Key Takeaways

- Dependence on traditional vehicles and physical dealerships exposes Motus to disruption from electric vehicles, digitalization, and shifting consumer preferences.

- Structural shifts in mobility trends, automaker disintermediation, and market volatility threaten Motus' revenue base, profitability, and long-term growth prospects.

- Broad diversification, strategic geographic expansion, brand partnerships, and ongoing digital innovation together underpin resilient earnings, stable margins, and long-term revenue growth.

Catalysts

About Motus Holdings- Provides automotive mobility solutions in South Africa, the United Kingdom, Australia, and Asia.

- The company's heavy exposure to traditional internal combustion engine vehicles puts future revenue growth at risk as electric vehicle adoption accelerates and emissions regulations tighten, threatening to erode demand in Motus' core import, distribution, and dealership businesses as consumer preferences and OEM product lines shift more quickly than the company's portfolio can adapt. This could lead to both top-line pressure and operating margin compression over the medium and long term.

- Emerging mobility trends such as ride-sharing, vehicle subscriptions, and mobility-as-a-service are likely to dampen private vehicle ownership rates across key urbanizing African and international markets, structurally reducing Motus' addressable market for both new and used car sales, leading to persistently lower volumes and limited organic growth opportunities, exacerbating pressure on revenue and cash flows.

- Motus' reliance on its physical dealership model and legacy infrastructure at a time of digital transformation leaves it vulnerable to competitors that are better positioned to capitalize on e-commerce and direct-to-consumer platforms, which could accelerate margin erosion and reduce customer lifetime value as consumer dealership visits and aftermarket spend migrate online.

- Global supply chain instability, ongoing FX volatility (particularly the rand), labor shortages, and rising commodity prices create a structurally higher and less predictable cost base for Motus' import and distribution operations, undermining the sustainability of current levels of net margins and constraining earnings growth even as Motus attempts further geographic diversification.

- Intensifying disintermediation risk from major automakers moving towards direct-to-consumer sales models will dilute Motus' bargaining power, shrink dealer market share, and increase price transparency-eroding profitability in both new vehicle sales and aftermarket parts, causing long-term margin compression and threatening the viability of core segments that drive headline earnings.

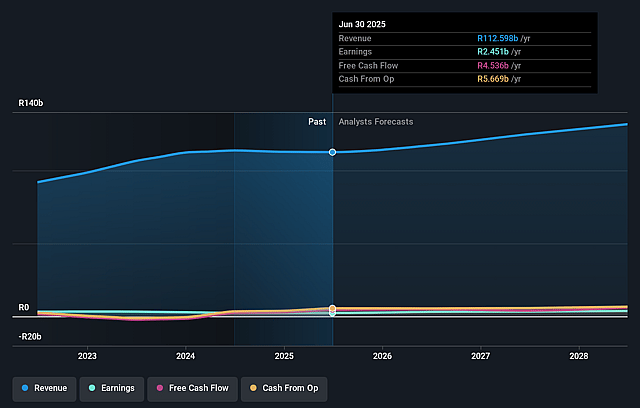

Motus Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Motus Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Motus Holdings's revenue will grow by 6.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.2% today to 2.7% in 3 years time.

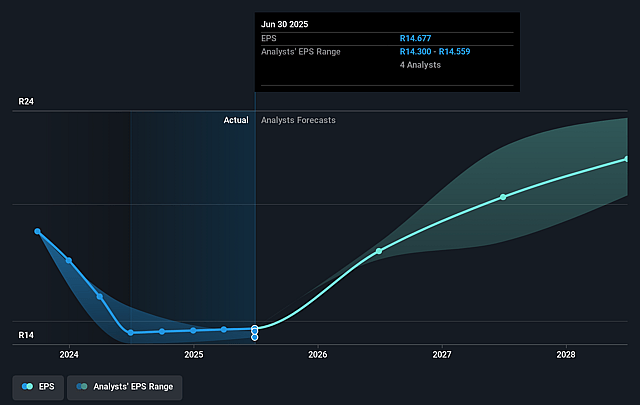

- The bearish analysts expect earnings to reach ZAR 3.6 billion (and earnings per share of ZAR 20.73) by about September 2028, up from ZAR 2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the ZA Specialty Retail industry at 8.9x.

- Analysts expect the number of shares outstanding to decline by 5.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.74%, as per the Simply Wall St company report.

Motus Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Motus has demonstrated strong and sustainable cash generation, with cash flow from operations up 60% to ZAR 5.7 billion and a permanent reduction of core interest-bearing debt by ZAR 3 billion, which improves both net margins and supports robust shareholder returns.

- The company has effectively diversified its earnings streams, with over 55% of profits coming from non-vehicle sales such as mobility solutions, aftermarket parts, service, and rentals, supporting stable group-level revenue and margins even during periods of weaker new vehicle sales.

- Expanded international presence, particularly in the U.K. and Australia, as well as an increasing footprint in high-growth African markets, enhances geographical diversification and earnings resilience, which supports long-term top-line and bottom-line stability.

- Strategic brand optimization, especially through partnerships with emerging OEMs such as Chinese and Indian brands (e.g., BYD and TATA), has enabled Motus to maintain market share and adapt to shifting consumer preferences, which safeguards revenue and operating profit margins against traditional brand market shifts.

- Ongoing investment in innovation, digital platforms, and data analytics-such as new mobility apps and optimization of inventory-positions Motus to harness secular trends in mobility solutions and digital retailing, which is likely to drive efficiency and recurring revenue growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Motus Holdings is ZAR103.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Motus Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR170.03, and the most bearish reporting a price target of just ZAR103.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ZAR134.2 billion, earnings will come to ZAR3.6 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 25.7%.

- Given the current share price of ZAR101.83, the bearish analyst price target of ZAR103.0 is 1.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.