR 5.45–5.55 billion, EPS of 1,450–1,480 cents, headline earnings of ZAR 2.56–2.61 billion, and HEPS of 1,535–1,565 cents.

- Previous guidance indicated operating profit for the full year 2025 was expected to be slightly down against the prior year.

Valuation Changes

Summary of Valuation Changes for Motus Holdings

- The Consensus Analyst Price Target has risen slightly from ZAR132.41 to ZAR137.50.

- The Future P/E for Motus Holdings has significantly risen from 11.03x to 12.28x.

- The Net Profit Margin for Motus Holdings has significantly risen from 2.66% to 2.94%.

Key Takeaways

- Strategic diversification and digital innovation are expanding Motus's customer base, revenue streams, and operational efficiency, supporting sustained profit growth.

- Geographic expansion and acquisitions in less saturated markets are reducing reliance on South Africa and strengthening overall earnings resilience.

- Structural shifts in automotive retail and heightened exposure to market, regulatory, and technological risks threaten Motus Holdings' profitability and long-term growth prospects.

Catalysts

About Motus Holdings- Provides automotive mobility solutions in South Africa, the United Kingdom, Australia, and Asia.

- Continued growth in middle-class consumption and urbanisation across South Africa and Africa is expected to underpin sustained demand for personal mobility and automotive ownership, supporting long-term revenue growth and market share for Motus.

- Expansion and operational improvement in aftermarket parts and maintenance services-evidenced by rising operating margins and full operationalisation of new distribution facilities-are expected to drive higher-margin, recurring revenue streams, lifting group net margins and earnings stability.

- Strategic diversification, including increased representation of Chinese and entry-level brands (such as TATA) and deeper penetration into underserved segments via digital platforms and app-driven initiatives, positions Motus to capture new customer bases and offset potential local market saturation, supporting both revenue and operating profit growth.

- Investment in innovation and digitisation-such as e-commerce platforms for vehicle sales, digital financing, and new digital customer engagement tools-should streamline operations, lower costs, improve customer acquisition efficiency, and support operating margin expansion.

- Ongoing geographical diversification and targeted bolt-on acquisitions in less saturated international markets (notably Africa, UK, Australia, and Poland) are expected to broaden the revenue base and reduce over-reliance on the South African market, underpinning resilient earnings growth and reduced risk to group results.

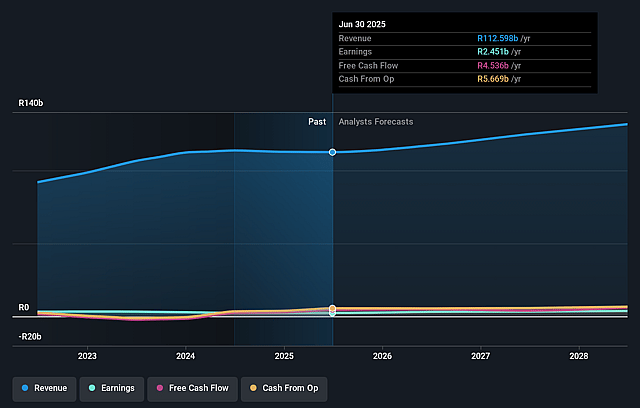

Motus Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Motus Holdings's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 2.7% in 3 years time.

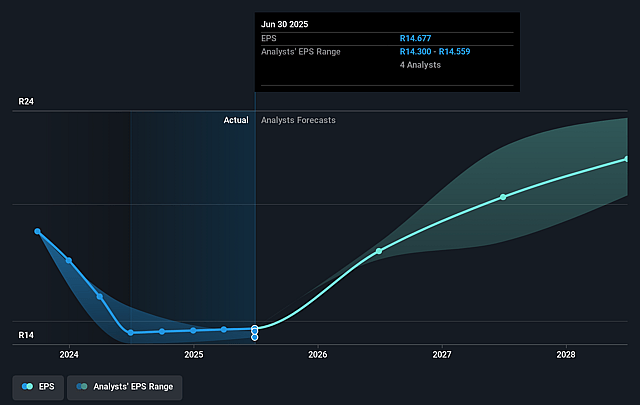

- Analysts expect earnings to reach ZAR 3.5 billion (and earnings per share of ZAR 20.37) by about September 2028, up from ZAR 2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 7.4x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 8.9x.

- Analysts expect the number of shares outstanding to decline by 5.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.9%, as per the Simply Wall St company report.

Motus Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent low GDP growth and constrained consumer spending in core markets such as South Africa, the UK, and Australia could limit future vehicle sales volume, directly impacting Motus Holdings' top-line revenue and growth potential.

- Market share gains from new entrants like Chinese brands are not guaranteed to be sustainable, and increased exposure to aggressive Chinese OEMs may result in ongoing margin compression and higher brand risk, putting pressure on long-term net margins and earnings.

- The company's extensive dealership network and large physical infrastructure represent substantial fixed costs; a potential long-term shift towards online car buying, direct-to-consumer sales by automakers, or increased adoption of ride-sharing and car subscription models could lead to structural declines in dealership traffic and revenue, squeezing both margins and return on capital employed.

- Slow transition to electric vehicles (EVs) and new energy vehicles (NEVs), especially if global EV adoption outpaces Motus' local product mix and infrastructure, risks inventory obsolescence and costly write-downs, heightening working capital requirements and depressing overall earnings.

- Heavy reliance on the South African market exposes Motus to enduring risks from currency volatility, political instability, compliance costs (such as B-BBEE requirements), and weak household balance sheets, each of which could exacerbate downward pressure on revenue growth, operating margins, and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR132.406 for Motus Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR170.03, and the most bearish reporting a price target of just ZAR103.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR133.2 billion, earnings will come to ZAR3.5 billion, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 25.9%.

- Given the current share price of ZAR101.83, the analyst price target of ZAR132.41 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.