Key Takeaways

- Dependence on South Africa's weak economic climate and slow regional diversification exposes the company to local market volatility and limits growth potential.

- Competition from agile fast fashion and online-only players, along with shifting consumer demands, risks eroding market share unless digital adoption and innovation accelerate.

- Dependence on a weak domestic market, costly modernization, and rising competition may pressure profitability, market share, and long-term earnings resilience.

Catalysts

About Mr Price Group- Provides fashion-value merchandise in South Africa and internationally.

- While Mr Price has expanded its footprint through 184 new stores and outperformed competitors in market share gains, the company faces persistent headwinds from subdued economic growth and weak consumer confidence in South Africa, which could limit growth in discretionary spending and constrain future revenue growth.

- Although investments in technology and supply chain modernization may position Mr Price to benefit from the ongoing shift towards digital and omnichannel retailing, there is a significant risk that lagging digital adoption or more agile online-only competitors could erode the company's share in a fast-evolving marketplace, impacting long-term earnings and margin expansion.

- Despite management's disciplined allocation of capital and demonstrated resilience with a zero-debt balance sheet, the continued prevalence of high input cost inflation, wage increases, and regulatory pressures-such as minimum wage hikes and sustainability mandates-could apply downward pressure on operating margins and net profitability over time.

- While expansion into new concepts, organic growth, and targeting underpenetrated categories suggest the potential to capture a greater share of a growing African middle class, the company's substantial reliance on South Africa's low-growth economy and the slow pace of regional diversification heighten vulnerability to local shocks, which may translate to revenue and earnings volatility.

- Although increasing urbanization and the formalization of retail markets favor modern, value-focused operators like Mr Price, ongoing threats from fast fashion entrants and changing consumer preferences-such as demands for ethical sourcing and rapid trend cycles-require sustained investment in product innovation and supply chain agility, and failure to adapt could weaken the company's competitive position and future growth trajectory.

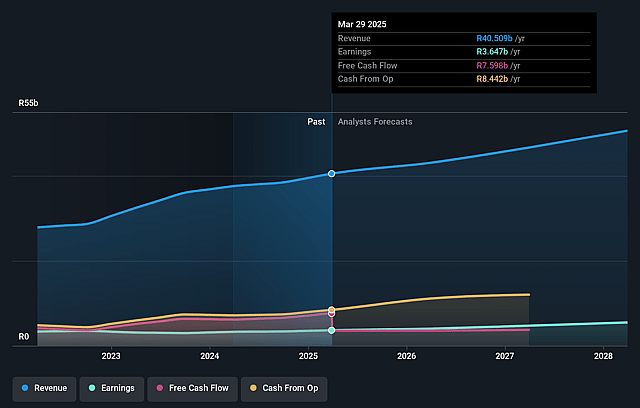

Mr Price Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mr Price Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mr Price Group's revenue will grow by 7.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.0% today to 10.5% in 3 years time.

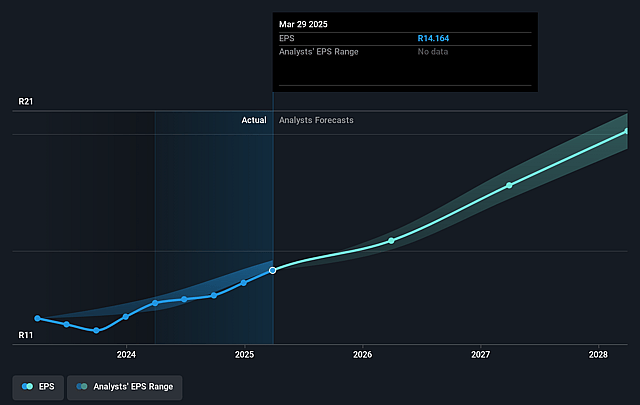

- The bearish analysts expect earnings to reach ZAR 5.3 billion (and earnings per share of ZAR 20.18) by about September 2028, up from ZAR 3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 14.8x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 9.0x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.96%, as per the Simply Wall St company report.

Mr Price Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged low economic growth and weak consumer confidence in South Africa, as highlighted by GDP growth of only 0.1% in Q1 2025 and ongoing fragility in the Government of National Unity, could suppress consumer spending and constrain top-line revenue growth for Mr Price Group.

- Increasing investment requirements in technology modernization, supply chain expansion, and cybersecurity-alongside high inflation-driven expense growth-may lead to cost pressures that erode net margins and reduce overall profitability.

- Persistent competition from fast-fashion, online-only foreign competitors (e.g., Shein and similar digital platforms), especially as e-commerce continues to penetrate the African market, risks eroding in-store market share and threatens both revenue and earnings if omni-channel strategy execution lags.

- Over-reliance on the South African market, with limited progress on effective international expansion, leaves Mr Price vulnerable to local macroeconomic shocks and currency volatility, increasing exposure to revenue and profit volatility.

- The growing need for supply chain transparency, sustainable sourcing, and compliance with ESG regulations may necessitate significant capital expenditure and margin-sacrificing adaptations, potentially resulting in pressure on long-term earnings as stakeholder and regulatory expectations in this area escalate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mr Price Group is ZAR257.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mr Price Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR628.77, and the most bearish reporting a price target of just ZAR257.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ZAR50.7 billion, earnings will come to ZAR5.3 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 20.0%.

- Given the current share price of ZAR208.9, the bearish analyst price target of ZAR257.0 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mr Price Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.