Key Takeaways

- Leadership in grid modernization and electrification drives reliable long-term growth, underpinned by robust regulatory support and decarbonization mandates in California.

- Ongoing wildfire risk mitigation and upcoming technology investments position the company for improved margins, stable earnings, and future upside potential.

- Ongoing wildfire liabilities, regulatory delays, high infrastructure costs, and shifts toward distributed energy threaten revenue stability, profit margins, and financial resilience.

Catalysts

About Edison International- Through its subsidiaries, engages in the generation and distribution of electric power.

- Aggressive expansion of grid infrastructure—including a plan for over 150 miles of undergrounded lines and 1,800 miles of hardened overhead distribution—positions Edison to capture rising demand tied to electric vehicles and electrification, driving robust rate base and revenue growth over the coming years.

- Major upcoming capital investment opportunities, such as the $1.1 billion next-generation Enterprise Resource Planning (ERP) project and an advanced metering infrastructure (AMI) upgrade, have not yet been embedded in current projections and point to upside in long-term capital deployment and earnings growth.

- Edison’s integration of wildfire mitigation strategies, like expanded use of covered conductors, targeted undergrounding, and new vegetation management protocols, is expected to substantially reduce operational risk and liability exposure—supporting improved net margins and more stable, predictable earnings.

- Continued regulatory support, evidenced by recent unanimous CPUC approvals and high authorizations of capital and O&M expenses (with settlements authorizing 100% of capital and 96% of O&M), underpins confidence in full cost recovery from future investments, thereby supporting steady increases in both revenue and cash flow.

- The company’s leadership in California—where binding state mandates for decarbonization and a clean energy transition guarantee multi-decade infrastructure modernization—gives Edison above-peer visibility for sustained rate base growth and strengthens the foundation for compounding core EPS, positioning it at the forefront of long-term electrification and renewable energy trends.

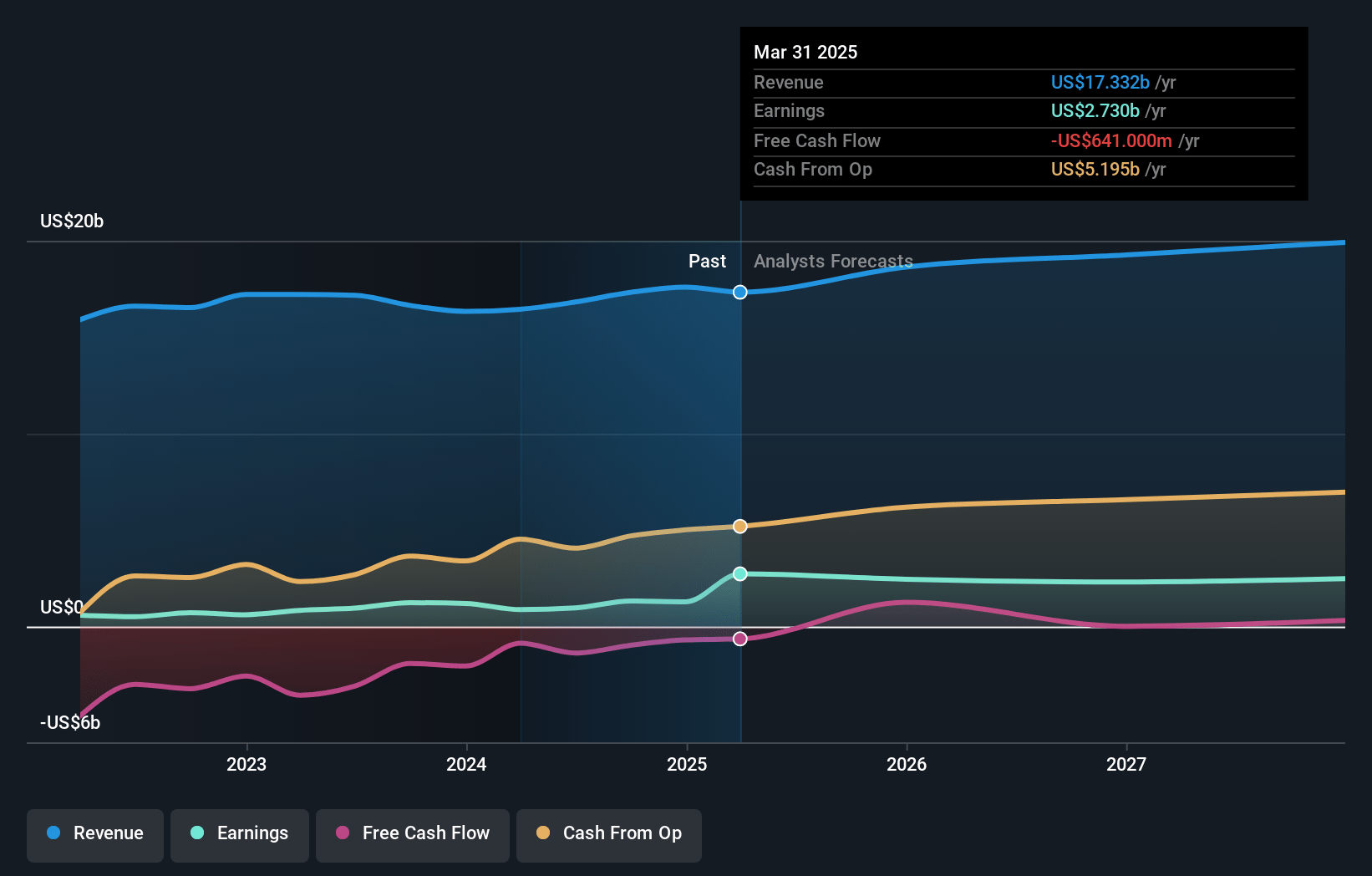

Edison International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Edison International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Edison International's revenue will grow by 9.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 15.8% today to 11.4% in 3 years time.

