Last Update 18 Dec 25

Fair value Increased 1.46%MDU: Pipeline Expansion And Equity Offering Will Shape Future Risk Reward Balance

Analysts nudged their price target on MDU Resources Group modestly higher, lifting fair value from $20.50 to $20.80 as they factor in a slightly richer future earnings multiple supported by an improving utilities capex backdrop and increasingly visible pipeline upside.

Analyst Commentary

Analysts remain broadly constructive on MDU Resources Group, highlighting an improving growth and return profile supported by pipeline expansion and a more favorable utilities capex cycle, but views diverge on how much of this upside is already reflected in the current valuation.

Bullish Takeaways

- Bullish analysts point to the Bakken East Pipeline as a meaningful upside driver, arguing it can add incremental value per share and improve the company’s long term earnings mix.

- Recent price target increases are framed around a modestly higher earnings multiple, supported by expectations for 6 percent to 8 percent annual earnings growth and a more supportive cost of capital environment for regulated utilities.

- Supportive demand trends for U.S. power and infrastructure are seen as creating a multi year runway for rate base and capex growth, which could justify a premium to MDU’s historical valuation if execution stays on track.

- The combination of visible utility capex, a growing pipeline platform and steady earnings growth is viewed as offering a compelling risk reward profile at current share levels for investors seeking stable, inflation resilient cash flows.

Bearish Takeaways

- Bearish analysts maintain more neutral stances, preferring to wait for clearer evidence of execution on large pipeline projects before assigning higher valuation multiples.

- Some see MDU as less leveraged to the most powerful data center and electrification themes in the utilities space, limiting its relative growth versus faster growing integrated peers.

- Hold ratings and more conservative price targets reflect concerns that near term upside may be constrained if regulatory outcomes or project timelines slip, which could temper the pace of earnings accretion.

- There is caution that, without consistent delivery of 6 percent or higher earnings growth and disciplined capital allocation, MDU could trade at a discount to the broader utilities and infrastructure group for longer than bullish analysts anticipate.

What's in the News

- Completed a follow on equity offering of approximately $200 million, issuing over 10.1 million common shares at $19.70 per share, with a $0.66 discount per share (Key Developments).

- Filed multiple follow on equity offering documents for up to $200 million in common stock, supporting planned capital investments and balance sheet flexibility (Key Developments).

- Added TD Securities, Inc. as Co Lead Underwriter on the roughly $200 million follow on equity offering, broadening the underwriting syndicate (Key Developments).

- Announced a lock up agreement covering more than 204 million common shares through early February 2026, limiting insider and major holder share sales in the near term (Key Developments).

- Signed a non binding MOU to secure 150 megawatts of capacity on the 3,000 megawatt North Plains Connector HVDC transmission project, which could cover over 15 percent of MDU’s 2024 peak load once operational (Key Developments).

Valuation Changes

- Fair Value: nudged higher from $20.50 to $20.80 per share, reflecting a modestly richer assessment of intrinsic value.

- Discount Rate: effectively unchanged at about 6.96 percent, indicating a stable view of MDU’s risk profile and cost of capital.

- Revenue Growth: remains steady at roughly 4.65 percent annually, with only immaterial model refinements.

- Net Profit Margin: essentially flat at about 11.57 percent, suggesting no meaningful shift in long term profitability assumptions.

- Future P/E: risen slightly from approximately 20.56x to 20.86x, supporting a small uplift in valuation multiple expectations.

Key Takeaways

- Focused investment in regulated utility and infrastructure projects positions the company for steady growth amid rising energy and construction demand.

- Divestment of non-core operations streamlines capital allocation, enhancing predictability and supporting stable, long-term earnings and cash flow potential.

- Mounting operational costs, infrastructure investment needs, and energy transition risks threaten stable growth, margin performance, and long-term returns amid regulatory, weather, and technological uncertainties.

Catalysts

About MDU Resources Group- Engages in the regulated energy delivery businesses in the United States.

- Strong ongoing and future investment in U.S. infrastructure, including large pipeline expansion projects and potential new transmission or generation to serve data centers, positions MDU to benefit from robust construction demand and growing energy needs, providing significant future revenue and earnings uplift.

- Accelerating demand for natural gas as a bridge fuel-supported by increasing data center loads, regional industrial growth, and population expansion in the Midwest and West-propels stable volumetric growth, underpinning consistent rate base and utility revenue expansion.

- Regulatory support for grid modernization, rate case success (Wyoming, South Dakota, Idaho, Montana), and capital-light approaches for initial data center loads enable higher allowed returns and margin optimization in the utility segment, supporting improved long-term net margins.

- The spinoff of non-core operations (like Knife River) has sharpened capital allocation, focusing investment on regulated businesses where high predictability and backlog visibility can drive steady EBITDA and earnings growth.

- A growing, diversified project pipeline and storage opportunities in the Bakken, supported by state interest and customer commitments, offer optionality for incremental growth beyond what is currently forecast, increasing upside potential for future earnings and cash flows.

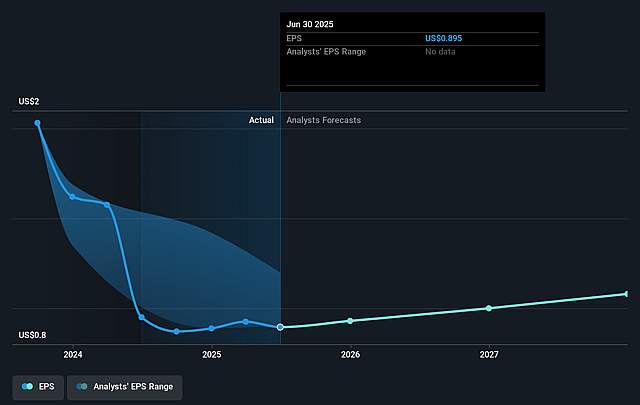

MDU Resources Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MDU Resources Group's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 11.5% in 3 years time.

- Analysts expect earnings to reach $233.0 million (and earnings per share of $1.08) by about September 2028, up from $182.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, up from 18.0x today. This future PE is greater than the current PE for the US Gas Utilities industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

MDU Resources Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating transition to renewable energy and potential carbon regulations may threaten long-term demand for natural gas infrastructure, risking stranded assets and slower growth in MDU's core pipeline and utility segments, thereby impacting long-term revenue and asset returns.

- Persistently rising operation and maintenance expenses, driven by payroll inflation, insurance, and regulatory compliance (including wildfire mitigation), could outpace rate recovery and offset revenue growth from rate cases, putting pressure on net margins and long-term earnings.

- Required multi-billion-dollar capital investments in rate base and new infrastructure may necessitate accessing equity markets, potentially leading to shareholder dilution and increasing financial leverage, which can limit EPS growth and negatively impact return on equity.

- Exposure to region-specific weather risks (as seen with warmer winters impacting natural gas volumes in Idaho and Montana) and reliance on localized customer and industrial demand, including uncertain data center expansion, may lead to unpredictable revenue streams and earnings volatility over the long term.

- Slow but steady electrification trends and technological competition in the utility sector could reduce future gas throughput and render legacy assets less competitive, limiting organic growth opportunities and pressuring long-term operating margins and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.5 for MDU Resources Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $233.0 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $16.06, the analyst price target of $19.5 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MDU Resources Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.