Key Takeaways

- Motus is set for significant revenue growth and market share gains through new brand partnerships, aftermarket expansion, and digital initiatives, exceeding conservative forecasts.

- Reduced debt and strong cash generation give Motus flexibility for acquisitions, buybacks, and investments, supporting enhanced shareholder returns and long-term resilience.

- Heavy reliance on traditional vehicles and dealership models exposes Motus to risks from EV transition, changing retail channels, and macroeconomic pressures, threatening long-term profitability.

Catalysts

About Motus Holdings- Provides automotive mobility solutions in South Africa, the United Kingdom, Australia, and internationally.

- Analysts broadly agree that Tata's introduction will boost Motus's share of the entry-level and small SUV market, but with Tata's aggressive product pipeline and rapid brand ramp-up-already expanding from 20 to 40 dealerships at launch-Motus is positioned to capture transformative volume-led revenue growth and sustainable share gains, driving outsized top-line expansion well above the cautious consensus.

- Where analyst consensus anticipates the international aftermarket parts network (notably FAI PRO and new warehouses) to steadily improve earnings, the operationalization of multi-country synergies and private label expansion-already exceeding expectations in both the UK and SA-suggests a step change in high-margin EBIT contributions and sticky annuity revenues, underappreciated in current market forecasts.

- Motus's digital innovation pipeline, including initiatives like the Klutch app for informal mechanics and digital rental solutions, directly taps into previously inaccessible customer bases and optimizes operational efficiency, supporting superior revenue growth and margin uplift as digital penetration accelerates in the automotive sector.

- The ongoing urbanization and expansion of middle-class populations across Africa-including Motus's focus on underserved markets via brand breadth, pre-owned strategies, and informal sector engagement-positions the group to ride decade-long structural tailwinds in mobility demand, amplifying volume growth and resilience of cashflows far beyond short-term GDP headwinds.

- The company's sharply reduced permanent debt (core interest-bearing debt down by 3 billion rand) and industry-leading cash generation capacity now provide Motus with unprecedented headroom for value-accretive bolt-on acquisitions, expanded buybacks, and organic investments, creating a platform for accelerating EPS growth and multiple rerating as capital allocation shifts from debt repayment to shareholder returns.

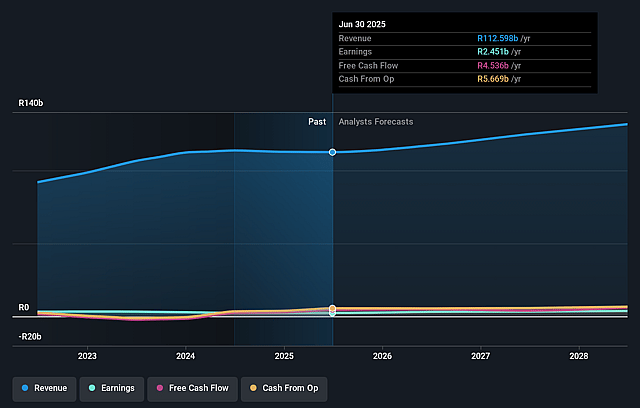

Motus Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Motus Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Motus Holdings's revenue will grow by 6.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 3.1% in 3 years time.

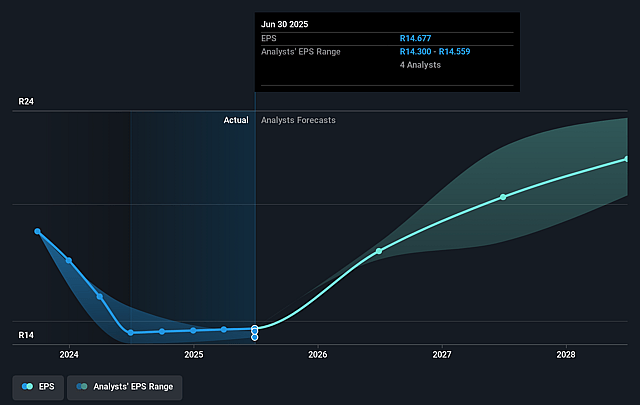

- The bullish analysts expect earnings to reach ZAR 4.2 billion (and earnings per share of ZAR 24.16) by about September 2028, up from ZAR 2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from 7.7x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 9.0x.

- Analysts expect the number of shares outstanding to decline by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.4%, as per the Simply Wall St company report.

Motus Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Motus Holdings remains heavily exposed to the traditional internal combustion engine vehicle market, and although the company has taken limited steps to include electric and Chinese brands in its portfolio, the accelerating global shift towards electric vehicles and stricter government policies on emissions could structurally erode demand for core products and materially reduce long-term revenues.

- The business relies significantly on dealership and OEM distribution models, particularly in South Africa and sub-Saharan Africa, which are at risk of disruption as automotive manufacturers globally move toward direct-to-consumer and online sales channels, potentially compressing Motus's margins and threatening future earnings.

- Growth in used car sales and aftermarket parts has helped balance recent declines in new vehicle sales, but the ongoing secular trend of urbanization and adoption of mobility-as-a-service platforms could reduce demand for both new and pre-owned vehicles, eroding Motus's core volume base and negatively impacting top-line revenue and aftersales income over time.

- With high exposure to South African consumer credit quality and employment levels, Motus is vulnerable to continued macroeconomic stagnation, as any extended downturn or higher unemployment in the region will likely hit unit sales, finance income, and related services, directly depressing net margins and earnings.

- While recent margin improvements and debt reduction are positive, competitive pressures from international entrants, e-commerce disruptors, and a possible need for heavy capital investment in EV and digital retail infrastructure could lead to squeezed margins, higher capex, and ultimately lower free cash flow and profitability compared to current levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Motus Holdings is ZAR170.03, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Motus Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR170.03, and the most bearish reporting a price target of just ZAR103.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR135.6 billion, earnings will come to ZAR4.2 billion, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 25.4%.

- Given the current share price of ZAR106.66, the bullish analyst price target of ZAR170.03 is 37.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.