Key Takeaways

- Leadership changes and strategic realignment are aimed at enhancing operational efficiencies and boosting shareholder value.

- Investments in natural gas infrastructure and customer growth in utilities set to increase revenue and support long-term growth.

- Declines at AmeriGas, cost increases, and financial charges pose risks to UGI’s revenue, profitability, and future earnings, with potential shareholder concerns.

Catalysts

About UGI- Distributes, stores, transports, and markets energy products and related services in the United States and internationally.

- The appointment of Bob Flexon as President and CEO, with his proven track record of creating shareholder value in the energy industry, could enhance operational efficiencies and revenue growth. This leadership change is expected to drive strategic realignment and shareholder value, impacting earnings positively.

- UGI's decision to achieve permanent cost savings between $70 million to $100 million by the end of fiscal 2025, primarily through rightsizing operations and driving efficiencies, could improve net margins and overall earnings.

- The expansion of natural gas infrastructure, particularly through projects like the Moody RNG facility and the Carlyle LNG storage and vaporization facility, is set to capitalize on increasing demand for natural gas, thus potentially boosting revenue and contributing to long-term growth.

- UGI's strategic realignment towards its core natural gas business and optimizing the LPG portfolio, focusing investments in high-growth areas, should enhance cash flow generation, possibly leading to higher future earnings and stabilized dividends.

- Continued customer growth in regulated utilities, driven by infrastructure investments and improved services, can lead to higher revenue and contribute positively to future earnings.

UGI Future Earnings and Revenue Growth

Assumptions

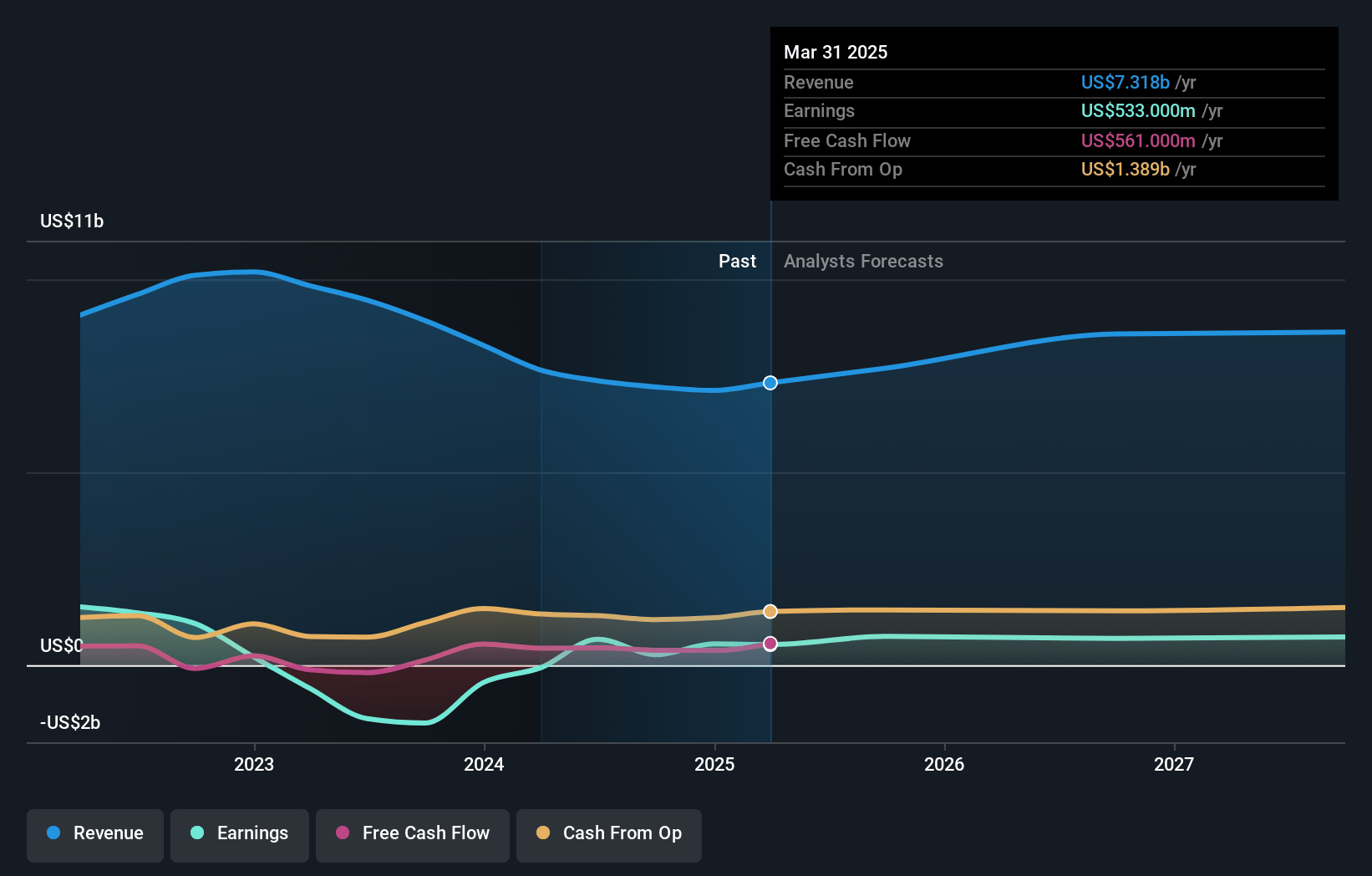

How have these above catalysts been quantified?- Analysts are assuming UGI's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 7.3% in 3 years time.

