Last Update 07 May 25

Fair value Increased 0.33%Key Takeaways

- Modernizing US infrastructure and regional expansion are driving recurring revenue and stable long-term growth in utility and pipeline services.

- Regulatory shifts toward clean energy and a focus on major growth projects position MDU for higher returns, improved efficiency, and strong cash flow.

- Increased reliance on regulated utilities, geographic concentration, and sector exposure heighten vulnerability to policy, economic, and regulatory risks, potentially constraining growth and earnings stability.

Catalysts

About MDU Resources Group- Engages in the regulated energy delivery businesses in the United States.

- MDU Resources is positioned to experience long-term growth fueled by the urgent need to modernize and expand US infrastructure, particularly in energy delivery sectors like natural gas pipelines and electric utilities, which should steadily lift revenue as infrastructure projects accelerate nationwide.

- Population growth and economic expansion in the Dakotas and Montana is expected to drive consistent customer additions and demand for both utility and pipeline services, leading to stable, recurring revenue streams and opportunity for sustained earnings growth over the long term.

- The shift toward cleaner energy and grid modernization is spurring regulatory-supported utility upgrades and capital investments, with MDU management guiding for utility rate base growth of 7 to 8 percent annually and the opportunity to secure higher allowed returns, directly enhancing future net earnings and cash flow.

- A pipeline of major growth projects—including the 580 megawatts of data center electric service contracts starting to ramp up between now and beyond 2025, as well as possible large-scale pipeline expansions in North Dakota—creates significant upside potential for revenue, capacity utilization, and operational leverage, supporting bullish earnings-per-share growth targets.

- Since its strategic transformation into a pure-play regulated energy business and following streamlining post-spin-offs, MDU is set to benefit from improved operational efficiency and net margins, while its strong balance sheet and $3.1 billion capital investment plan over five years signal the ability to capture forthcoming demand surges, all underpinning management’s outlook for 6 to 8 percent compound annual EPS growth and robust dividend payouts.

MDU Resources Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MDU Resources Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MDU Resources Group's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.3% today to 10.6% in 3 years time.

- The bullish analysts expect earnings to reach $224.0 million (and earnings per share of $1.08) by about May 2028, up from $181.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.3x on those 2028 earnings, up from 19.8x today. This future PE is greater than the current PE for the US Gas Utilities industry at 19.1x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.24%, as per the Simply Wall St company report.

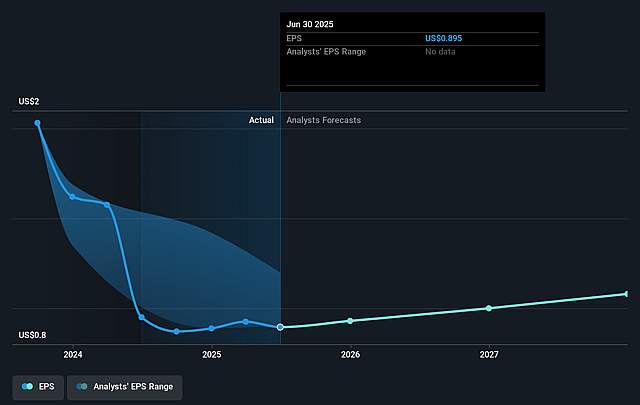

MDU Resources Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is increasingly reliant on regulated electric and natural gas delivery, which exposes it to secular risks from ongoing decarbonization and electrification trends; sustained policy efforts to move away from fossil fuels could suppress long-term growth in gas demand, eroding revenues and earnings power.

- Large investments are required to replace and expand aging infrastructure, and future returns could be challenged by inflation-driven increases in capital costs and uncertainty around cost recovery from regulators, ultimately squeezing net margins and reducing free cash flow.

- MDU's customer base and operations are concentrated in limited geographic regions, particularly the Upper Midwest, making it vulnerable to regional economic slowdowns or policy shifts that could destabilize revenues and impair future growth potential.

- The company has undergone significant business simplification and spinoffs, including Everest and Knife River, leaving it less diversified and more exposed to utility sector earnings volatility, which could negatively affect stability and predictability of long-term earnings.

- Rising interest rates and cost of capital, combined with possible equity issuances to fund new growth projects, may dilute existing shareholders and increase financing costs, putting downward pressure on overall returns and potential earnings per share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MDU Resources Group is $24.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MDU Resources Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $224.0 million, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $17.54, the bullish analyst price target of $24.0 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MDU Resources Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.