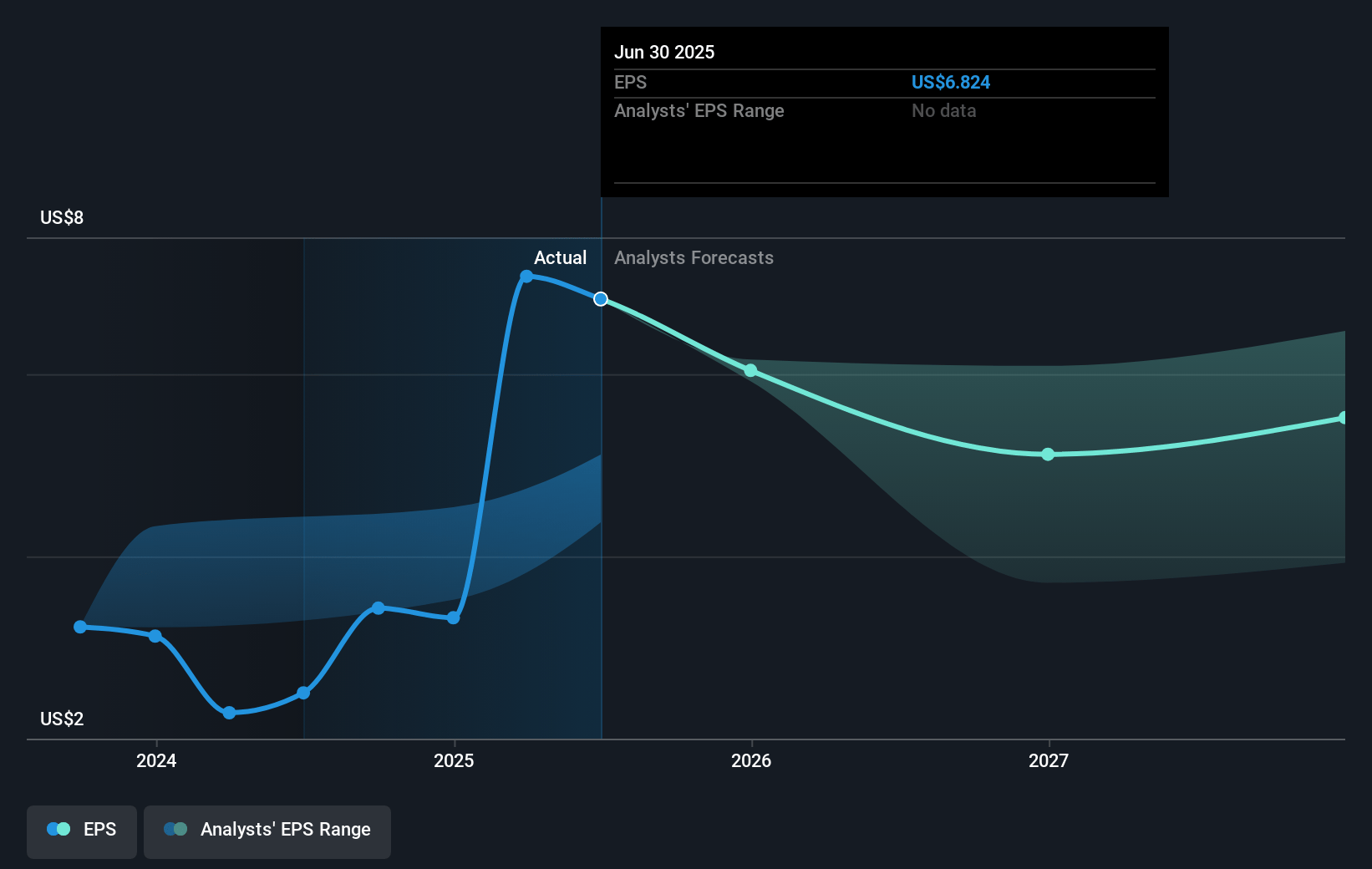

- The bullish analysts expect earnings to reach $2.6 billion (and earnings per share of $6.05) by about July 2028, down from $2.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 7.3x today. This future PE is lower than the current PE for the US Electric Utilities industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

Edison International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued exposure to wildfire liabilities in Southern California, as highlighted by the Eaton fire, creates significant legal uncertainty and potential for large, unquantifiable material losses, which could drive earnings volatility and threaten net income in the future.

- Difficulty achieving timely and favorable regulatory outcomes, with delays in general rate case decisions and uncertainty around authorized returns on equity, may constrain revenue growth and compress net margins if cost increases outpace recovery allowances.

- The need for continually rising capital expenditures to address aging infrastructure and implement large-scale wildfire mitigation and undergrounding programs strains free cash flow and increases reliance on debt, which could dilute shareholder returns or increase financing costs over time.

- Long-term secular shifts such as the growing adoption of distributed energy resources—including rooftop solar and home battery storage—are likely to reduce electricity sales from the central utility model and put pressure on top-line revenues over the coming decade.

- Persistent risks from climate change, accelerating energy efficiency adoption, and competition from community choice aggregators can lead to stagnant or declining electricity demand while simultaneously requiring expensive resiliency investments, eroding both revenue certainty and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Edison International is $86.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Edison International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $50.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $22.5 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of $52.03, the bullish analyst price target of $86.0 is 39.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.