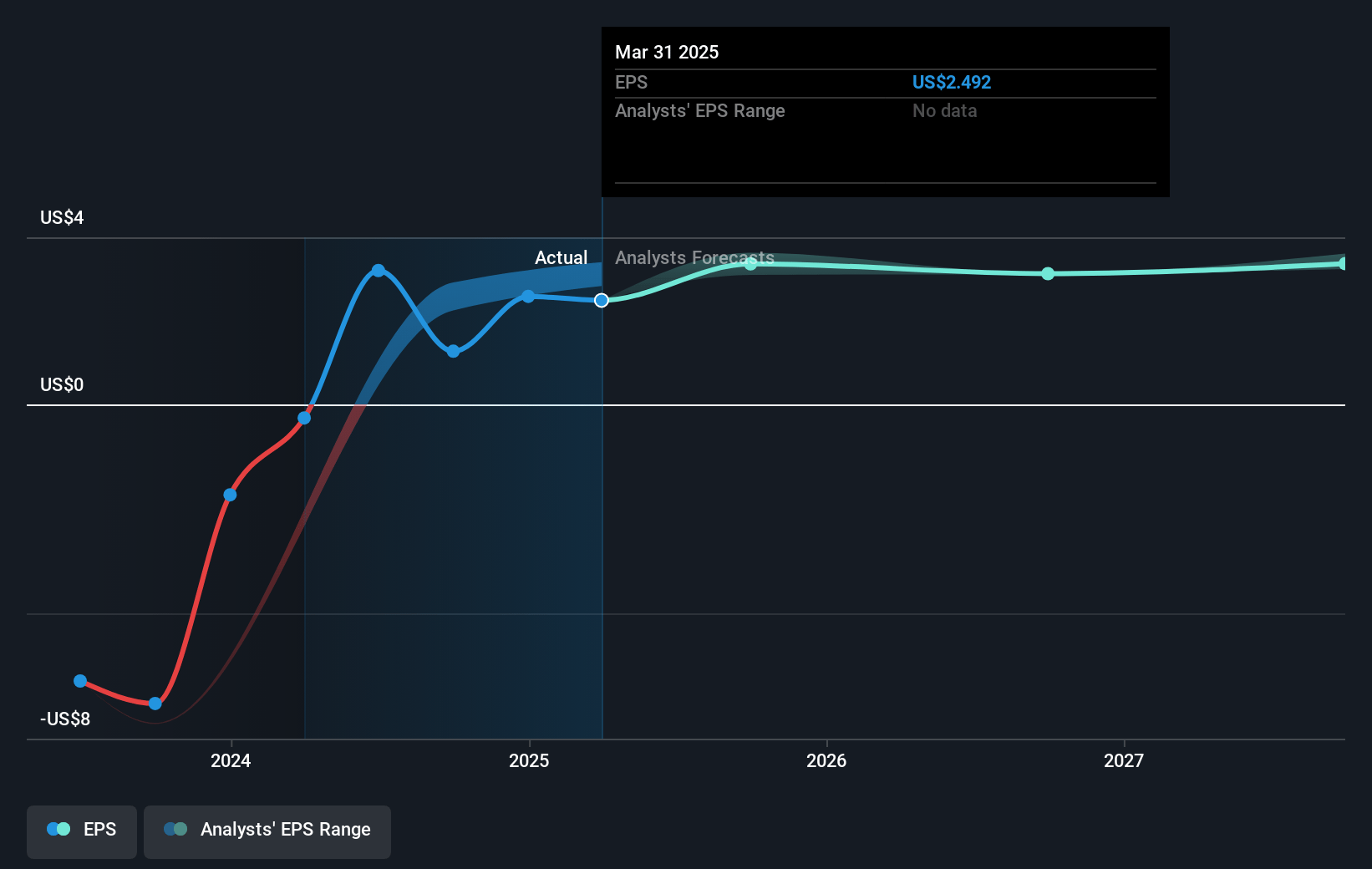

- Analysts expect earnings to reach $677.7 million (and earnings per share of $3.14) by about January 2028, up from $269.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 24.3x today. This future PE is lower than the current PE for the US Gas Utilities industry at 18.4x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

UGI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing volume decline at AmeriGas poses a risk to UGI's revenue and overall profitability, as stabilizing and improving performance in this segment is still an ongoing challenge.

- The company has recorded a noncash pretax goodwill impairment charge of approximately $195 million for AmeriGas due to lower growth expectations, indicating potential risks to future earnings.

- The damage to a supply port in France is expected to increase distribution costs for UGI International in fiscal 2025, potentially impacting net margins if those costs are not fully recoverable through insurance.

- Increased interest expenses related to recent financing activities could negatively impact net earnings, as reflected by the increase in the Corporate & Other segment’s expenses.

- The fiscal 2025 EPS guidance range suggests that anticipated earnings may experience a slight decline compared to fiscal 2024, posing a potential risk to shareholder expectations of growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.5 for UGI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.3 billion, earnings will come to $677.7 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of $30.41, the analyst's price target of $33.5 is 9.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives