Key Takeaways

- Projected capital increase for a North Dakota project could impact net margins if operating costs outpace revenue growth.

- Spin-offs, nonrecurring costs, and regulatory activities pose challenges to earnings growth and revenue expectations.

- Record earnings in the Pipeline segment and strategic investments position MDU Resources for sustained revenue and earnings growth, driven by utility expansions.

Catalysts

About MDU Resources Group- Engages in the regulated energy delivery businesses in the United States.

- MDU Resources is anticipating a potential step change in necessary capital by 2028, driven by the development of a new project to serve a natural gas-fired electric generating station in North Dakota. This capital increase may impact net margins if operational costs rise faster than anticipated revenue growth.

- The company is facing dissynergies and nonrecurring costs associated with the spin-offs of Knife River and Everest, impacting earnings per share. The absence of these nonrecurring items in future reports presents a less favorable year-over-year earnings comparison for 2025.

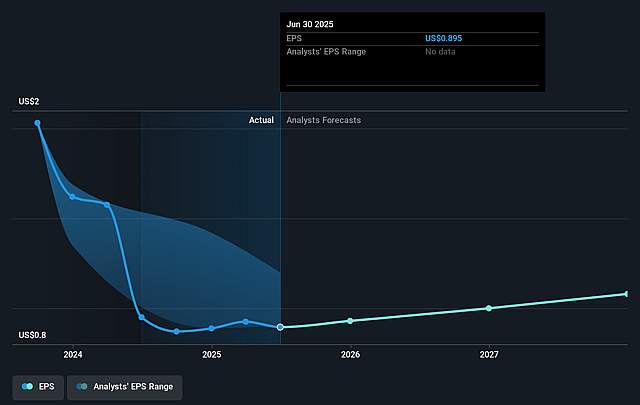

- Although MDU Resources reported an impressive 22% increase in adjusted earnings per share in 2024 year-over-year, their projected earnings growth for 2025 is in the $0.88 to $0.98 per share range, reflecting the company's caution in anticipating similar levels of growth and possibly tempering investor expectations, impacting potential share price growth.

- There are significant ongoing regulatory activities and rate cases across multiple states, such as the natural gas rate increase requested in Wyoming and settlement agreements in Washington and Montana. Delays or unfavorable outcomes in these rate cases could affect revenue growth projections.

- The company's planned transition to a capital-light business model for serving large customer opportunities may limit potential future revenue growth if not complemented by corresponding operational efficiencies or if the demand growth does not materialize as expected.

MDU Resources Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on MDU Resources Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming MDU Resources Group's revenue will grow by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.3% today to 11.9% in 3 years time.

- The bearish analysts expect earnings to reach $224.0 million (and earnings per share of $1.08) by about April 2028, up from $181.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 19.4x today. This future PE is greater than the current PE for the US Gas Utilities industry at 19.3x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.22%, as per the Simply Wall St company report.

MDU Resources Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MDU Resources Group achieved record earnings in its Pipeline segment with a 45% increase, driven by record transportation volumes and increased storage revenue, which positively impacts their revenue and net margins.

- The Electric segment also experienced earnings growth, primarily due to rate relief, suggesting that higher retail sales revenue from rate adjustments can continue to support net margins and earnings.

- The company has signed electric service agreements amounting to 580 megawatts for data centers, with further growth expected, which should bolster future revenue and earnings.

- MDU Resources expects a 6% to 8% long-term EPS growth, indicating confidence in future earnings potential and strengthening net margins.

- The firm maintains a strong balance sheet with planned capital investments of $3.1 billion over the next five years, targeting utility rate base growth of 7% to 8% and customer growth, supporting future revenue and earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for MDU Resources Group is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MDU Resources Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $224.0 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $17.18, the bearish analyst price target of $18.0 is 4.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.