Key Takeaways

- Strong market share gains and margin expansion, driven by digital investments and category innovation, position the company for sustained outperformance and higher earnings growth.

- Expansion into new segments and Africa's growing middle class unlocks unique top-line growth potential and enhances long-term shareholder value.

- Reliance on physical retail, tough economic conditions, rising competition, sustainability pressures, and limited expansion threaten Mr Price's future growth and profitability.

Catalysts

About Mr Price Group- Provides fashion-value merchandise in South Africa and internationally.

- Analyst consensus expects a much improved H2, but recent double-digit sales growth in April and May, combined with broad-based market share gains across all divisions-including previously underperforming units-suggests the company is already at the beginning of a far stronger and faster turnaround, with potential for sustained outperformance in revenue and HEPS growth well above market expectations.

- While consensus focuses on incremental gross margin improvements, Mr Price's demonstrated ability to consistently deliver market share gains and margin expansion-even in a low-growth, volatile environment-points to an ongoing margin inflection, likely to push operating and net margins beyond new medium-term target ranges, fundamentally resetting long-term earnings power.

- Mr Price is uniquely positioned to capture exceptional top-line growth by leveraging its deep value positioning and expanding footprint as Africa experiences rapid urbanization and extraordinary middle-class growth, giving it access to an outsized and structurally expanding retail market well ahead of competitors.

- The group's aggressive investment in proprietary digital, analytics, and omni-channel infrastructure-including AI integration and targeted e-commerce initiatives-will unlock significant efficiencies and drive high-margin revenue streams, accelerating sustainable earnings growth and customer engagement above industry norms.

- Category innovation and organic concept scaling, especially in fast-growing segments like telecoms, kids, and homeware, are poised to compound earnings upward, leveraging Group-wide supply chain integration and proven new store return discipline for enhanced return on equity and substantial long-term shareholder value creation.

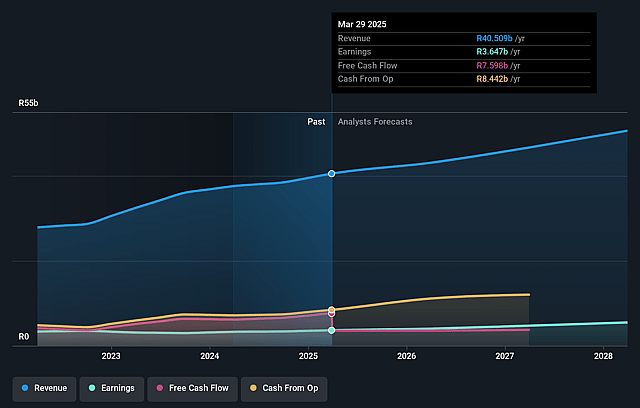

Mr Price Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Mr Price Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Mr Price Group's revenue will grow by 8.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.0% today to 10.2% in 3 years time.

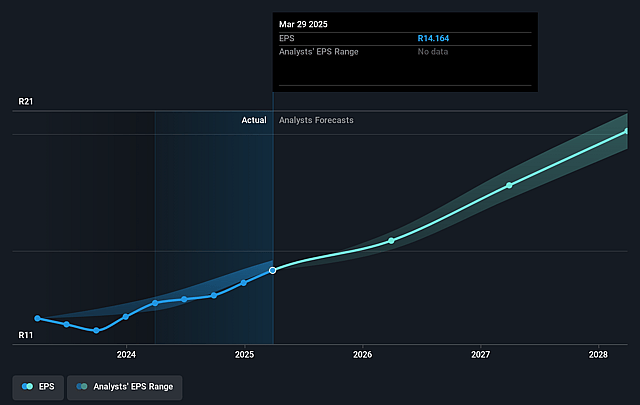

- The bullish analysts expect earnings to reach ZAR 5.3 billion (and earnings per share of ZAR 20.18) by about September 2028, up from ZAR 3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 45.8x on those 2028 earnings, up from 14.8x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 9.0x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.96%, as per the Simply Wall St company report.

Mr Price Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating adoption of e-commerce by South African consumers could erode Mr Price Group's market share as its online sales only accounted for 2.5% of revenue and the business remains reliant on physical stores, posing a long-term risk to revenue growth if digital transformation efforts underperform.

- Persistently low South African GDP growth, high unemployment, and constrained consumer disposable income threaten demand for discretionary spending, increasing the likelihood that revenue growth and same-store sales may stagnate or decline.

- Growing competition from fast fashion e-commerce platforms and international discount retailers like Shein, H&M, and Pepkor may drive industry-wide price wars and force lower margins across Mr Price's core categories, threatening both revenue and profitability.

- Cost pressures from climate change, resource scarcity, and regulatory demands for more sustainable and ethically sourced fashion could raise input costs for Mr Price, squeezing gross and operating margins in the long term.

- Market saturation in its core lower

- and mid-income segments in South Africa as well as slow expansion outside its domestic base may cap store-led growth, creating a ceiling for top-line revenue and earnings as opportunities for new store rollout diminish.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Mr Price Group is ZAR553.99, which represents two standard deviations above the consensus price target of ZAR316.95. This valuation is based on what can be assumed as the expectations of Mr Price Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR628.77, and the most bearish reporting a price target of just ZAR257.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR52.2 billion, earnings will come to ZAR5.3 billion, and it would be trading on a PE ratio of 45.8x, assuming you use a discount rate of 20.0%.

- Given the current share price of ZAR208.9, the bullish analyst price target of ZAR553.99 is 62.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.